Talking Points

- USD/JPY closing in on important support

- USD/CAD rolls over

- Key inflection point in EUR/USD over next couple of days

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

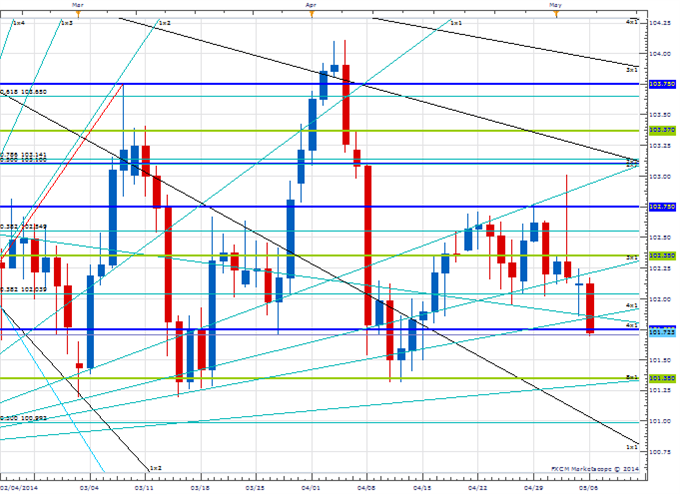

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY has come under downside pressure to start the week

- Our near-term trend bias is lower while below 103.10

- A break of 101.35 is needed to trigger a more important decline

- An important cycle turn window is seen this week

- A daily close over 103.10 would shift the near-term trend bias higher

USD/JPY Strategy: Looking to sell on any strength.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

*101.35 |

100.70 |

101.75 |

102.75 |

*103.10 |

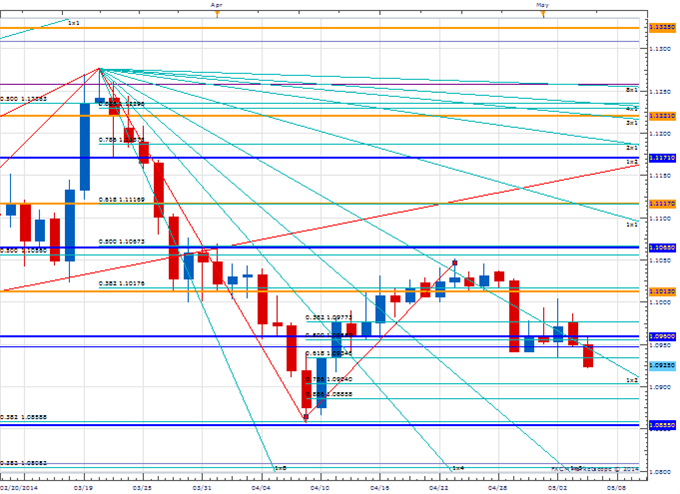

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/CAD has come under steady downside pressure since failing near the 50% retracement of the March/April decline last month

- Our near-term trend bias is lower in Funds while below 1.1030

- The 78.6% retracement of the late April advance near 1.0900 is interim support ahead of a key downside pivot at 1.0855

- A minor cycle turn window is seen around the end of the week

- A daily close over 1.1030 would turn us positive on USD/CAD

USD/CAD Strategy: Like the short side while below 1.1030.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/CAD |

*1.0855 |

1.0900 |

1.0925 |

1.0960 |

*1.1030 |

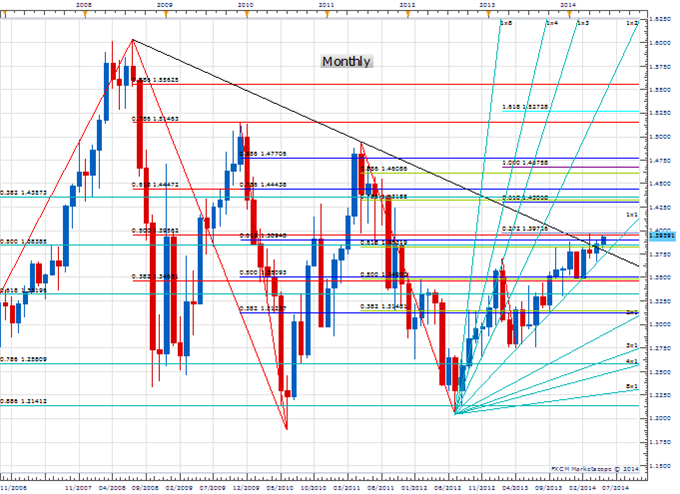

Focus Chart of the Day: EUR/USD

The next couple of days look critical for EUR/USD from a time cycle perspective. Since October of last year the uptrend in the Euro has been capped by a key Fibonacci confluence between 1.3835 and 1.3970 (50% retracement 2008/2010 decline, 61.8% retracement 2011/2012 decline & 127% extension of 1Q13 decline among others). With the Euro testing the top end of this zone today it is “do or die” for the single currency into this turn window. Another failure near 1.3970 would set up a potentially very important top while a daily close over 1.3970 paves the way for a push towards the next big confluence zone near 1.4350. A top is favored.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia