Talking Points

- EUR/USD struggling at key resistance, reversal looming?

- USD/JPY flirting break of important downside pivot

- GBP/USD under pressure, but nearby support proving formidable

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

Foreign Exchange Price & Time at a Glance:

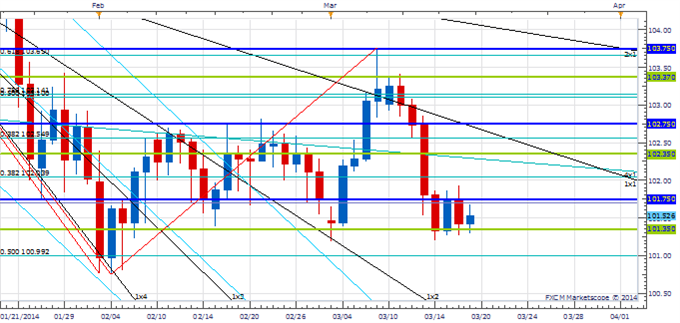

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY is in consolidation mode above the 4th square root relationship of the year’s high at 101.35

- A close below 101.35 will turn us negative on USD/JPY

- A move back through 102.30/75 is needed to relieve some of the immediate downside pressure

- The end of the week is a minor cycle turn window

USD/JPY Strategy: Holding to reduced longs while above 101.35.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

100.75 |

*101.35 |

101.50 |

102.30 |

*102.75 |

Price & Time Analysis: GBP/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- GBP/USD remains weak, but so has not breached key support at the 2nd square root relationship of the year’s high around 1.6560

- Our near-term trend bias is higher in Cable while this level holds

- A close over 1.6690 is needed restore some upside momentum in the exchange rate

- An important cycle turn window is seen around the end of the month

- A daily close below 1.6560 will turn us negative on the Pound

GBP/USD Strategy: Like small longs against 1.6560. May look to go short on a clear break of that level.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

GBP/USD |

1.6495 |

*1.6560 |

1.6630 |

*1.6690 |

1.6735 |

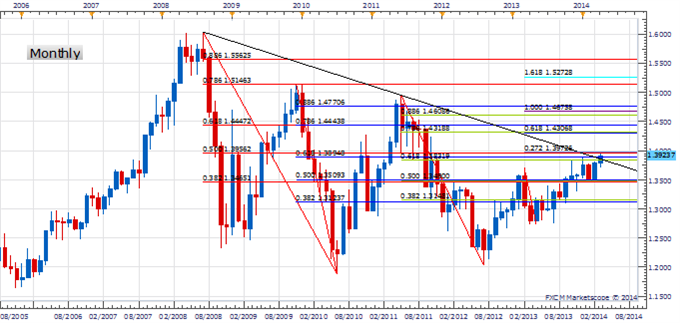

Focus Chart of the Day: EUR/USD

EUR/USD continues to threaten a break of 1.3970. This level is important resistance as it marks the 50% retracement of the 2008 to 2010 decline. A clear move through this barrier would be a positive development in the long-term as it would do some technical damage to the notion that the move higher since July 2012 has only been a correction within a primary downtrend. Time, however, is starting to run out for the single currency to accomplish this break as a few cyclical relationships are converging early next week. Failure to get through this resistance area before then or worse yet a break of it during this turn window (ie. a false break) would pave the way for an important reversal. 1.3830 is an important pivot and a daily close below this level during this time would confirm at least a near-term top.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia