AUD Hangs Hopes On Status Quo RBA Minutes and Strong China Data

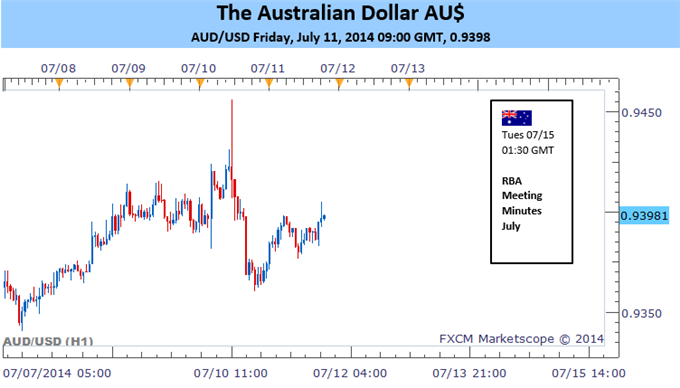

Hourly Chart - Created Using FXCM Marketscope 2.0

Fundamental Forecast for Australian Dollar: Neutral

- RBA Minutes unlikely to shift expectations for a “period of stability” for Australian interest rates

- Yield advantage may continue to offer support to the currency amid low vol. environment

- Strong readings from a slew of upcoming Chinese economic data would bode well for the AUD

The Australian Dollar finished relatively flat for the week despite several bumps along the way. Domestic data presented a mixed bag with soft employment figures offsetting some positive leads from a rebound in consumer confidence and business conditions data earlier in the week. Two key themes are likely to continue to offer the Aussie guidance over the week ahead; policy expectations and risk appetite.

On the policy front the RBA July Meeting Minutes due on Tuesday take center stage amid a light economic docket for the week. The central bank has held steadfast in its rhetoric suggesting a “period of stability” remains the best course for rates over the near-term. Although recent economic news-flow has disappointed relative to expectations, a more material deterioration would likely be required to cause the central bank to shift its stance. In the absence of a dovish tone in the communique, the Australian Dollar may be afforded some breathing room.

The Aussie’s relative yield advantage over its US counterpart continues to offer the currency a source of support. Anemic implied volatility levels suggest traders are pricing in a low probability of a major economic disruption occurring over the near-term. If this environment persists over the coming week, carry trade demand for the AUD could keep the currency elevated.

Additional guidance for the Australian Dollar is likely to stem from a string of top-tier Chinese economic releases including second quarter GDP, Retail Sales, and Industrial Production figures. We have witnessed a turnaround in economic data from the Asian giant over the past month, which has helped alleviate concerns over a further deceleration for growth. A strong second quarter GDP print would be a positive for the Australian economy, via a strong trade link, and would offer a source of support to the AUD. For views on the US Dollar side of AUD/USD equation, refer to the US Dollar outlook available here.

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia