Just How Big of A Deal is This Recent EUR/USD Decline?

Talking Points

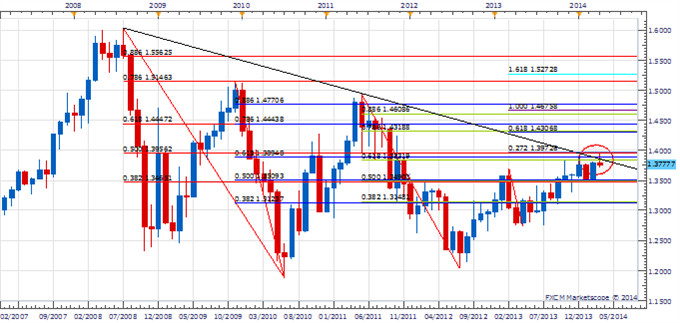

- EUR/USD reverses sharply from key long-term resistance zone

- Bigger top developing?

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

EUR/USD has had a very difficult time penetrating the top end of an important Fibonacci confluence zone that rests between 1.3830 and 1.3970. This zone is important because the 50% retracement of the 2008/2010 decline, the 61.8% retracement of 2009/2010 decline, the 61.8% retracement of the 2011/2012 decline and the 127% extension of the 1Q13 decline all converge there. In their own right each one of these levels is probably important enough to prompt a reversal of some importance, but together they demand a lot more attention. Last week’s failure coupled with the aggressive weakness witnessed over the past couple of days in the exchange rate warns that a top of some importance has likely been recorded. The near-term cyclical picture looks positive for a few days, however, and we like selling into any strength that develops during this period.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

EUR/USD Daily Chart: March 20, 2014

Charts Created using Marketscope – Prepared by Kristian Kerr

Key Event Risk in Coming Sessions:

LEVELS TO WATCH

Resistance: 1.3825 (Gann), 1.3855(Fibonacci)

Support: 1.3730 (Gann), 1.3710 (Gann)

Strategy: Sell EUR/USD

Entry: Sell EUR/USD at 1.3855

Stop: 1-day close above 1.3930

Target: 1.3710

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail [email protected]. Follow me on Twitter at@KKerrFX.

original source

Indonesia

Indonesia