GBPCAD Challenging Feb Range High- Scalp Bias Bullish Above 1.8037

Talking Points

- GBPCAD testing near-term resistance- February high in focus

- Scalp bias weighted to the topside above 1.8037

- Limited event risk this week on this long-range scalp

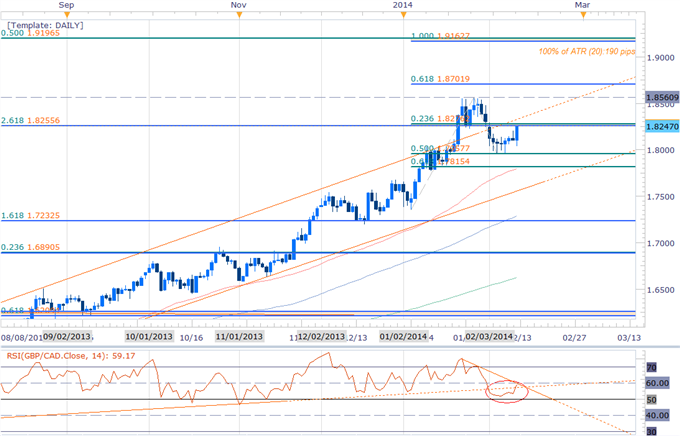

GBPCAD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- GBPCAD February opening range in focus (1.7957- 1.8293)

- RSI has remained above 40 since July/ above 50 since October- bullish

- RSI resistance trigger pending- Breach to offer long conviction

- Topside objectives 1.8550, 1.8702, 1.9163/96

- Break below weekly ORL invalidates scalp bias

- Break below monthly ORL- bearish

- Limited event risk this week- watch US advanced retail sales / weekly jobs report

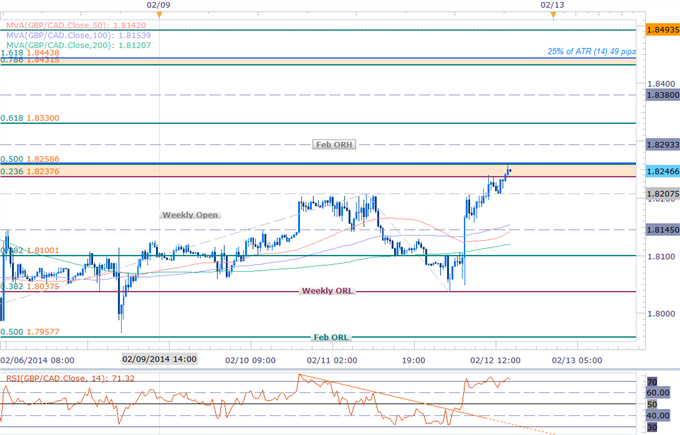

GBPCAD Scalp Chart

Notes: One of my top 2014 trade ideas and a popular pair in the DailyFX on Demand trading room, the GBPCAD has been on a tear since breaking above a multi-year consolidation pattern back in August of last year. Our scalp bias shifted to the topside with today’s break above the weekly opening range high at 1.8207 before coming into more significant Fibonacci resistance at 1.8289. Look for a move surpassing the February high at 1.8293 to offer further conviction on our directional bias.

Bottom line: we’ll continue to favor buying dips / breaks of resistance while above the weekly opening range low with only a move below the February low at 1.7958 invalidating our topside bias. Such a scenario would suggest that a more significant high may have been put in place last month. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

|

Entry/Exit Targets |

Timeframe |

Level |

Significance |

|

Resistance Target 1 |

Daily / 30min |

1.8238/59 |

23.6% & 50% Retrace(s) / 2.618 Ext |

|

Bearish Invalidation |

Daily / 30min |

1.8293 |

February High |

|

Break Target 1 |

30min |

1.8330 |

61.8% Retracement |

|

Break Target 2 |

30min |

1.8380 |

Soft Resistance / Pivot |

|

Break Target 3 |

30min |

1.8432/43 |

78.6% Retrace / 1.618% Extension |

|

Break Target 4 |

30min |

1.8492 |

88.6% Retracement |

|

Break Target 5 |

Daily / 30min |

1.8560 |

January 2014 High |

|

Break Target 6 |

Daily |

1.8702 |

61.8% Fib Ext |

|

Support Target 1 |

30min |

1.8207 |

Weekly ORH / Pivot |

|

Support Target 2 |

30min |

1.8145 |

Soft Support / Pivot |

|

Support Target 3 |

30min |

1.8100 |

38.2% Retracement |

|

Bullish Invalidation |

30min |

1.8038 |

Weekly ORL / 38.2% Retrace |

|

Break Target 1 |

Daily / 30min |

1.7958 |

50% Retracement / February ORL |

|

Break Target 2 |

30min |

1.7876 |

50% Retracement |

|

Break Target 3 |

Daily / 30min |

1.7800/15 |

61.8 Retracements / 50DMA |

|

Daily (20) |

190 |

Profit Targets 45-48pips |

|

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

- AUDNZD Target Key Resistance- Bullish Scalp Bias at Risk Sub 1.09

- GBPNZD Scalps Target Opening Range- Higher Low in Place?

- AUDCAD Eyes Key Resistance- Bullish Scalp Bias at Risk Sub 9953

- Trading the EURAUD Reversal- Scalp Bias Bearish Below 1.533

- EURNZD Scalps Eye Key Inflection Point- Bias at Risk Sub 1.6720

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email [email protected] or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars next week Monday- Thursday mornings on DailyFX Plus (Exclusive of Live Clients) at 1130 GMT (11:30ET)

Interested in learning about Fibonacci? Watch this Video

original source

Indonesia

Indonesia