GBPAUD Weekly Range in Focus- Bullish Scalp Bias at Risk Sub 1.86

Talking Points

- GBPAUD testing interim resistance- Weekly opening range in focus

- Broader bias remains weighted to the topside

- Major event risk on tap from the UK

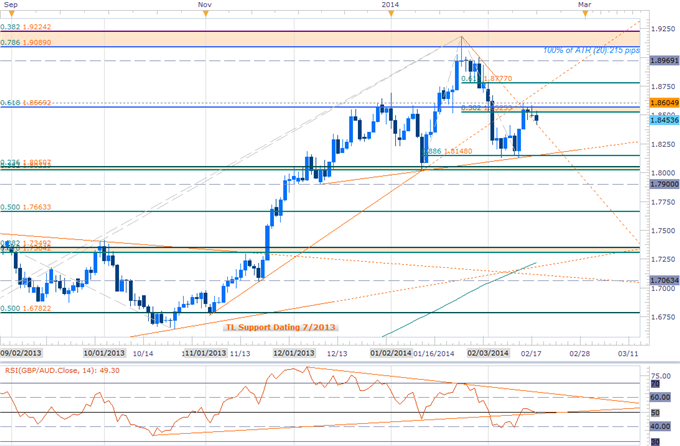

GBPAUD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- GBPAYD 1.86 resistance range in focus

- Breach/Close above targets objectives at 1.8770, 1.8969, 1.9089, 1.9224

- Support at 1.8148, 1.8023/50- bullish invalidation

- Daily RSI rebounds at 40-threhold / hold above 50-constructive

- Weekly opening range break to offer conviction scalp bias (1.8410- 1.8587)

- Key Events Ahead: UK employment tomorrow and retail sales data on Friday

GBPAUD Scalp Chart

Notes: The last time we covered this pair back on December 4th we noted a constructive outlook while above 1.79-handle. The GBPAUD has since achieved all three of our targeted objectives before turning heavy in late January as the Australian dollar mounted a counteroffensive. With the daily momentum signature finding support at the 40-threhsold, we are treating this pullback as a correction within the broader up-trend and our broader bias remains weighted to the topside while above 1.8022/50.

The immediate focus falls on the weekly opening range with the a breach above validating the TL resistance break seen last week and offering conviction on long scalp exposure. Conviction on the resumption of the topside trend is offered with a breach above the near-confluence of the monthly opening range high and a long dated 61.8% Fibonacci extension at 1.8770/95.

A move sub 1.8410/22 would put us neutral with only a break below 1.8364/70 suggesting that a larger correction may be underway. Note that a break below 1.8148 puts possible head and shoulders objectives into play with such a scenario eyeing support targets at 1.8022/50, 1.79, and 1.7663.

Bottom line: although our broader bias remains constructive, we will respect a break of the weekly opening range. Look for guidance from the GBPUSD which faces key resistance at 1.6748/54 and the AUDUSD resistance level at 9080. Note that UK employment data tomorrow and retail sales on Friday could spark added volatility on this long-range scalp and as such, prudence is warranted heading into these prints. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

|

Entry/Exit Targets |

Timeframe |

Level |

Significance |

|

Resistance Target 1 |

Daily / 30min |

1.8525 |

38.2% Retracement |

|

Bearish Invalidation |

Daily / 30min |

1.8587/98 |

Weekly ORH / 38.2% Extension |

|

Break Target 1 |

30min |

1.8650/56 |

50% Retrace / 50% Ext / Dec High (1.8647) |

|

Break Target 2 |

30min |

1.8715 |

61.8% Extension |

|

Break Target 3 |

Daily / 30min |

1.8777/97 |

61.8% Retrace / 78.6% Ext / Feb ORH |

|

Break Target 4 |

30min |

1.8902 |

100% Fib Ext |

|

Break Target 5 |

30min |

1.8956/68 |

78.6% Retracement / Jan 24 close |

|

Break Target 6 |

30min |

1.9000 |

Soft Resistance / Pivot |

|

Bullish Invalidation |

30min |

1.8410/22 |

38.2% Retrace / Wkly ORL / Last Wk’s ORH |

|

Break Target 1 |

30min |

1.8364/70 |

50% & 23.6% Retracement(s) |

|

Break Target 2 |

30min |

1.8306 |

61.8% Retracement |

|

Break Target 3 |

30min |

1.8223/33 |

78.6% & 76.4% Retracement(s) |

|

Break Target 4 |

Daily / 30min |

1.8118/48 |

88.6% Retrace / February ORL / TL Support |

|

Break Target 5 |

Daily |

1.8022/50 |

38.2% & 23.6% Retrace(s) / Jan Low |

|

Break Target 6 |

Daily |

1.7900 |

December Low |

|

Daily (20) |

215 |

Profit Targets 51-53pips |

|

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

- GBPCAD Challenging Feb Range High- Scalp Bias Bullish Above 1.8037

- AUDNZD Target Key Resistance- Bullish Scalp Bias at Risk Sub 1.09

- GBPNZD Scalps Target Opening Range- Higher Low in Place?

- AUDCAD Eyes Key Resistance- Bullish Scalp Bias at Risk Sub 9953

- Trading the EURAUD Reversal- Scalp Bias Bearish Below 1.533

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email [email protected] or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars this week Monday- Thursday mornings on DailyFX Plus (Exclusive of Live Clients) at 1230 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

original source

Indonesia

Indonesia