Talking Points

- USD/JPY testing key resistance zone

- GOLD backs off from important Fibonacci area

- EUR/USD nearing important turn window

Unfamiliar with Gann Square Root Relationships? Learn more about them here.

Foreign Exchange Price & Time at a Glance:

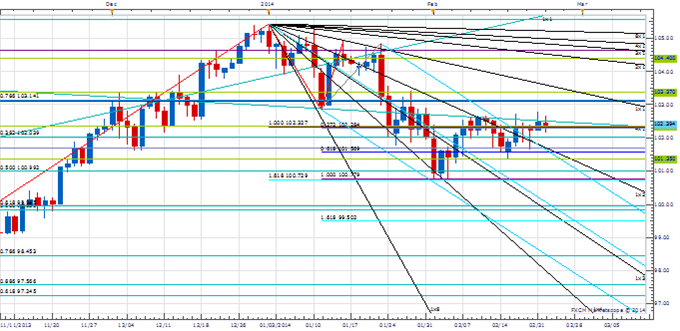

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY remains in consolidation mode above the 4th square root relationship of the year’s high near 101.35

- Our near-term trend bias is higher while above 101.35

- The 2nd square root relationship of the year’s low at 102.75 is a major hurdle that needs to be overcome soon on a closing basis if a more important advance is to take hold

- The middle of the week is a cycle turn window

- A daily close below 101.35 would turn us negative on the exchange rate

USD/JPY Strategy: Square for the moment. Awaiting a break of 102.75.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

*101.35 |

101.70 |

102.40 |

*102.75 |

103.10 |

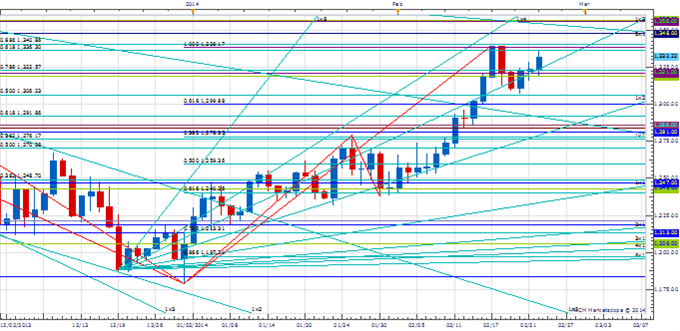

Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

- XAU/USD has stalled its advance since encountering resistance last week at a confluence of Fibonacci levels between 1336 and 1341

- Our near-term trend bias is positive in Gold while above 1306

- The 1341 level is an important near-term pivot with traction above needed to signal a resumption of the broader uptrend

- A very minor cycle turn window is seen today

- Weakness below the 50% retracement of the August to December decline at 1306 would turn us negative on the metal

XAU/USD Strategy: Like the long side while above 1306.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

XAU/USD |

1286 |

*1306 |

1331 |

*1341 |

1356 |

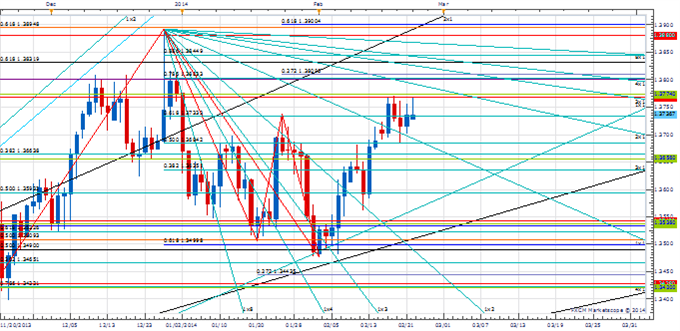

Focus Chart of the Day: EUR/USD

We had a good call in USD/CAD last week as the rate reversed sharply higher from the cycle turn window we had been closely watching mid-week. EUR/USD, on the other hand, has been a different story. The turn we were looking for early last week failed to produce any change and the rate has been threatening resistance at the 1st square root relationship of the 2013 high at 1.3775 ever since. The choppy nature of trading in the Euro since the start of the year is making short-term cycle analysis challenging to say the least. With the rate in its 4th week of an advance, our best guess for the next important turn window is around the middle of this week. A turn lower in the Euro here would signal the 2013 high is still influencing and would potentially set the stage for a broader resumption lower. Continued strength after Thursday above 1.3800 and all bets are off.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia