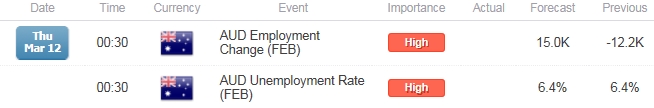

AUD/USD Bearish Outlook Vulnerable to Strong Australia Employment

- Australia Employment Expected to Increase for Fourth Time in Last Six Months.

- Jobless Rate to Hold Steady at Annualized 6.4% for Second-Month.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Australia Employment Change

A 15.0K rebound in Australia Employment may generate a short-term rebound in AUD/USD as market participants scale back bets for a rate cut at the Reserve Bank of Australia’s (RBA) April 7 policy meeting.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Signs of a stronger recover may encourage the RBA to retain its current policy throughout 2015, but Governor Glenn Stevens may continue to jawbone the local currency in an effort to further assist with the rebalancing of the real economy.

Expectations: Bullish Argument/Scenario

|

Release |

Expected |

Actual |

|

Retail Sales (MoM) (JAN) |

0.4% |

0.4% |

|

Building Approvals (MoM) (JAN) |

-2.0% |

7.9% |

|

HIA New Home Sales (MoM) (JAN) |

-- |

1.8% |

The resilience in building activity along with the pickup in private sector consumption may encourage Australian firms to expand their labor force, and a marked expansion in employment may spur a test of former support in AUD/USD as market participants curb speculation for lower borrowing-costs.

Risk: Bearish Argument/Scenario

|

Release |

Expected |

Actual |

|

NAB Business Confidence (FEB) |

-- |

0 |

|

Trade Balance (JAN) |

-925M |

0.1% |

|

Company Operating Profits (QoQ) (4Q) |

0.5% |

-0.2% |

However, waning business confidence paired with the widening trade deficit may drag on job growth, and dismal employment print may generate fresh-lows in AUD/USD as it drags on interest rate expectations.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bullish AUD Trade: Australia Employment Expands 15.0K or Greater

- Need green, five-minute candle following the report for a potential long AUD/USD trade

- If market reaction favors a long aussie trade, buy AUD/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit

Bearish AUD Trade: Job Growth Falls Short of Market Forecast

- Need red, five-minute candle to consider a short AUD/USD position

- Carry out the same setup as the bullish aussie trade, just in the opposite direction

Read More:

GBPAUD Scalps Target 1.9850 Resistance Ahead of UK & AUS Data

Price & Time: Sterling Bucks USD Strength But For How Long?

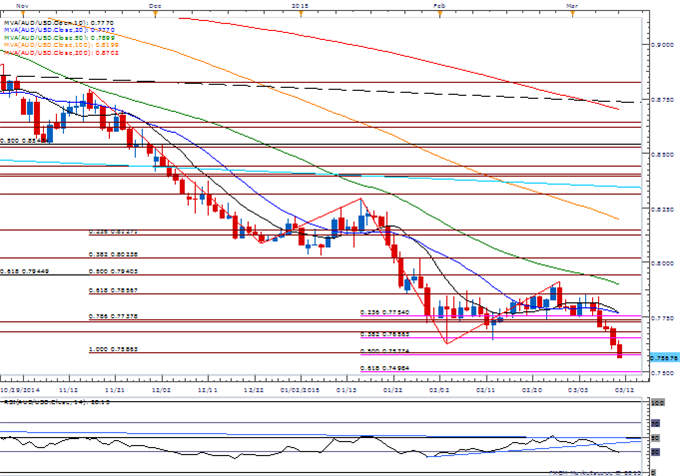

Potential Price Targets For The Release

Join DailyFX on Demandfor Real-Time Updates on the DailyFX Speculative Sentiment Index!

AUD/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- Failure to retain the bullish RSI momentum from earlier this year favors the approach to ‘sell-bounces’ in AUD/USD especially as the RBA keeps the door open to further embark on its easing cycle.

- Interim Resistance: 0.7720 (161.8% expansion) to 0.7730 (78.6% expansion)

- Interim Support: 0.7490 (61.8% expansion) to 0.7500 pivot

Impact that Australia Employment Change has had on AUD during the last release

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

JAN 2015 |

02/12/2015 00:30 GMT |

-5.0K |

-12.2K |

-58 |

-53 |

January 2015Australia Employment Change

Australia employment shrank 12.2K in January 2015 after expanding a revised 42.3K the month prior. At the same time, the jobless rate increased from 6.1% to 6.4% during the same period, marking the highest level since the early 1990s. The ongoing slack in the real economy may encourage the Reserve Bank of Australia (RBA) further embark on its easing cycle in an effort to generate a stronger recovery. The Australian dollar lost ground following the worse-than-expected print, with AUD/USD slipping below the 0.7700 region to end the Asia/Pacific session at 0.7659.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia