Bearish EUR/USD Formation Remains in Focus- AUD Hit by RBA Rhetoric

Talking Points:

- Bearish EUR/USD Formation Remains in Focus as Second T-LTRO Disappoints.

- AUD/USD Remains Oversold as RBA Governor Stevens Toughens Verbal Intervention.

- USDOLLAR Preserves Bullish RSI Momentum on Upbeat Retail Sales Report.

For more updates, sign up for David's e-mail distribution list.

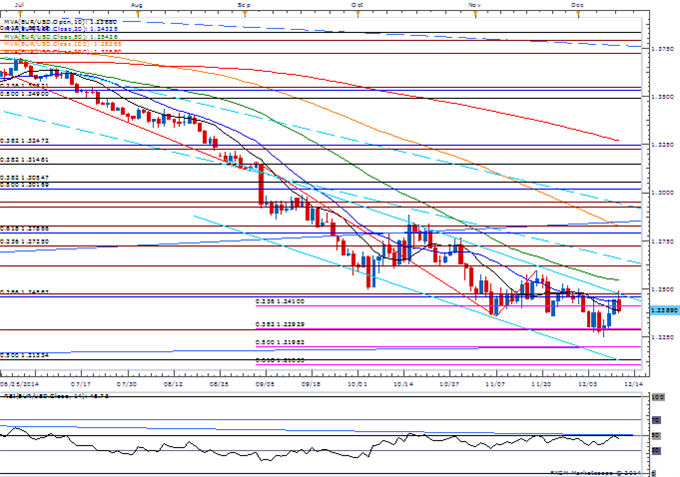

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD retains monthly opening range/bearish formation as the second take-up of the targeted Long-Term Refinancing Operation (LTRO) amounted to EUR 129.8B amid expectations for EUR 170B.

- Seeing increased bets for quantitative-easing in the euro-area as European Central Bank (ECB) struggles to achieve its EUR1T balance sheet expansion target, favoring bearish outlook for EUR/USD.

- Nevertheless, the DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-short EUR/USD this week after flipping on December 9, with the ratio currently standing at -1.12.

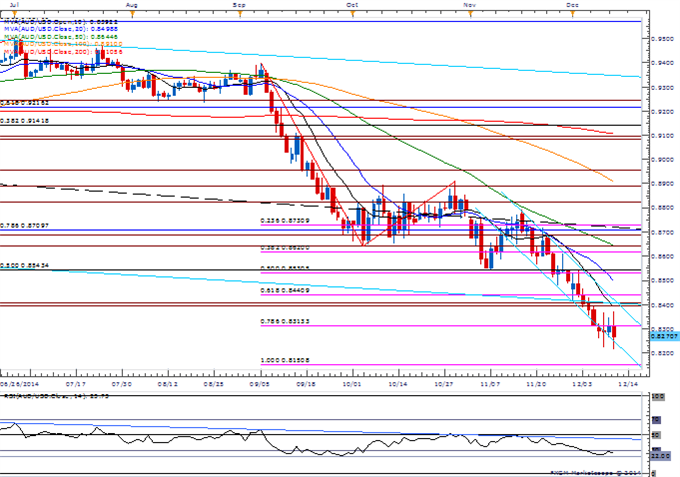

AUD/USD

- AUD/USD slips to fresh monthly low of 0.8213 as Reserve Bank of Australia (RBA) Governor Glenn Stevens toughens the verbal intervention and sees the exchange rate closer to 0.7500 over the next 12-months.

- Even though the Relative Strength Index (RSI) holds it overbought territory, a move back above 30 may highlight a larger rebound for AUD/USD especially as the oscillator holds support around 22.

- Will watch former support around 0.8530 (50% expansion) to 0.8540 (50% retracement) for new resistance, with the next downside target coming in at 0.8150 (100% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: USD/JPY - What Next?

GBPAUD Exhaustion Trade- Longs at Risk Sub 1.9000

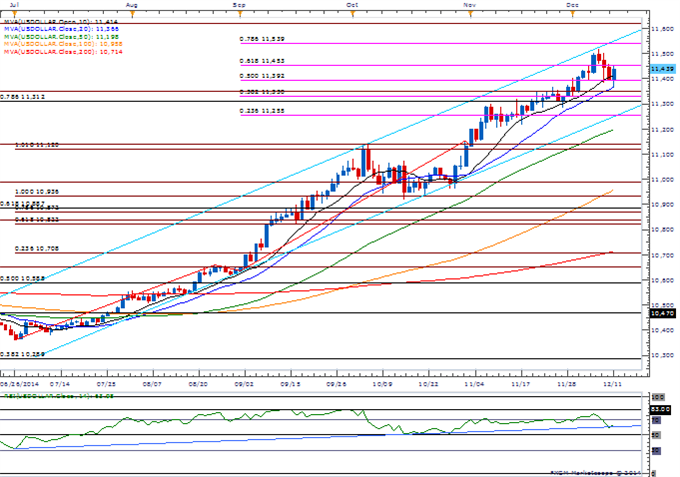

USDOLLAR(Ticker: USDollar):

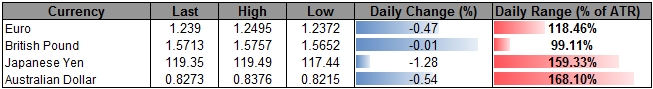

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

11439.60 |

11452.98 |

11363.36 |

0.38 |

152.63% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar may continue to face a limited correction amid the string of closes above 11,392 (50%), while the RSI bounces off of trendline support.

- Despite seasonal factors, the better-than-expected U.S. Retail Sales report may fuel interest rate expectations as private-sector consumption remains one of the leading drivers of growth.

- Will wait for a close below 11,392 for a larger correction, and will keep a close eye on former resistance zones around 11,312 (78.6% retracement) to 11,351 (78.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Advance Retail Sales (NOV) |

13:30 |

0.4% |

0.7% |

|

Advance Retail Sales ex Autos (NOV) |

13:30 |

0.1% |

0.5% |

|

Advance Retail Sales ex Auto and Gas (NOV) |

13:30 |

0.5% |

0.6% |

|

Advance Retail Sales Control Group (NOV) |

13:30 |

0.5% |

0.6% |

|

Import Price Index (MoM) (NOV) |

13:30 |

-1.8% |

-1.5% |

|

Import Price Index (YoY) (NOV) |

13:30 |

-2.6% |

-2.3% |

|

Initial Jobless Claims (DEC 6) |

13:30 |

297K |

294K |

|

Continuing Claims (NOV 29) |

13:30 |

2349K |

2514K |

|

Business Inventories (OCT) |

15:00 |

0.2% |

0.2% |

|

Household Change in Net Worth (3Q) |

17:00 |

-- |

-$141B |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia