EURUSD Fails above Long Term Trendline as USDCAD Breaks Out

- EURUSD 1.3800 a decent pivot

- AUDUSD at critical juncture from long term trendline

- USDCAD announces next bull leg

--Friday’s DailyFX Plus webinar (video is titled Jamie’s Trading Webinar 03-21-2014).

--Subscribe to Jamie Saettele's distribution list in order to receive a free report to your inbox once a day.

--Trading specifics are availabletoJ.S. Trade Desk members.

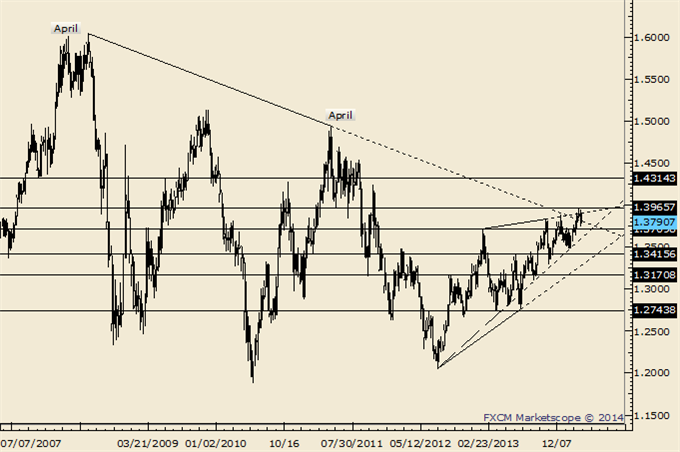

EUR/USD

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader

-EURUSD failed to hold above the line that extends off of the 2008 and 2011 highs this week. The development could mark an important change in conditions. A reaction area rests at the February 2013 high of 1.3710 and a break below 1.3642 would make a stronger case for a larger topping process.

-Trading wise, 1.3810/30 is resistance (held Friday) although 1.3868 could come into play down the road.

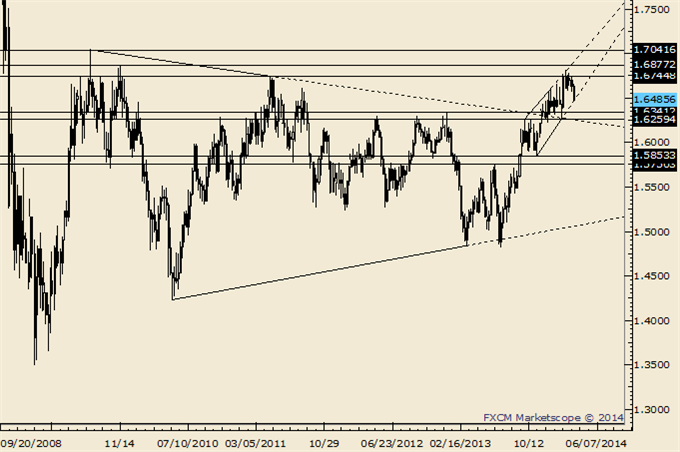

GBP/USD

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader

-GBPUSD found support in February from former resistance levels; specifically the October high and top side of the line that extends off of the 2009 and 2011 highs. The rally from the level signals a significant breakout but the move has stalled near the November 2009 high.

-A weekly key reversal the week that ended 2/21 and a doji the week that ended 3/7 were advance warnings of a top. The rate ends Friday near the line that extends off of the November and February lows. Failure to hold up here would further bearish developments and open up 1.6250-1.6300.

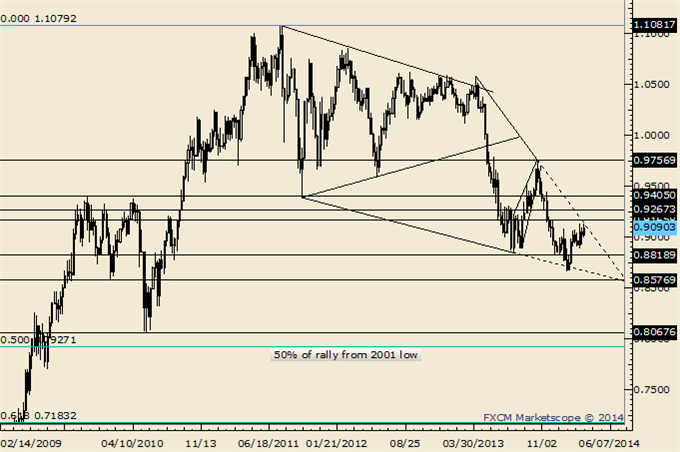

AUD/USD

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader

-The next major target in AUDUSD is .7937. This target is determined by the .8847-.9757 range (.8847 – (.9757-.8847). Interestingly, the 50% retracement of the decline from the 2001 low registers at .7927. ‘Chartwise’, the 2010 low is at .8067.

