Price & Time: Downside Break on the Horizon in USD/JPY?

Talking Points

- Key cyclical turning point this week

- The 101.35 area is a key pivot

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

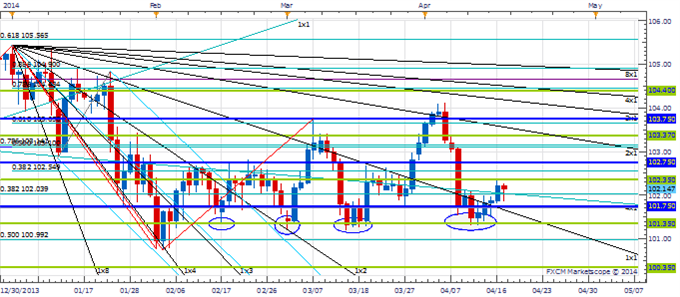

The latter half of this week is potentially quite significant for USD/JPY from a cyclical perspective. The exchange rate peaked back on January 2nd at 105.43 and at the end of this week it will be 105 calendar days from that high - a clear potential price/time convergence. With the rate rebounding over the past few days, a turn lower is now favored coming out of this key cyclical period. However, with USD/JPY stuck in a sideways to higher range for the better part of three months we are reluctant to sell until it starts to exhibit some kind of material weakness. The 4th square root relationship of the year’s high at 101.35 has proven to be major support over the past few months and a breach of this level over the next few days should be enough to confirm the start of a sustainable decline.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

USD/JPY Daily Chart: April 17, 2014

Charts Created using Marketscope – Prepared by Kristian Kerr

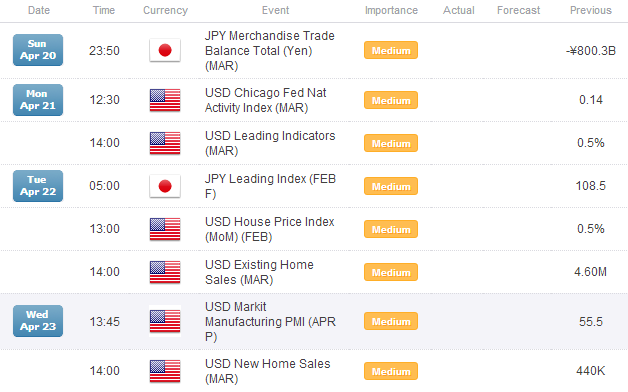

Key Event Risk in Coming Sessions:

LEVELS TO WATCH

Resistance: 102.35 (Gann), 102.75 (Gann)

Support: 101.35 (Gann), 100.75 (YTD low)

Strategy: Sell USD/JPY

Entry: Sell USD/JPY on a 101.30 stop

Stop: 1-day close above 102.00

Target: 100.10

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail [email protected]. Follow me on Twitter at@KKerrFX.

original source

Indonesia

Indonesia