Canadian Dollar Soars on Better Than Expected Inflation and Retail Sales

Talking Points:

- Canadian annual inflation reported at 1.1% for February

- Retail sales rise the most in eight months

- The Canadian Dollar rises 50 pips against USD

Want to trade with proprietary strategies developed by FXCM? Find out how here.

|

Canada |

Actual |

Expected |

Prior |

Revised Prior |

|

Consumer Price Index M/M |

0.8% |

0.6% |

0.3% | |

|

Consumer Price Index Y/Y |

1.1% |

1.0% |

1.5% | |

|

Retail Sales M/M |

1.3% |

0.7% |

-1.8% |

-1.9% |

The Canadian Dollar soared fifty pips against the US Dollar, as two simultaneous releases showed improved January retail sales and better than expected inflation in February. The 1.3% rise in retail sales was the biggest gain in 8 months, and the annual rise in consumer prices fell back from a yearly high inflation reported at 1.5% for January.

Bank of Canada Governor Poloz said earlier this week that the February annual CPI comparison will appear weak because of the strong rise in consumer prices in February of 2013. Although, Poloz also predicted softer long-term inflation and growth, and he added that the slower growth shouldn’t be blamed only on the weather. The BoC has said that the next direction of its target rate change depends on data, and Poloz said earlier this week that he wouldn’t rule out a rate cut. Therefore, better than expected inflation and retail sales should add to arguments for the Canadian central bank to avoid further loosening monetary policy.

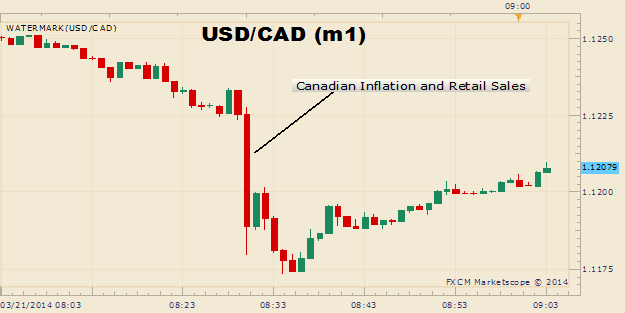

USD/CAD 1-Minute: March 21, 2014

USD/CAD fell to 1.1173 before finding support by the former resistance created by the January 23rd high. Ilya Spivak mentioned that following the recent breakout higher, he would wait for a correction before entering long in the pair.

Chart created by Benjamin Spier using Marketscope 2.0. Add DailyFX Support/Resistance to your charts at FXCM Apps.

-- Written by Benjamin Spier, DailyFX Research. Feedback can be sent to [email protected] .

original source

Indonesia

Indonesia