Talking Points

- Cyclical turning point this week

- Weakness in metal after Friday would confirm top

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

The price action in Gold leading into this week’s turn window has been less than ideal. Given the strong downtrend trend in place since mid-March we were initially looking for a low to develop. The metal, however, found support early last week from just under the 50% retracement of the December/March advance at 1285. The recovery that has followed has not been very impressive retracing only just over 38% of the decline from 1292. In terms of time though it is long enough to qualify as a “trend” and any weakness that develops over the next few days would confirm a minor cyclical top is in place in the metal and set the stage for a possible resumption of the medium-term downtrend. Only a move back through this week’s high (next week) would invalidate and re-focus higher.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

Gold Daily Chart: April 10, 2014

Charts Created using Marketscope – Prepared by Kristian Kerr

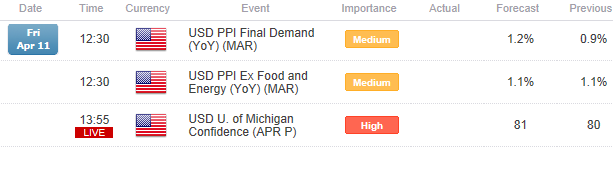

Key Event Risk in Coming Sessions:

LEVELS TO WATCH

Resistance: 1324 (WTD high), 1335 (Fibonacci)

Support: 1296.95(Tuesday’s low), 1277 (MTD low)

Strategy: Sell Gold on weakness

Entry: Sell XAU/USD on a 1300 stop

Stop: 1-day close above 1335

Target: 1230

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail [email protected]. Follow me on Twitter at@KKerrFX.

original source

Indonesia

Indonesia