Crude Near Key Support as OPEC Meeting, US Inventories Data Loom

Talking Points

- WTI Near Critical Support Ahead Of Key Fundamental Event Risk

- Natural Gas Advance Questionable Without Shift In Supply Story

- Quarterly Forecast: Gold RemainsVulnerable To USD Strength

The crude oil benchmarksextended their recent declines on Tuesday with WTI plunging by over 2 percent for the session. Newswires tied the drop to a lack of action by OPEC members at a gathering ahead of the more significant pow-wow set to take place later in the week. The plunge in crude prices over recent months has bolstered speculation that producers may respond with supply cuts. Yet further inaction could leave ample supply expectations to persist, which could in turn keep pressure on the commodity.

The upcoming DOE’s Weekly Petroleum Status Report offers an additional source of event risk for WTI. With total US crude production resting near multi-decade highs - it would likely take an overwhelmingly bullish report to erode some of the negative sentiment facing crude.

Also in energy space; natural gas witnessed an astounding rebound of more than 6 percent with media sources citing expectations for another blast of US cold weather as a likely catalyst. Yet in the absence of a meaningful shift in the supply story there is some doubt over the prospect of continued gains for the commodity.

Meanwhile the precious metals saw modest gains in recent trade with another lackluster session for their pricing currency the USD. Some hesitation from the US Dollar bulls may be due to thin trading conditions ahead of the Thanksgiving holiday in the US. Yet the potential for a pullback for the greenback is questionable. Especially given the prospect of another round of strong US economic prints over the session ahead, which include Durable Goods Orders readings, and PCE figures. Without a weaker greenback a more sustained advance for gold and silver is questionable.

ECONOMIC EVENTS

Due to the extent of US data due over the session ahead the usual image has not been included today. Please refer to the DailyFX Economic Calendar for the information.

Market Movements (Tue 25 Nov, 2014, Close 5PM EST)

|

Energy |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

US Oil |

75.68 |

76.56 |

73.7 |

73.85 |

(1.83) |

-2.42% |

|

UK Oil |

79.5 |

80.42 |

78.03 |

78.16 |

(1.34) |

-1.69% |

|

Natural Gas |

4.147 |

4.439 |

4.145 |

4.43 |

0.29 |

6.90% |

|

Metals |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

Gold |

1,196.76 |

1,202.86 |

1,190.31 |

1,200.60 |

3.84 |

0.32% |

|

Silver |

16.46 |

16.71 |

16.45 |

16.66 |

0.20 |

1.23% |

|

Palladium |

790.4 |

798.8 |

789.3 |

792.2 |

1.80 |

0.23% |

|

Platinum |

1,202.70 |

1,225.10 |

1,201.80 |

1,222.70 |

20.00 |

1.66% |

|

Copper |

3.00 |

3.02 |

2.96 |

2.96 |

(0.04) |

-1.23% |

CRUDE OIL TECHNICAL ANALYSIS

Crude remains capped below the 77.00 barrier with indications of a downtrend persisting (descending trendline, 20 SMA). This leaves the downside risks centered on the late September 2010 low at 72.70. A daily close above 77.00 would be required to warn of a base for the commodity.

Crude Oil: Retests and Respects Critical 77.00 Barrier

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD TECHNICAL ANALYSIS

Gold remains at a crossroads as trend indicators warn of building upside momentum (20 SMA and ROC). Yet it is still capped below key resistance at 1,208 (also the 61.8% Fib.). This leaves a clearer setup desired to offer a more concrete technical bias.

The DailyFX SpeculativeSentimentIndex suggests a mixed bias for gold based on trader positioning.

Gold: Trend Indicators Begin To Point Higher

Daily Chart - Created Using FXCM Marketscope 2.0

SILVER TECHNICAL ANALYSIS

Silver has cleared several technical barriers; the 20 SMA, descending trendline, and 50% Fib. Alongside a positive trend signal from the Rate of Change indicator the odds are being stacked in favor of a further gains for the precious metal. A leap over former support-turned-resistance at 16.70 would put the focus on the 17.70 ceiling.

Silver: Sentiment Shifts As Key Barriers Cleared

Daily Chart - Created Using FXCM Marketscope 2.0

COPPER TECHNICAL ANALYSIS

Copper has continued its choppy impulsive swings between trendline resistance and support at 2.96. Caution is suggested when adopting fresh positioning given the commodity’s tendency towards volatility over recent months. Further, trend indicators have proven prone to rapidly changing direction, suggesting a lack of strong conviction from traders.

Copper: Choppiness Suggests Caution Required

Daily Chart - Created Using FXCM Marketscope 2.0

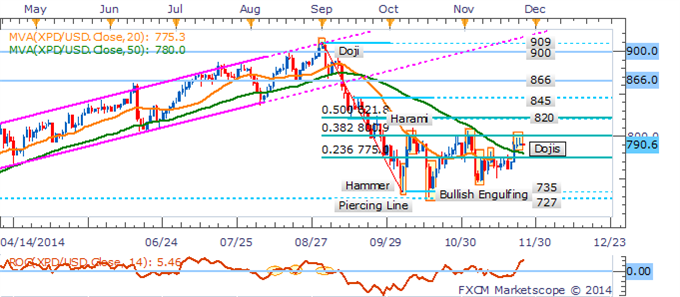

PALLADIUM TECHNICAL ANALYSIS

Palladium is struggling to sustain its recent gains at the 38.2% Fib. This has left a pair of Dojis in its path. However, the candlestick formations are not considered key reversal patterns. Alongside signs of an emerging uptrend a pullback is questionable.

Palladium: Struggles Sub The 38.2% Fib.

Daily Chart - Created Using FXCM Marketscope 2.0

PLATINUM TECHNICAL ANALYSIS

Platinum continues to struggle to lift-off from the 1,187 floor despite a Bullish Engulfing pattern lying in its wake. This the bears are still unprepared to relinquish their grip on the metal and may continue to pull it towards its recent lows.

Platinum: Bears Pull Prices Towards Recent Lows

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia