Copper Vulnerable As China Data Looms, Dovish Yellen To Support Gold

Talking Points

- Crude oil and gold retreat as traders re-assess Ukrainian tensions

- Dovish “fed speak” may dampen USD demand and boost gold prices

- Copper vulnerable to further declines on disappointing China GDP print

The precious metals are retreating alongside declines for energy commodities during the Asian session as traders likely digest strong US economic data overnight and weigh the prospect of an escalation of turmoil in Eastern Europe. Waning Ukrainian tensions may weigh on crude oil and gold in the session ahead, with additional guidance offered by upcoming ‘Fed’ speak and US inflation figures. Meanwhile, Copper is likely to face a volatile 24 hours ahead with top-tier Chinese economic data on tap.

One Eye On The East

- WTI and palladium have continued their slide in Asian trading as investors likely re-assess the potential threat of supply disruptions posed by the most recent flare-up in the ongoing Ukrainian crisis. Similarly, gold and silver prices are pulling back as ebbing geopolitical concerns sap safe-haven demand for the precious metals. While the stand-off between Russia and Ukraine remains on the radar, the absence of a further escalation may weigh on crude oil and gold in the session ahead. The sharp correction in the gold price in mid-March that occurred as concerns over Eastern Europe abated should be kept in mind (see chart below).

- Traders Listening For Dovish “Fed Speak”

- The precious metals may yet find some support on dovish comments from Fed Chair Janet Yellen during her upcoming speech. Traders will be quick to remember the plunge in gold prices following Dr. Yellen’s recent suggestion that the central bank may hike rates within six months of finishing its quantitative easing program. A reassurance that Fed policy will remain highly accommodative to support continued improvements in the US labour market may renew selling pressure in the greenback, which in turn is bullish for gold.

- Upcoming US CPI figures may face a fairly muted reaction, barring a significant deviation from expectations Persistently low levels of inflation and well-anchored expectations have afforded the Fed considerable scope for easy policy. It would take a material increase in CPI to prompt a more aggressive stance from the central bank which would be supportive for the greenback and bearish for gold.

- Copper’s Fate Hangs On Upcoming China Data

- Chinese Retail Sales, Industrial Production and first quarter GDP figures are all set to drop on Wednesday, putting copper in store for a potentially volatile 24 hours ahead. On balance economic data out of the world’s largest copper consumer has been disappointing of late, which has likely contributed to the melt-down in the copper price which has fallen by roughly 10% year-to-date. Thus another miss from tomorrow’s top-tier releases could send copper plunging below critical support at the $3.00 handle.

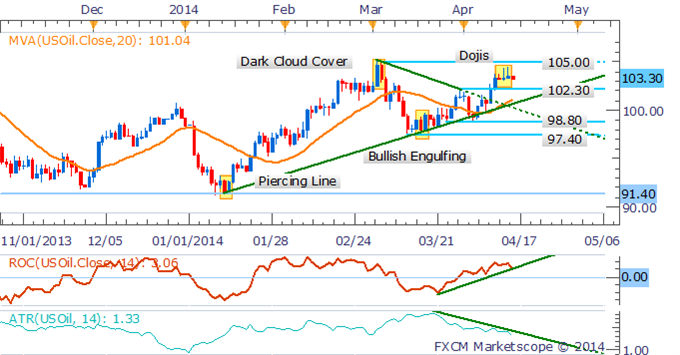

CRUDE OIL TECHNICAL ANALYSIS

Crude oil is struggling below the 105.00 handle following a break above the triangle formation on the daily. The hesitation amongst the bulls is made evident by the emergence of several Doji formations. While the breakout and continued uptrend favors a bullish technical bias, there is the potential for a pullback to support at 102.30, which would be seen as an opportunity to enter new long positions.

Crude Oil: Struggles To Hit 105.00 As Dojis Warn of a Pullback

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD TECHNICAL ANALYSIS

Gold has shifted to a short-term uptrend on the daily as signaled by prices edging above the 20 SMA and a move into positive territory on the Rate of Change indicator. The bounce in the gold price was foreshadowed by the Morning Star formation that arose near key support at $1,277. In light of the bullish technical signals for the commodity; the move above the $1,320 handle favors longs with a target offered by the next noteworthy resistance at $1,351. However, it is likely the 50% Fib Retracement level ($1,332.75) will again put up some interim selling pressure.

The DailyFX Speculative Sentiment Index suggests a mixed bias for gold based on trader positioning.

Gold: Technicals Support Further Gains

Daily Chart - Created Using FXCM Marketscope 2.0

SILVER TECHNICAL ANALYSIS

Silver continues to keep traders in suspense with prices hugging the $20.00 handle. The recent consolidation suggests the short-term downtrend may be set to shift, which is reinforced by the Rate of Change indicator pushing into positive territory. The struggle between the bulls and bears is made further evident by several Doji formations on the daily, with the decline in volatility eliciting the lowest 14 day ATR reading since July 2009. The potential for an upside break above $20.00 makes new short positions look less attractive.

Silver: Traders In Suspense Near $20.00 Handle

Daily Chart - Created Using FXCM Marketscope 2.0

COPPER TECHNICAL ANALYSIS

The uptrend for copper is already showing signs of capitulation as the commodity struggles to push above the 38.2% Fib Level at $3.085. Several Doji formations on the daily demonstrate indecision amongst traders, yet they are not enough to suggest a correction at this stage. Additionally, with the rate of change indicator signaling fading upside momentum, we’re left with a neutral technical bias.

Copper: Bulls Hold Back Near $3.085

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Market Analyst, FXCM Australia

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia