Crude Oil & Gold May Remain Under Pressure As The USD Bulls Return

Talking Points

- Crude Oil Resumes Descent As Supply Glut Concerns Linger

- Silver At A Critical Juncture Near Key Technical Barriers

- Quarterly Forecast: Gold RemainsVulnerable To USD Strength

The precious metals slipped at the outset of the week with a stronger greenback likely weighing on the alternative assets. Interestingly, the bulk of the gains for the USD occurred ahead of the US session and medium-tier US economic data. This suggests the potential for the US Dollar bulls to continue their return over the session ahead, despite a lack of major supportive news flow. In turn this could keep pressure on gold and silver.

Crude oil also dipped on Monday with newswires citing demand side concerns based on Japan unexpectedly entering a recession. Alongside anticipation of a lingering supply this may spell further weakness for the energy commodity.

Meanwhile natural gas bucked the trend in the commodities space and witnessed an astounding gain of close to 6% for the session. The weather-sensitive instrument was likely propelled by expectations for freezing Northern US weather conditions. Yet once the supportive weather-related factors fade, the prospect of further gains is questionable. This is given the ongoing above-average storage injections for natural gas, which in turn increases the likelihood of ample supplies for the looming US winter.

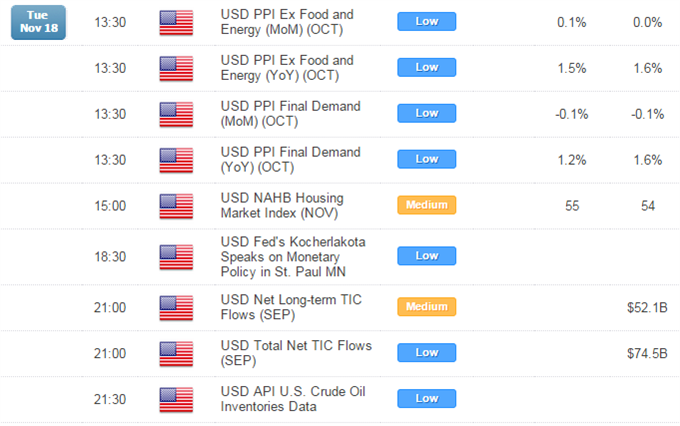

ECONOMIC EVENTS

Source:DailyFX Economic Calendar, Times In GMT

Market Movements (Mon 17 Nov, 2014, Close 5PM EST)

|

Energy |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

US Oil |

75.94 |

76.15 |

74.69 |

75.45 |

(0.49) |

-0.65% |

|

UK Oil |

79.65 |

79.65 |

77.92 |

79.07 |

(0.58) |

-0.73% |

|

Natural Gas |

4.062 |

4.342 |

4.062 |

4.30 |

0.24 |

5.81% |

|

Metals |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

Gold |

1,188.29 |

1,194.11 |

1,181.32 |

1,186.34 |

(1.95) |

-0.16% |

|

Silver |

16.28 |

16.45 |

16.02 |

16.12 |

(0.15) |

-0.94% |

|

Palladium |

764.1 |

774.4 |

760.6 |

768.6 |

4.50 |

0.59% |

|

Platinum |

1,212.00 |

1,212.80 |

1,195.90 |

1,199.80 |

(12.20) |

-1.01% |

|

Copper |

3.04 |

3.06 |

3.02 |

3.03 |

(0.01) |

-0.30% |

CRUDE OIL TECHNICAL ANALYSIS

Crude remains capped below the 77.00 barrier with trend indicators continuing to point downward (descending trendline, 20 SMA, ROC). This suggests a potential run on the late September 2010 low near 72.70. A daily close above the 77.00 hurdle would be required to warn of a base for the commodity.

Crude Oil: Spotlight On Late Sep ‘10 Low Near 72.70

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD TECHNICAL ANALYSIS

Gold is testing several technical barriers including the 20 SMA and 50% Fib. While the core trend remains lower negative momentum appears to have stalled (as signaled by the ROC indicator). This suggests some caution is warranted when looking to enter fresh short positions.

The DailyFX SpeculativeSentimentIndex suggests a bullish bias for gold based on trader positioning.

Gold: Negative Momentum Fades Within Core Downtrend

Daily Chart - Created Using FXCM Marketscope 2.0

SILVER TECHNICAL ANALYSIS

Silver is at a critical juncture as it tests its descending trendline, 20 SMA and the 50% Fib. While below these barriers a bearish technical bias is retained. A potential downside target is offered by the recent lows near 15.00. Yet fading negative momentum suggested by the ROC indicator suggests some caution is warranted.

Silver: Downtrend Remains Intact Despite Recent Bounce

Daily Chart - Created Using FXCM Marketscope 2.0

COPPER TECHNICAL ANALYSIS

Copper has continued its choppy impulsive swings under trendline resistance. Caution is suggested when adopting fresh positioning given the commodity’s tendency towards volatility over recent months. Further, trend indicators have proven prone to rapidly changing direction, suggesting a lack of strong conviction from traders.

Copper: Choppiness Suggests Caution Required

Daily Chart - Created Using FXCM Marketscope 2.0

PALLADIUM TECHNICAL ANALYSIS

Palladium remains in respect of the 23.6% Fib. and 20 SMA, suggesting that the bears are retaining their grip on the metal. However, some caution is required when looking to adopt fresh positioning. This is given palladium’s disposition towards whipsaws in recent trade.

Palladium: Bears Retain Their Grip

Daily Chart - Created Using FXCM Marketscope 2.0

PLATINUM TECHNICAL ANALYSIS

Platinum remains inches away from the critical 1,187 barrier as a Bullish Engulfing formation awaits confirmation. Yet with trend indicators pointing downward (20 SMA, descending trendline) a breakout could pave the way for a push towards the July ’09 low near 1,101.

Platinum: At A Critical Juncture Near Technical Floor

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia