USDJPY Testing March Low Ahead of FOMC- Longs Favored Above 101.20

Talking Points

- USDJPY trading near support of well-defined range

- Weekly opening range in focus- break to offer conviction scalp bias

- Major event risk on tap from US this week

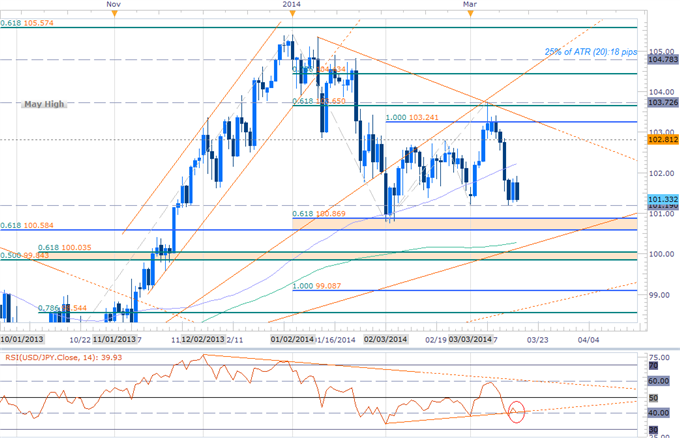

USDJPY Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- USDJPY testing bottom of March range at 101.19- bullish invalidation

- Weekly opening range forming just above (101.26 – 101.80/92)

- Breach targets objectives at 102.47 & 102.80 (Feb High)

- Subsequent resistance targets at 103.24 & 103.65/73

- Support break targets 100.58/86 range- Key support 99.84- 100.03

- Daily RSI resting on support trigger dating back to 2014 low

- Event Risk Ahead: FOMC Policy Decision tomorrow, Existing Home Sales on Thursday

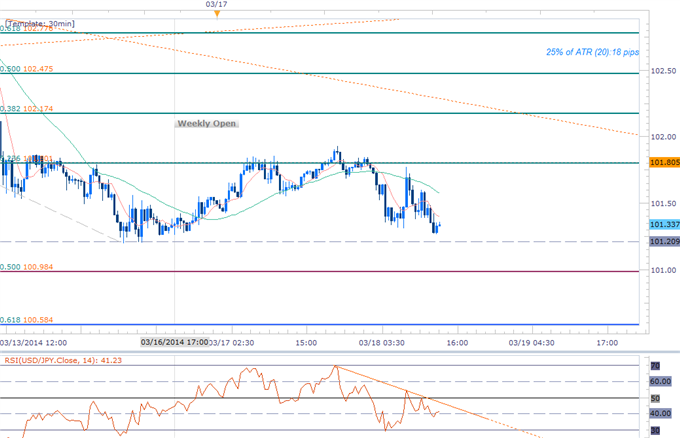

USDJPY Scalp Chart

Notes: The USDJPY has continued to trade within the initial March opening range with the recent decline taking the pair back into the monthly low. The weekly opening range is now forming just above this level and our immediate focus is on the long-side while above 101.19. Intra-day RSI divergence and proximity to this threshold has us holding a long position off these levels, but a move surpassing the weekly high is needed to offer conviction on our near-term directional bias.

Note that despite our short-term outlook, we will respect a break/close below the 101.19 with such a scenario risking substantial losses for the pair. On a broader basis, a rally through the 61.8% retracement of the decline at 102.77 is needed warrant long exposure targeting the monthly highs.

Bottom line: calling turns is always risky business. We’ll remain nimble on long exposure while above the monthly low with a breach above the weekly opening range shifting our scalp bias more aggressively to the topside. Use caution heading into the FOMC policy decision tomorrow with the bulk of the volatile likely to occur during the subsequent presser with newly appointed Fed Chair Janet Yellen. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

|

Entry/Exit Targets |

Timeframe |

Level |

Significance |

|

Bearish Invalidation |

30min |

101.80 |

23.6% Retracement/ Weekly ORH (101.92) |

|

Break Target 1 |

30min |

102.17 |

38.2% Retracement / March TL Res |

|

Break Target 2 |

30min |

102.47 |

50% Retracement / 61.8% Ext |

|

Break Target 3 |

30min |

102.77 |

61.8% Retracement |

|

Break Target 4 |

Daily / 30min |

103.00 |

Soft Resistance / Psychological Figure |

|

Break Target 5 |

Daily / 30min |

103.20/24 |

78.6% Retrace / 100% Ext / March Close High |

|

Break Target 5 |

Daily |

103.65/72 |

March 2013 High / 61.8% Retrace / Monthly High |

|

Bullish Invalidation |

Daily / 30min |

101.20 |

Weekly & Monthly ORL |

|

Break Target 1 |

30min |

100.98 |

50% Retracement |

|

Break Target 2 |

Daily / 30min |

100.58 |

61.8% Ext / September High |

|

Break Target 3 |

Daily / 30min |

99.84 – 100.04 |

50% & 61.8% Retrace(s) / April 2013 High |

|

Break Target 4 |

Daily |

99.09 |

100% Ext |

|

Daily (20) |

70 |

Profit Targets 16-18pips |

|

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

- Trading the USDCAD Triangle- Weekly Opening Range in Focus

- NZDUSD Rallies Into Key Resistance on RBNZ- Bearish Below 8580

- Is an AUDUSD Top in Place? Shorts at Risk Above 8920

- Scalping the EURUSD: Breakout or Fakeout?

- GBPUSD at Risk Heading into BoE, NFPs- Key Resistance 1.6754

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email [email protected] or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Wednesday and Thursday morning this week on DailyFX Plus (Exclusive of Live Clients) at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

original source

Indonesia

Indonesia