Weekly Price & Time: EUR/USD Nearing Key Technical Level

Talking Points

- EUR/USD recovery stalls at important retracement

- USD/JPY still unable to overcome key long-term retracements over 105.00

- Gold break important Gann resistance

Looking for real time Forex analysis throughout the day? Try DailyFX on Demand.

Weekly Foreign Exchange Price & Time at a Glance:

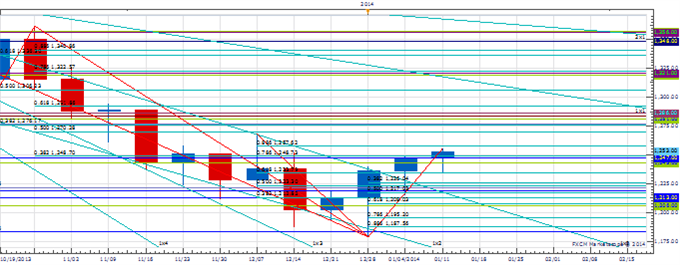

Weekly Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD rebound from last week off key Gann support failed from just above the 38% retracement of the year’s range

- Our trend bias is lower in the Euro while below the 2013 closing high near 1.3800

- The 1.3540 area remains key support, with weakness below needed to signal a broader downside resumption

- The latter half of the month is the next medium-term cycle turn window

- Only a daily close back over 1.3800 would turn us positive on the Euro again

Weekly EUR/USD Strategy: Like the short side under 1.3800.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

EUR/USD |

1.3485 |

*1.3540 |

1.3565 |

1.3685 |

*1.3800 |

Weekly Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY came under further pressure this past week and traded to its lowest level in over three weeks before rebounding sharply from the 161.8% projection of the early January decline at 102.90

- Our broader trend bias is positive in the exchange rate while above 103.35

- The 105.55 level remains critical resistance that must be overcome soon if another important leg higher is to unfold

- The latter part of next week is a medium-term cycle turn window

- A weekly close below the 2nd square root relationship of the year’s high at 103.35 will turn us negative on the exchange rate

Weekly USD/JPY Strategy: Like being long against 103.35, but should be reduced.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

102.90 |

*103.35 |

104.25 |

104.80 |

*105.55 |

Weekly Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

- XAU/USD has stalled its advance since reversing from the 1184 161.8% extension of the October advance at the end of December

- However, Monday’s close above the 2nd square root relationship of the 2013 low at 1247 has turned our broader trend bias to positive in the metal

- The Decemeber high at 1267.75 is a near-term upside pivot with traction above needed to trigger a more important move higher

- A medium-term cycle turn window is seen around the end of the month

- A daily close back under 1213 would turn us negative on the metal

Weekly XAU/USD Strategy: Like being long while over 1213.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

XAU/USD |

1184 |

*1213 |

1252 |

*1268 |

1281 |

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia