USDCAD Reversal Underway- Long Scalps Favored Above 1.10

Talking Points

- Weekly opening range break turns USDCAD scalp bias positive

- Broader outlook constructive above 1.0906- bullish invalidation

- Major event risk on tap from US & Canada

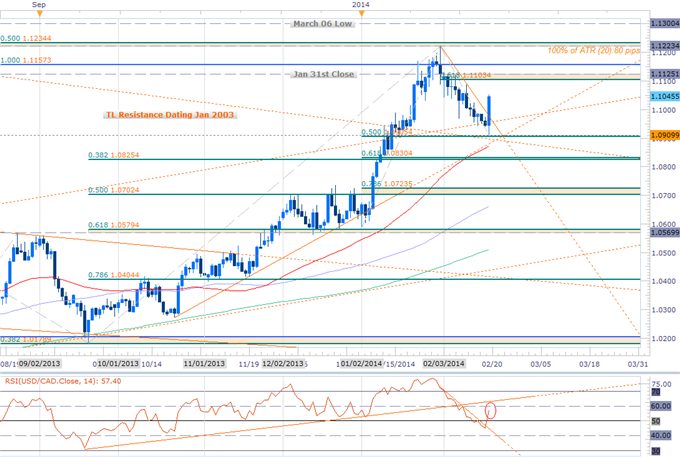

USDCAD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- USDCAD turns ahead of Fib support / TL resistance breach- bullish

- Outside key reversal today / RSI resistance trigger break- bullish

- Breach above weekly opening range high shifts scalp bias to the topside

- Topside resistance objectives at 1.1103/25, 1.1157 & 1.1223/34

- Key support now 1.0906- bullish invalidation

- Break targets support at 1.0825/30 & 1.0702/24

- Key Events Ahead: US Consumer Price Index (CPI) & weekly jobless claims on Thursday and Canadian retail sales & CPI data & US existing home sales on Friday

USDCAD Scalp Chart

Notes: Our focus has shifted back to the topside with today’s breach above the weekly opening range high at 1.0996 and long exposure is favored while above this mark. An outside day reversal pattern on the daily chart paired with a rebound off the 1.0905 key support threshold suggests that a more significant low may have been put in place here. The daily RSI signature remains constructive with the oscillator continuing to respect the 40-threshold with room to spare on subsequent pullbacks since the September lows. A topside trigger / 50-breach today offers further conviction on our directional bias and puts last month’s breakout of the 2003 trendline resistance back into play.

Our immediate focus is to the topside and we’ll look to buy dips / breaks of resistance with RSI conviction while above 1.0996 with only a break / close below 1.0905 invalidating our broader outlook. Caution is warranted heading into key data prints from both countries tomorrow and Friday with pullbacks likely to offer favorable long entries. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

|

Entry/Exit Targets |

Timeframe |

Level |

Significance |

|

Resistance Target 1 |

Daily / 30min |

1.1066 |

50% Retracement |

|

Resistance Target 2 |

30min |

1.1089 |

Last Week’s High / Soft Resistance |

|

Bearish Invalidation |

Daily / 30min |

1.1103/25 |

61.8% Retracement / Jan 31st Close |

|

Break Target 1 |

Daily / 30min |

1.1156/57 |

78.6% Retracement / 100% Ext |

|

Break Target 2 |

30min |

1.1175 |

Soft Support / Pivot |

|

Break Target 3 |

30min |

1.1195 |

Soft Support / Pivot |

|

Break Target 4 |

Daily / 30min |

1.1223/34 |

2014 High / 50% Retracement |

|

Break Target 5 |

Daily |

1.1300 |

March 2006 Low / Soft Resistance |

|

Support Target 1 |

30min |

1.1020 |

61.8% Retracement / Pivot |

|

Bullish Invalidation |

30min |

1.0996/99 |

50% Retracement / Weekly ORH |

|

Break Target 1 |

30min |

1.0975 |

Soft Support / Pivot |

|

Break Target 2 |

30min |

1.0952 |

23.6% Retracement |

|

Break Target 3 |

30min |

1.0929 |

61.8% Fib Extension |

|

Break Target 4 |

Daily / 30min |

1.0906/09 |

50% Retrace / Weekly ORL / Feb Low |

|

Break Target 5 |

30min |

1.0872/74 |

50DMA / TL Support / Pivot |

|

Break Target 6 |

Daily / 30min |

1.0825/31 |

61.8% & 38.2% Retrace(s) / 100% Ext |

|

Daily (20) |

80 |

Profit Targets 17-20pips |

|

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

- GBPAUD Weekly Range in Focus- Bullish Scalp Bias at Risk Sub 1.86

- GBPCAD Challenging Feb Range High- Scalp Bias Bullish Above 1.8037

- AUDNZD Target Key Resistance- Bullish Scalp Bias at Risk Sub 1.09

- GBPNZD Scalps Target Opening Range- Higher Low in Place?

- AUDCAD Eyes Key Resistance- Bullish Scalp Bias at Risk Sub 9953

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email [email protected] or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars next week Monday- Thursday mornings on DailyFX Plus (Exclusive of Live Clients) at 1130 GMT (11:30ET)

Interested in learning about Fibonacci? Watch this Video

original source

Indonesia

Indonesia