Price & Time: Watching & Waiting in the Yen

Talking Points

- EUR/USD nears neckline of multi-week double top

- GBP/USD fails near key Gann level

- USD/JPY hovering above major downside pivot

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

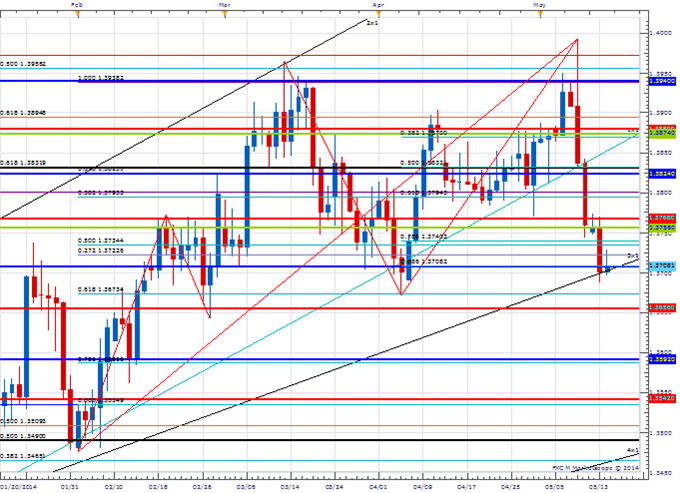

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD touched its lowest level since early April on Tuesday before finding support near the 3x1 Gann angle line of the 2013 low in the 1.3700 area

- Our near-term trend bias is lower in the Euro while below 1.3875

- Last month’s low near 1.3670 remains a key downside pivot with a daily close below needed to confirm a broader topping pattern

- A very minor cycle turn window is seen today

- Only strength back through the 1st square root relationship of the year’s high at 1.3875 would shift the near-term trend bias positive

EUR/USD Strategy: Like the short side while below 1.3875. May look to add on strength over the next couple of days.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

EUR/USD |

*1.3670 |

1.3695 |

1.3710 |

1.3755 |

1.3825 |

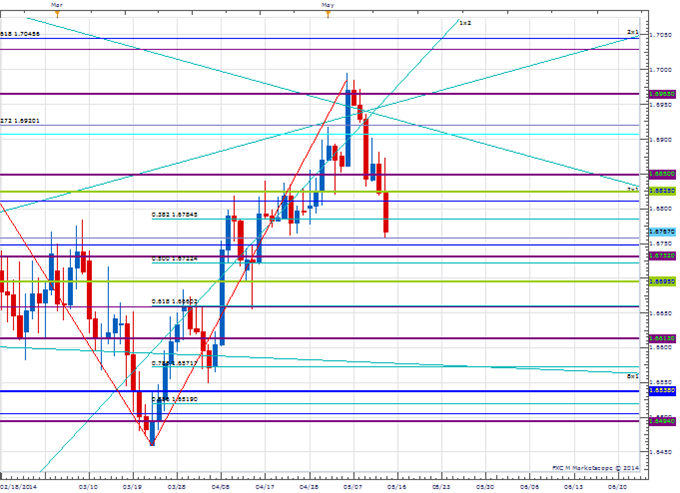

Price & Time Analysis: GBP/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- GBP/USD touched its highest level since the 3rd quarter of 2009 last week before reversing near the 18th square root relationship of the 2013 low in the 1.6965 area

- Our near-term trend bias remains higher, however, while above the 2nd square root relationship of the year’s high at 1.6695

- A move through 1.6920 is needed to re-instill upside momentum in Cable

- A minor cycle turn window is seen late this week/early next week

- A move under 1.6695 will confirm a more important top in the Pound.

GBP/USD Strategy: Like being square for the time being.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

GBP/USD |

*1.6695 |

1.6745 |

1.6770 |

1.6820 |

*1.6920 |

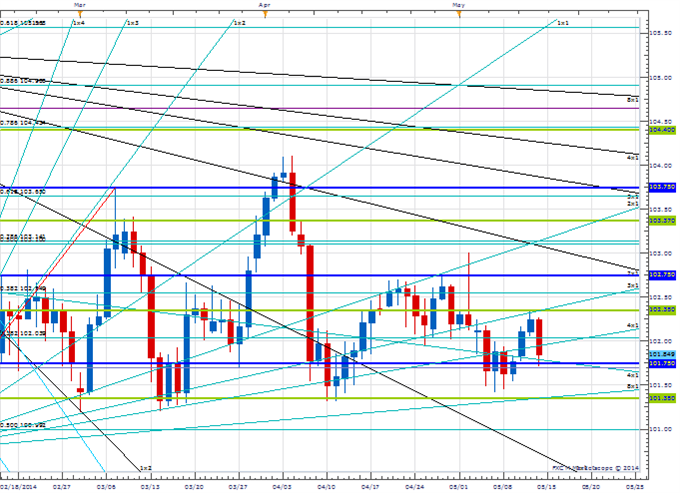

Focus Chart of the Day: USD/JPY

The range in USD/JPY is making the exchange rate much more difficult to analyze from a short-term cyclical perspective. Despite this lack of short-term clarity, the longer-term cyclical picture still suggests the real risk in the exchange rate is to the downside from this multi-month consolidation. The 4th square root relationship of the year’s high at 101.35 remains a critical near-term pivot with weakness below this level needed to signal the start of a new impulsive leg lower. Only a move back through 103.10 would cast doubt on our broader negative cyclical view.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia