Price & Time: Important Turn Anticipated in Key Cross Rate

Talking Points

- EUR/USD closing in on key Fib resistance

- USD/CAD has key turn window later this week

- Important reversal eyed in AUD/NZD

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

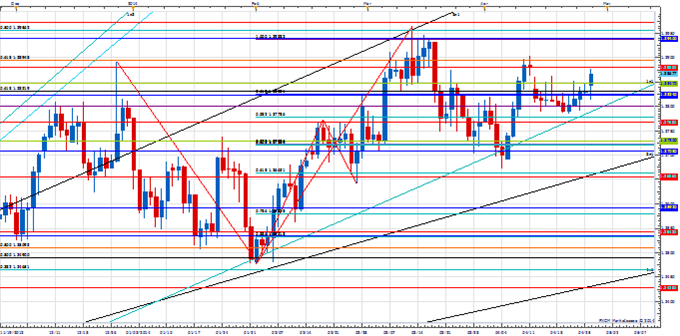

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD has traded in a range since reversing earlier this month at the 78.6% retracement of the March to April decline near 1.3900

- Our near-term trend bias is positive in the Euro while over 1.3730

- A break of 1.3900 is needed to signal that a new move higher is underway

- The middle of the week is a medium-term cycle turn window in the Euro

- A breach of 1.3730 would turn us negative on the Euro

EUR/USD Strategy: Like the long side while over 1.3730.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

EUR/USD |

*1.3730 |

1.3780 |

1.3865 |

*1.3900 |

1.3930 |

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/CAD has moved modestly higher since finding support earlier in the month just ahead of the 4th square root relationship of the year’s high at 1.0855

- Our near-term trend bias remains higher in Funds while above 1.0960

- The 50% retracement of the March/April decline at 1.1065 is key upside pivot

- An important cycle turn window is eyed around the end of the week

- A daily close under 1.0960 would turn us negative on USD/CAD

USD/CAD Strategy: Like only small long positions while over 1.0960. May look to go short later this week.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/CAD |

*1.0960 |

1.1015 |

1.1060 |

*1.1065 |

1.1100 |

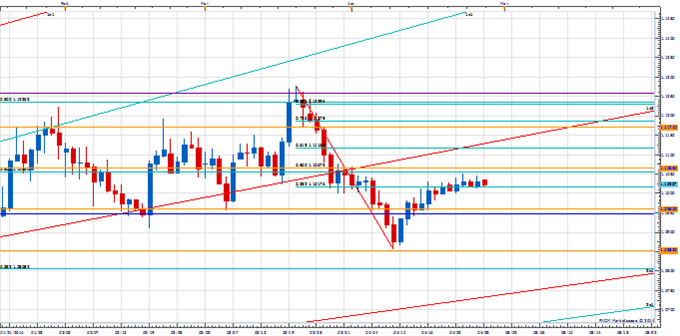

Focus Chart of the Day: AUD/NZD

We don’t spend too much time doing cyclical analysis on cross rates. However, occasionally something will spark our interest. The latter part of the week looks significant for AUD/NZD from a timing perspective as a variety of cyclical techniques will be converging in the rate around this time. With the cross trending steadily higher since mid-March, a top of some kind is favored heading into this turn window. Key resistance levels that we will be monitoring for a reaction are the 38% retracement of the October to January decline at 1.0900 and a key Gann/Fibonacci convergence between 1.1000 & 1.1035. It would take a decline under last week’s low of 1.0757 to raise the possibility of an upside reversal heading into this key turn period.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia