The EUR/JPY and EUR/USD Ranges to Watch after the ECB Rate Decision

Talking Points:

- Euro initially rallies on hold decision, but falls during press conference.

- ECB hammers home message that rates will stay low for a very long time.

- No official decision on further accommodative policies.

To keep up with the European data and news as the week goes forward, be sure to sign up for my distribution list.

Intraday Price Perspective

A scan of this morning’s best and worst performers via the Strong/Weak app in the wake of the ECB press conference shows that the Euro’s previously amassed gains over the past 24-hours have relented, with the EURJPY as the worst performing pair on the H4 timeframe. However, on lower timeframes (m15 and H1), the Euro has already started to stabilize.

With such significant event risk having just passed and more yet to come – January US labor market report tomorrow – the quick shifts in price action seen this morning may be insignificant just a day in the future. Here are where the EURJPY and EURUSD sit after this morning:

TECHNICAL ANALYSIS – CHART OF THE DAY

EURJPY H1 Chart: June 2013 to Present

Want to automate your trading or trade baskets of currencies? Try Mirror Trader.

- The EURJPY attempted to retake highs seen earlier this week near ¥143.00/20 but failed as a result of price action around the ECB’s press conference.

- The rally off of the weekly low set on Monday may be tentatively breaking lower with a test of 142.00 earlier.

- Price action since last Thursday has resulted in a range between 141.45 and 143.20. Accordingly, as a sideways range has no bias, longs are eyed >143.20 (stop under ECB low of 142.00) and shorts are eyed <141.45(stop above weekly high of 143.20).

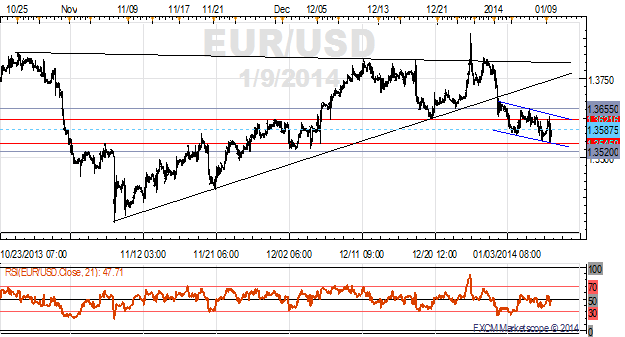

EURUSD H1 Chart: June 2013 to Present

Want to automate your trading or trade baskets of currencies? Try Mirror Trader.

- The EURUSD recently broke down out of the uptrend off of the November 7 and 21 lows, and has begun to consolidate near the December lows just above $1.3620/30.

- A slight descending channel has formed the past few days, with a range forming between 1.3520/45 and 1.3620/55 (numerous highs and lows on H1 timeframe set at the extremes of this range over the past few days.

- Accordingly, as a sideways range has no bias, bulls will need >1.3655 before further gains look attainable (stop under ECB low of 1.3545); bears will need to see price trade <1.3520 (stop above ECB high of 1.3635).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail [email protected]

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

original source

Indonesia

Indonesia