Price & Time: Moment of Truth Coming Up for the Euro

Talking Points

- Cycle turn window later this week for the Euro

- USD/JPY reverses from minor turn window

- GOLD fails near key retracement level

Looking for real time Forex analysis throughout the day? Try DailyFX on Demand.

Foreign Exchange Price & Time at a Glance:

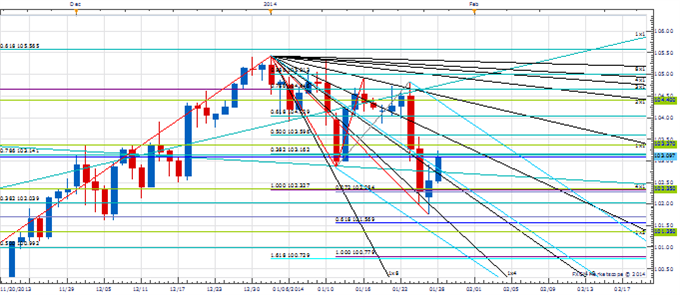

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY continued higher on Tuesday from the reversal seen during Monday’s cycle turn window

- Our near-term trend bias remains lower in the exchange rate while below 103.75

- The 102.40 level is interim support, but a daily close below the 38% retracement of the October to January advance near 102.00 is required to signal a resumption of the broader move lower

- A minor turn window is seen at the end of the week

- A close over 103.75 would shift our near-term trend bias to positive

USD/JPY Strategy: Like only reduced short positions while below 103.75.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

*102.00 |

102.40 |

103.10 |

103.35 |

*103.75 |

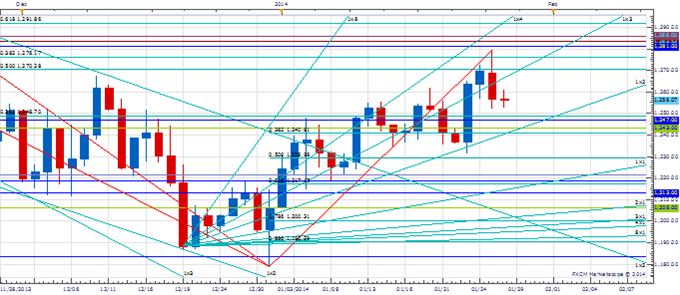

Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

- XAU/USD failed on Monday from just above the 38% retracement of the August to December decline at 1276

- Our near-term trend bias is higher in Gold while over the 50% retracement of the December/January range at 1229

- A cluster of Fibonacci and Gann resistance between 1276 and 1291 needs to be overcome to setup a more signficant move higher

- The end of the week is a minor cycle turn window

- Only a daily close below 1229 would turn us negative on the metal

XAU/USD Strategy: Like buying into weakness againt 1229.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

XAU/USD |

*1229 |

1249 |

1255 |

1276 |

*1291 |

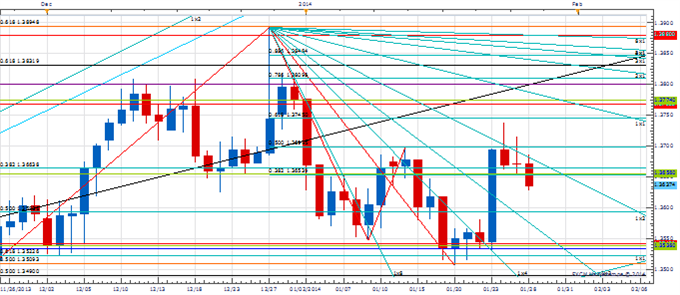

Focus Chart of the Day: EUR/USD

Last week we wrote that EUR/USD was entering a short-term positive cyclical period. With the exception of last Thursday’s price action the move higher has been fairly unimpressive which suggests the reprieve is likely only a correction within the budding downtrend. The second half of this week is a clear cycle turn window where the downtrend could try to re-assert itself. Any traction below the 3rd square root relationship of the 2013 high at 1.3540 during this time would be a clear sign that another important leg lower is unfolding. With important event risk in the form of the FOMC decision on Wednesday we cannot discount a final attempt higher, but only aggressive strength through 1.3775 would turn the broader cyclical outlook positive.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia