Talking Points

- USD/JPY expansion in volatility eyed

- GBP/USD at risk of at least a minor top

- Important turn in Gold

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

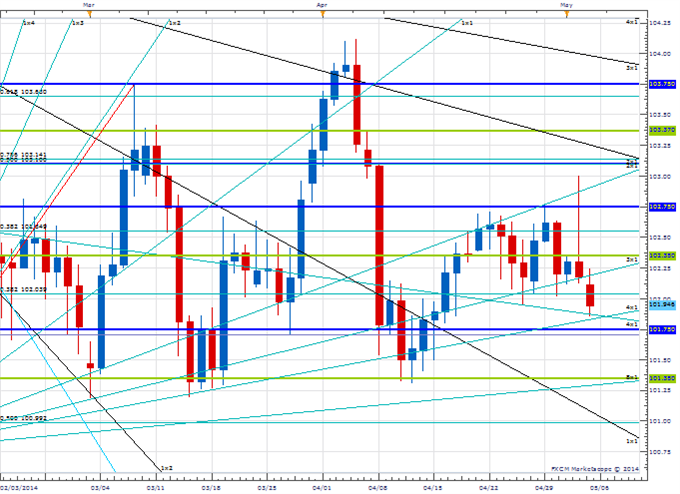

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY spiked higher to 103.00 on Friday before reversing sharply to end the week almost unchanged

- Our near-term trend bias is lower while below 103.10

- A breach of 101.35 is needed to signal that a more important decline is underway

- An important cycle turn window is seen around this time

- A daily close over 103.10 would shift the near-term trend bias higher

USD/JPY Strategy: Looking to sell on any strength seen over the next day or two.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

*101.35 |

100.70 |

101.95 |

102.75 |

*103.10 |

Price & Time Analysis: GBP/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- GBP/USD touched its highest level in almost 5 years last week

- Our near-term trend bias is higher in Cable while over 1.6730

- The 127% extension of the Feb/March decline at 1.6920 is key resistance with a daily close over this level needed to set up another leg higher

- A cycle turn window of some importance is seen over the next few days

- A daily close below 1.6730 would turn us negative on the Pound

GBP/USD Strategy: Like the long side while 1.6730 holds, but positions should be reduced into this turn window.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

GBP/USD |

*1.6730 |

1.6810 |

1.6860 |

*1.6920 |

1.6970 |

Focus Chart of the Day: GOLD

As we have noted before, the reversal in Gold on March 24th off 1270 came right on the 61.8% time extension of last year’s June and December lows. Another Fibonacci cycle turn window late last week saw the March closing low tested, but 1270 easily held before the metal reversed sharply higher. This action (two large range reversals from cycle turn windows) is potentially very bullish for the metal. Today’s early push through 1306 confirms at least a minor low is in place. Focus is now on last month’s high near 1331 with a move over this level needed to signal that a much more important move higher is indeed underway. Unexpected aggressive weakness under 1270 would completely undermine our positive cyclical outlook.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia