Weekly Price & Time: Secondary Top Next Week in EUR/USD?

Talking Points

- EUR/USD reverses sharply after failing to overcome key resistance - what next?

- USD/JPY nearing big break?

- GOLD reverses at important cycle point, further weakness ahead

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

Weekly Foreign Exchange Price & Time at a Glance:

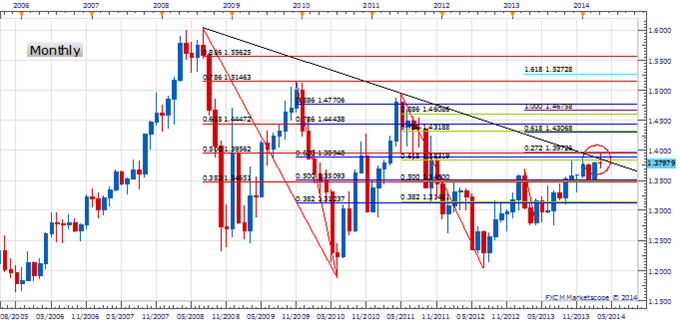

Weekly Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD came under aggressive pressure this past week after failing to overcome key resistance at 1.3970

- Our longer-term trend bias is positive while above 1.3730

- Fibonacci resistance at 1.3970 remains key and needs to be convincingly overcome to signal the ‘all clear’ for a more important run higher

- A cycle turn window is next week

- A move under 1.3730 will turn us negative on the Euro

Weekly EUR/USD Strategy: May look to sell soon if price action confirms a break.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

EUR/USD |

1.3640 |

*1.3730 |

1.3800 |

1.3855 |

*1.3955/70 |

Weekly Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY found support this week near the 4th square root relationship of the year’s high around 101.35

- Our broader bias is negative in the rate while below 104.40

- The year’s low near 100.75 is critical support with a move below having very ominous implications for the exchange rate

- A cycle turn window is seen around the middle of next week

- A weekly close back over 104.40 would turn us positive again on USD/JPY

Weekly USD/JPY Strategy: We like tactical short positions in USD/JPY while below 104.40 on a weekly close basis.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

*100.75 |

101.35 |

102.25 |

103.75 |

*104.40 |

Weekly Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

- XAU/USD touched its highest level since early September during the Monday cycle turn window before turning sharply lower from the 6th square root relationship of the 2013 low

- Weakness below 1348 has turned us negative on the metal

- A confluence of several key Fibonacci and Gann levels between 1310/18 needs to be broken to confirm that a more important move lower is indeed underway

- The next important turn window is seen in early April

- A daily close back over 1380 would turn us positive again on the metal

Weekly XAU/USD Strategy: Like selling into strength against 1380.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

XAU/USD |

1285 |

*1310/18 |

1335 |

1350 |

*1380 |

Unfamiliar with Gann Square Root Relationships? Learn more about themHERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved

To contact Kristian, e-mail [email protected]. Follow me on Twitter @KKerrFX

original source

Indonesia

Indonesia