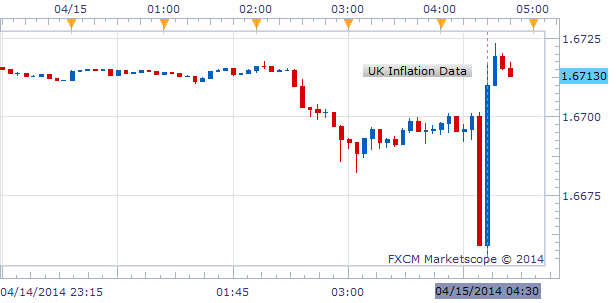

British Pound Pares Losses Following UK Inflation Data

Talking Points:

- U.K. CPI 1.6% y/y in March vs. 1.7% in Feb.

- British Pound Rose vs US Dollar As Data Reports In-Line with CPI

- British Pound May Find Resistance at 1.6783

Get Real-Time Feedback on Your Trades with DailyFX on Demand!

The March set of UK Inflation Data reported broadly in-line with expectations. The headline year-on-year CPI measure of price growth fell to the lowest level since October 2009, and the year-on-year measures of retail inflation fell to the weakest levels in nearly five years. The year-on-year ONS House Price index stands out the most as the print beat expectations and reached the highest level since August 2010. Currency Analyst Ilya Spivak cautions that weakening price pressures coupled with soft readings may push back against BOE policy normalization expectations.

|

Release |

Actual |

Survey |

Previous |

|

UK CPI (MoM) (Mar) |

0.2% |

0.2% |

0.5% |

|

UK CPI (YoY) (Mar) |

1.6% |

1.6% |

1.7% |

|

UK CPI Core (YoY) (Mar) |

1.6% |

1.6% |

1.7% |

|

UK ONS House Price (YoY) (Feb) |

9.1% |

7.4% |

6.8% |

|

UK RPI (MoM) (Mar) |

0.2% |

0.3% |

0.6% |

|

UK RPI (YoY) (Mar) |

2.5% |

2.5% |

2.7% |

The British Pound pared losses and returned to familiar overnight ranges after falling as much as 0.41% to 1.6660. The British Pound may push towards next resistance at 1.6783, according to Sr. Technical Strategist Jamie Saettele, CMT. Market Analyst David de Ferranti notes that GBPUSD may continue lower as candlestick analysis suggests bulls are losing conviction.

GBP/USD 5-Minute Chart. April 15, 2014. Charted created using FXCM Marketscope 2.0.

-- Written by David Maycotte, DailyFX Research Team. Questions, comments or concerns can be sent to [email protected].

Want to trade with proprietary strategies developed by FXCM? Find out how with Mirror Trader.

original source

Indonesia

Indonesia