Price & Time: Fibonacci “Time Reversal” in Gold

Talking Points

- USD/JPY consolidation continues

- GBP/USD touches multi-year high

- GOLD rebounds from key Fibonacci turn window

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

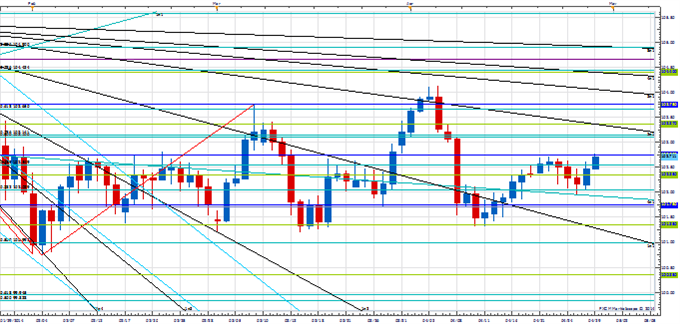

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY has traded steadily higher since finding support earlier in the month at the 4th square root relationship of the year’s high near 101.35

- Our near-term trend bias is lower while under 103.10

- Weakness under 101.35 is needed to signal the start of a more important decline

- A cycle turn window of some importance is seen early next week

- A breach of 103.10 would turn the near-term trend bias positive

USD/JPY Strategy: Like being square for a few days.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

*101.35 |

102.05 |

102.70 |

102.70 |

*103.10 |

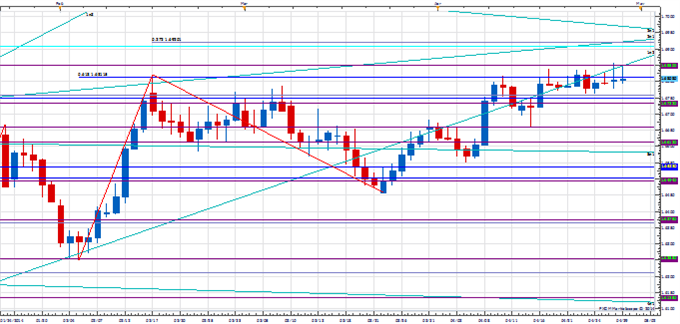

Price & Time Analysis: GBP/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- GBP/USD touched its highest level since late 2009 on Monday before finding resistance at the 17th square root relationship of last year’s low in the 1.6850 area

- Our near-term trend bias remains higher in Cable while over 1.6655

- A daily close over 1.6850 is required to spark the next leg higher in the Pound

- An important cycle turn window is eyed later next week

- Weakness under 1.6655 would turn us negative on GBP/USD

GBP/USD Strategy: Like the long side while over 1.6655.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

GBP/USD |

*1.6655 |

1.6735 |

1.6805 |

*1.6850 |

1.6905 |

Focus Chart of the Day: GOLD

The reversal last week in Gold off 1270 on option expiration day was quite dramatic. There is a strong chance it marked an important low as it occurred right on the 161.8% time extension of the June and December 2013 lows. Such “loud” reversals on or around turn dates usually prove important. A minor cyclical turn window is eyed around the end of the week, but any weakness into this timeframe is probably only some sort of re-test of last week’s low. A move through last week’s high near 1306 would provide initial confirmation of a low, but strength over the month-to-date high at 1331 is really needed to trigger a more important move higher. Any unexpected aggressive weakness after Monday of next week below 1270 would turn the cyclical and technical picture very negative.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia