Price & Time: Almost Time to Sell the Pound?

Talking Points

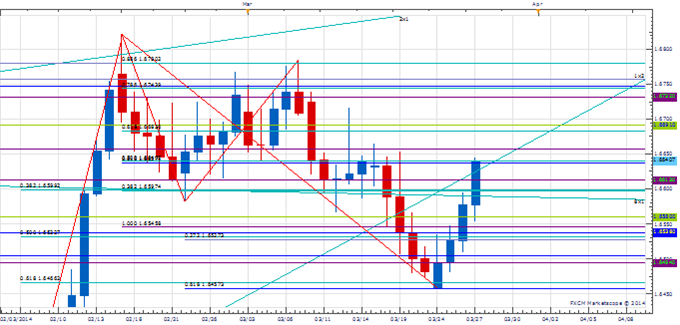

- GBP/USD at important cyclical inflection point

- Eyeing reaction at key Fib level for signs of a secondary top

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

GBP/USD is entering a critical cyclical period over the next few days. The exchange rate is in the midst of an aggressive rally since finding support earlier in the week at the 1.6460 161.8% projection of the late February decline. On the surface this move higher looks to be a resumption of the uptrend in place since July of last year. Cycle analysis, however, warns that this is a potential ‘bull trap’. A variety of different cyclical relationships, including one related to last year’s low, converge over the next few days. With the Pound moving higher into this “turn window” we believe the risk is for some sort of secondary top to develop. The 61.8% retracement of the mid-February to March range at 1.6685 is an ideal turning point and we like selling around there. Only unexpected persistent strength over 1.6685 after Monday of next week would signal that Cable has weathered the cyclical storm and is headed higher

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

GBP/USD Daily Chart: March 27, 2014

Charts Created using Marketscope – Prepared by Kristian Kerr

Key Event Risk in Coming Sessions:

LEVELS TO WATCH

Resistance: 1.6680 (Fibonacci), 1.6745(Gann)

Support: 1.6560 (Gann), 1.6460 (Fibonacci)

Strategy: Sell GBP/USD

Entry: Sell GBP/USD at 1.6675

Stop: 1-day close above 1.6745

Target: 1.6460

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail [email protected]. Follow me on Twitter at@KKerrFX.

original source

Indonesia

Indonesia