Is an AUDUSD Top in Place? Shorts at Risk Above 8920

Talking Points

- AUDUSD holds within February opening range

- Broader advance off yearly low in focus while above 8920 region

- Major event risk on tap over the next 48-hours from Australia and US

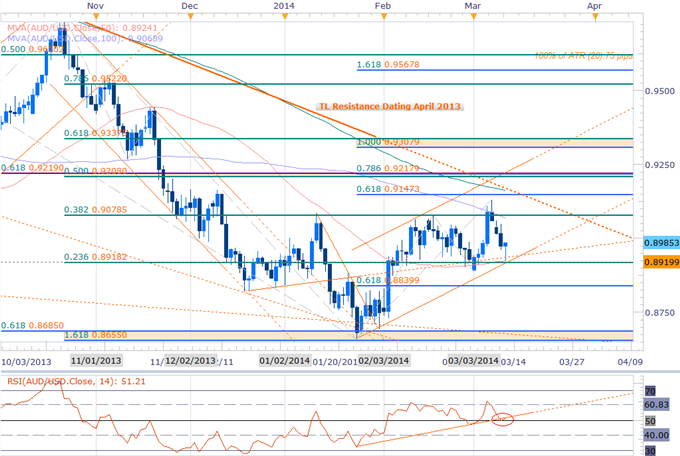

AUDUSD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- AUDUSD holding above trendline support / March opening range low

- Resistance objectives 9080, 9147, 9208/19

- Constructive above 8920- bullish invalidation

- Breaks shifts focus back on the short-side

- Support targets 8840, 8655/85

- Daily RSI Support trigger pending- look for 60-breach to confirm breakout

- Key Event Risk Ahead: Australian Employment data tonight & US Retail Sales on Thursday, Michigan Confidence on Friday

AUDUSD Scalp Chart

Notes: The AUDUSD has been on our radar over the past few days and the pullback from February high is now approaching our bullish invalidation zone at 8919/26. This level is defined by the 23.6% retracement of the Decline off the October high, the 50-day moving average and trendline support dating back to the January low. Note that the pair has now completed a 100% correction off the highs (8926) and if this level holds, suggests that the broader rally off the yearly low remains in focus.

The 30min chart shows the pair continuing to trade within the confines of a well-defined descending channel formation off the monthly high. Although the weekly opening range did break to the downside with the move sub 9010, the decline has taken the pair into key support and our scalp bias is now at risk above this level. As long as price remains above the 8920 region, the broader focus remains weighted to the topside. Look for a break above channel resistance with RSI conviction to warrant long exposure with a move surpassing the weekly high targeting a longer-term trendline dating back to the April 2013 high.

Bottom line: everyone is looking for the AUD short, but until we invalidate the current formation, we cannot rule out a continuation higher here. That said, we will respect a close below 8920 with such a scenario eyeing subsequent support targets into the yearly lows. Caution is warranted heading into the Aussie employment report tonight with US data tomorrow morning also likely to fuel volatility in the pair. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

|

Entry/Exit Targets |

Timeframe |

Level |

Significance |

|

Resistance Target 1 |

30min |

9001 |

50% Retrace / Weekly ORL |

|

Resistance Target 2 |

30min |

9060/62 |

Weekly ORH / March 7th Close / 100DMA (9069) |

|

Bearish Invalidation |

Daily / 30min |

9079/85 |

38.2% Retrace / Jan & Feb High(s) |

|

Break Target 1 |

30min |

9110 |

Soft Resistance / Pivot |

|

Break Target 2 |

30min |

9132/47 |

2014 High / 61.8% Extension |

|

Break Target 3 |

Daily / 30min |

9162 |

200DMA / TL Resistance Dating 4/2013 |

|

Break Target 4 |

Daily / 30min |

9208/18 |

61.8 & 50% Retrace(s) / 78.6% Ext / Channel Res |

|

Support Target 1 |

30min |

8973/81 |

61.8% Ext / 61.8% Retracement |

|

Support Target 2 |

30min |

8945 |

76.4% Retracement |

|

Bullish Invalidation |

Daily / 30min |

8918/26 |

23.6% Retrace / 100% Ext / 50DMA / Weekly Low |

|

Break Target 1 |

30min |

8896 |

50% Retracement |

|

Break Target 2 |

Daily / 30min |

8840/50 |

61.8% Retracement / 1.618 Ext |

|

Break Target 3 |

30min |

8755/60 |

78.6% Retracement / Jan 20th Low |

|

Break Target 4 |

Daily / 30min |

8655/85 |

1.618% Ext / 61.8 / 2014 Low |

|

Daily (20) |

75 |

Profit Targets 17-19pips |

|

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

- Scalping the EURUSD: Breakout or Fakeout?

- GBPUSD at Risk Heading into BoE, NFPs- Key Resistance 1.6754

- Gold Rally Vulnerable Sub $1361- March Opening Range, NFPs in Focus

- EURJPY Rally at Risk Sub 141- Weekly Opening Range in Focus

- USDCAD Reversal Underway- Long Scalps Favored Above 1.10

Monthly open high 2009

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email [email protected] or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Thursday morning this week on DailyFX Plus (Exclusive of Live Clients) at 15:30 GMT (11:30ET)

Interested in learning about Fibonacci? Watch this Video

original source

Indonesia

Indonesia