Australian Dollar, Japanese Yen Face Event Risk on Economic Calendar

Talking Points:

-Australian inflation data to be this week’s highlight in terms of event risk.

-RBNZ rate decision with a neutral tone could prompt Kiwi selling.

-Japanese CPI data to prompt BoJ speculation?

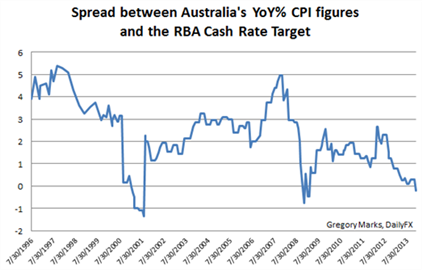

As we have stressed, inflation data out of Australia has become increasingly more important after last quarter’s YoY figure came in at 2.7%, above the 2.5% cash target rate out of the RBA. We have only seen inflation rates above cash target rates a number of times over the past decade and that period has not lasted long (see spread chart below). With that said, if we do see higher inflation out of Australia it is likely that the Aussie is to be well supported on the print. As the Reserve Bank of Australia is hesitant of raising rates in the current environment, higher rates may put pressure on the central bank to take on New Zealand style actions to curb on foreign purchases of domestic homes. Chinese buying of the residential property market has helped push up home prices and contribute to headline inflation figures over the past few months. Read more on Australia’s inflation and how it may impact the Australian Dollar in the second quarter.

The Bank of England likely had some insight in regards to the inflation and jobs data out last week and we may see some comments on those latest developments. Although inflation came in below market expectations, employment data indicated that the rate dropped to 6.9% in March. As the GBPUSD pair continues to face heavy resistance at the YTD highs, any hawkish tone to the BoE minutes could help the pair achieve fresh highs. Nevertheless, with such a large degree of bullish expectations we may wish to remain cautious and attentive to incoming data.

Although expectations have been at record extremes in regards to rate hike increases, inflation data from last week may be the start of a shift in sentiment. Milk auctions have been light consistently over the past few weeks and with lower inflation as of March, a shift in sentiment could be fast and pronounced in what has been a one-sided move higher in the NZD over the past few months. That move could be especially pronounced in the context of a return of USD strength. Any neutral comments out of the RBNZ over some of the more hawkish rhetoric seen over the past few weeks could prompt further Kiwi selling.

The recent tax hike out of Japan has left market participants wary in regards to incoming data. Mixed messages last week out of the government left market in further confusion as the government detailed recent weakness while the BoJ noted that slowdowns in spending have been less pronounced than first thought. Still inflation data for March below expectations could prompt further speculation of more Bank of Japan measures come summer. It is important to note that Yen crosses as of late have been reacting less and less to Japanese data and more in regards to correlations with US yields.

Gregory Marks, DailyFX Research Team

Keep up to date on event risk with the DailyFX Calendar.

How does a Currency War affect your FX trading?

Keep track of live forex rates on DailyFX

original source

Indonesia

Indonesia