Gold Bounce Continues, SPX 500 Sees Worst Losing Streak in Two Months

Talking Points:

- US Dollar Eyes March Low Amid Steady Selling Pressure

- S&P 500 Suffers the Worst Losing Streak in Two Months

- Crude Oil Flirts with Breakout, Gold Correction Continues

Can’t access to the Dow Jones FXCM US Dollar Index? Try the USD basket on Mirror Trader. **

US DOLLAR TECHNICAL ANALYSIS – Prices are edging lower within the confines of a falling channel.Near-term support is in the 10495-500 area, marked by the 38.2% Fibonacci expansion and the March 19 low. A break below this boundary aims for the channel bottom at 10487, followed by the 50% level at 10470. Alternatively, a push above the channel top at 10573 aims for the 38.2% Fib retracement at 10595.

Daily Chart - Created Using FXCM Marketscope 2.0

** The Dow Jones FXCM US Dollar Index and the Mirror Trader USD basket are not the same product.

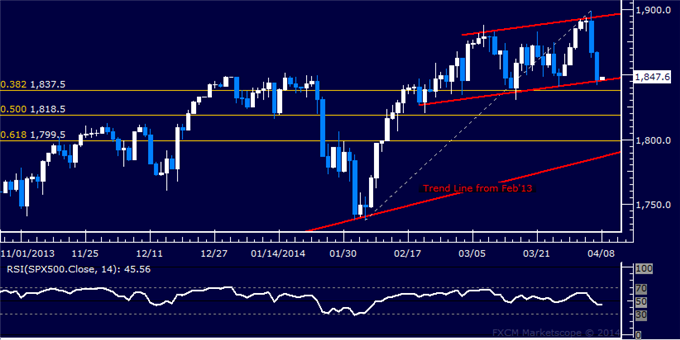

S&P 500 TECHNICAL ANALYSIS – Prices recoiled downward having found resistance below the 1900.00 figure to test rising channel support set from mid-February, now at 1845.20. A break below that initially targets the 38.2% Fibonacci retracement at 1837.50, followed by the 50% level at 1818.50. Channel top resistance is now at 1894.50.

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD TECHNICAL ANALYSIS – Prices turned higher as expected after putting in a Bullish Engulfing candlestick pattern. Buyers are testing resistance at 1308.11, the 14.6% Fibonacci expansion, with a break above that exposing the 23.6% level at 1327.29. Near-term support is at 1277.00, the April 1 low.

Daily Chart - Created Using FXCM Marketscope 2.0

CRUDE OIL TECHNICAL ANALYSIS – Prices are consolidating within the confines of a Triangle pattern, a setup hinting at upward trend continuation. Confirmation requires a daily close above the formation’s top, now at 101.00, with a break initially exposing the March 28 high at 102.21. Alternatively, a push through support at 100.36, the 23.6% Fibonacci expansion, exposes the 99.21-46 area marked by the Triangle bottom and the 38.2% level.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

original source

Indonesia

Indonesia