-AUDUSD is nearing the .9166-.9267 resistance zone but the market is already at trendline resistance. A break above the line makes a case for a run to .9386-.9405 (2009 high and 2011 low).

NZD/USD

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader

-NZDUSD spent much of the week above the line that extends off of the 2011 and 2013 highs but closed the week close to unchanged. The development could indicate a false break and therefore a top.

-Weakness below .8350 is needed to suggest that the larger trend has reversed.

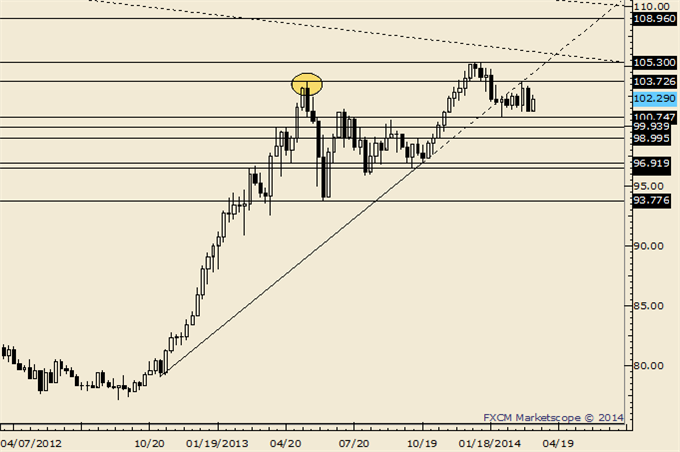

USD/JPY

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader

-USDJPY tested the underside of the trendline that connects the lows from November 2012 and October 2013 2 weeks ago. The top was also in line with the May 2013 high.

-Near term, USDJPY is failing within the 102.50/85 zone. USDJPY rallies are corrective at multiple degrees of trend; from 100.75 and 101.20. The implication is bearish.

-Longer term, there is an Elliott case to be made for a return to the 4thwave of one less degree. The range spans 93.78 to 96.55.

USD/CAD

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader

-Measured objectives from the breakout above the 2011 high range from 1.1680 to 1.1910. The Jul 2009 high rests in this zone at 1.1724 and the 2007 high is near the top of the zone at 1.1875.

-From an Elliott perspective, it’s possible that the rally from the 2012 low composes a ‘3rd of a 3rd (or C)’ wave from the 2007 low.

-The close above the line that extends off of the 2002 and 2009 highs as well as the close above corrective channel resistance add credence to the 3rd of a 3rd wave position.

USD/CHF

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader

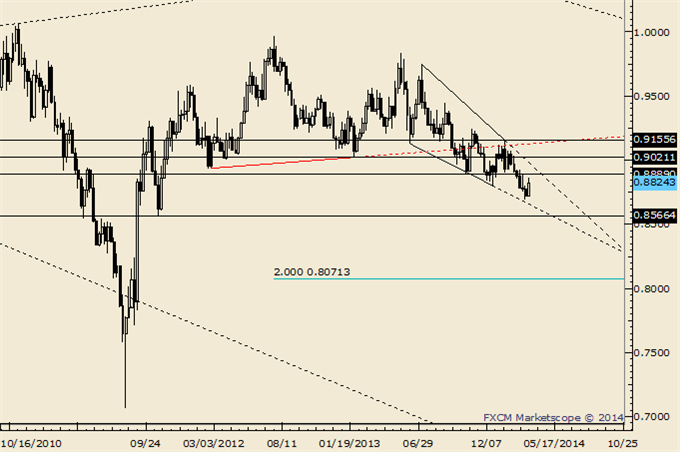

-USDCHF has broken to its lowest level since October 2011. A massive head and shoulders top is completed (again) after a false break in October, and neckline retest in January. There is no chart support until .8566 (October 2011 low) and the head and shoulders target is .8071.

-Use .8930 as a pivot. In other words, price needs to exceed .8930 in order to negate downside bearish implications from the break.

original source

Indonesia

Indonesia