British Pound Rips on Better-than-Expected Retail Sales

Talking Points:

- U.K. Retail Sales y/y and m/m Beat Expectations

- British Pound Rises against US Dollar Following Data Release

- U.K. Rate Forecasts Refuse to Retreat, so Does Sterling

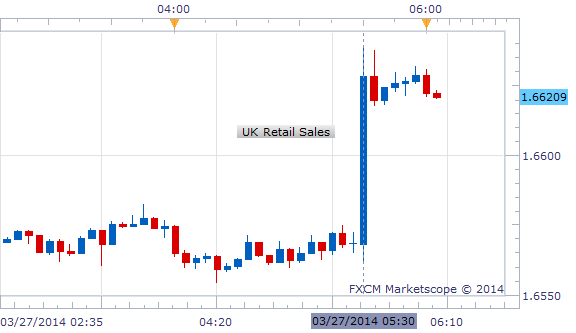

U.K. Retail Sales in February came in better-than-expected as receipts excluding automotive expenditures posted a 4.2 percent year-on-year increase, and beating expectations calling for a print of 2.9 percent. The British Pound broke out of its overnight range extending its gains against the US Dollar for what may be the fourth consecutive day. According to DailyFX Market Analyst David DeFerranti, GBP/USD faces resistance at 1.6600 based on candlestick analysis.

DailyFX Chief Strategist John Kicklighter says that the British Pound remains bullish on a fundamental level. He says that the sterling stands out for its focus on the relative monetary policy outlook. UK-US two-year yield spreads remain at two-and-a-half year highs, and expects bulls to continue as U.K. rate forecasts refuse to retreat.

Due later today is the third revision of fourth-quarter US GDP figures, and DailyFX Strategist Ilya Spivak says the US Dollar may rise as 4Q GDP upgrade bolsters Fed taper outlook.

GBP/USD 5-minute chart – Created Using FXCM Marketscope 2.0

Get Real-Time Feedback on Your Trades withDailyFX on Demand

-- Written by David Maycotte, DailyFX Research Team. Questions, comments or concerns can be sent to [email protected].

Want to trade with proprietary strategies developed by FXCM? Find out how with Mirror Trader.

original source

Indonesia

Indonesia