Bank of England Holds UK Interest Rates at 0.5%; GBP/USD Faces Resistance

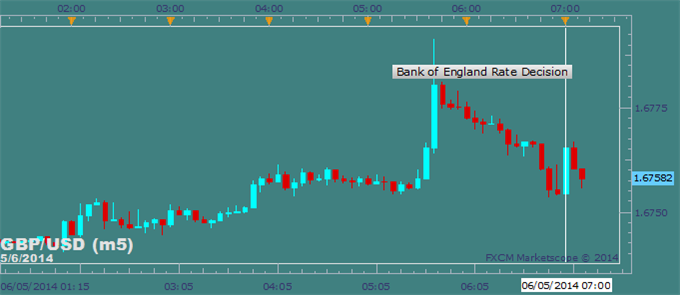

The Bank of England kept its benchmark interest rate unchanged at 0.50 percent. There was no policy statement following the release.

UK CPI continues below the 2 percent target rate established at the central bank. The headline inflation rate is at 1.8 percent, and the month-on-month registered at 0.4 percent in May. The central bank may not be prompted to rethink its accommodative policy until remaining spare capacity is absorbed. Noting that UK 2-year bond yields are higher for the past 15 months, suggests traders may continue to entertain a relatively hawkish view of the BOE. Continued inaction by the central bank may leave the bulls disappointed, potentially leading to a shift in market sentiment.

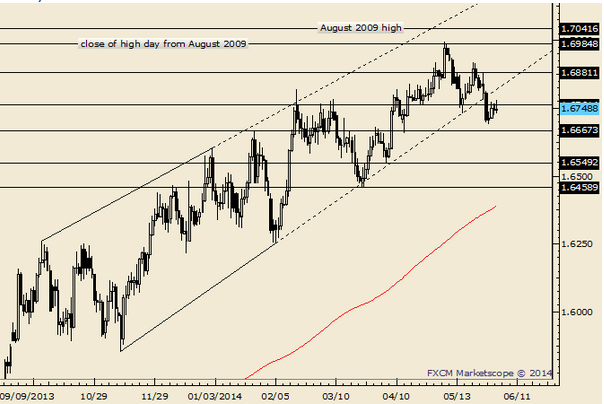

The event was largely uneventful for the British Pound, registering a minor uptick following the release. DailyFX Strategist Jamie Saettele, CMT sees GBP/USD bearish below 1.6900. He notes that former support near 1.6760 has responded as resistance.

GBP/USD Daily

Chart Prepared by Jamie Saettele, CMT using FXCM Marketscope 2.0

GBP/USD 5-Minute Chart Using FXCM Market Scope

-- Written by David Maycotte, DailyFX Research Team. Questions, comments or concerns can be sent to [email protected].

Want to trade with proprietary strategies developed by FXCM? Find out how with Mirror Trader.

original source

Indonesia

Indonesia