Economic Calendar: Volatility Risk on European CPI, Fed and NFPs

Talking Points:

-Aside from Chinese PMI data and the BoJ, event risk focuses in U.S. and Europe.

-EUR inflation figures could heavily impact sentiment ahead of the ECB.

-Fed to parse words, but another $10B reduction could present risks for Q2/Q3.

Tuesday Event Risk: GBP GDP, EUR German CPI, USD Consumer Confidence

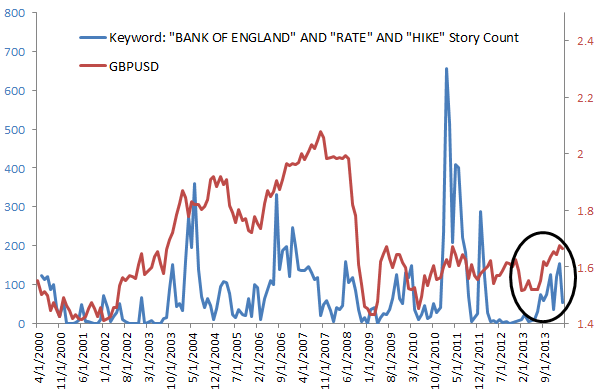

As the GBPUSD pair sits just below 2009 highs, data such as this first quarter GDP reading becomes increasingly more important. The rise of GBPUSD has been loosely founded upon (1) broad based USD weakness and (2) market participants expecting a rate hike sooner rather than later out of the Bank of England. Although data has continued to remain strong out of the U.K., the marginal growth of that strong data has been declining. Employment data has continued to strengthen, but inflation has not risen as fast as market participants first speculated when they were the bid on GBPUSD in 2013 and Q1 2014. The pair has found itself at levels such as this before including in 2011 and 2009. For market participants to justify a rise above the 2009 high, it is likely that GDP and other data sets (including inflation) will need to beat market expectations by a long-shot. Check out our “Trade the News” report on the DailyFX homepage before the print for specific levels to watch.

Rate Hike Speculation vs. GBP: Inflation Follow Through Needed in 2Q?

Wednesday Event Risk: EUR German Unemployment, EUR CPI, CAD GDP, USD GDP, FOMC

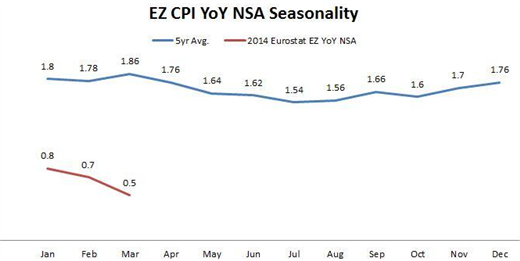

Unique opportunities are presented for EURCAD, EURUSD and USDCAD during the European and early U.S. session with key April Euro-Zone CPI data being released as well as Canadian and US GDP. We detailed risks to April figures back at the beginning of the month as seasonality trends are not in the ECB’s favor. Mr. Draghi and other ECB members have stated that they were ‘surprised’ by March data, but all expect better figures in April. The confidence that central bankers at the ECB as well as market participants have given the EUR may come into question if April data comes in as a threatening ‘surprise’ once more. Such a downside surprise to April price levels will likely force the hand of Draghi and others to comment on action or to go about a symbolic rate cut at the next meeting. Nevertheless, with Euro strength capped as of late in a tight range below March highs, disappointing price level data poses unique and substantial risks to any pronounced move above 1.40. With volatility at some of the lowest levels in EURUSD since mid-2007, it is quite clear that market participants are waiting for a catalyst.

Following Euro-Zone CPI, Canadian and US GDP figures early on Wednesday, we will get the Federal Reserve Rate Decision and monthly pace at which MBS and Treasury purchases will occur at 18:00GMT. In light of what occurred at the last FOMC meeting, it will be no surprise if the Fed parses its words and gives less specific comments on the timing of any increase in the Fed Funds Rate. It is likely that comments lean to the dovish side in the context of the March meeting. The market response to Yellen in March led the Fed to completely reverse course on some comments and make the generic statement clear once more that policy will remain accommodative for an extended period of time. Watch AUDUSD and USDCNH in the context of data later in the session.

Thursday Event Risk: CNH PMI, USD ISM

As we detailed last week, the risks remaining for the Chinese Yuan are substantial to say the least. Although HSBC PMI data continues to indicate that the manufacturing sector is in contraction, the Chinese release continues to print above 50 and not deviate from market expectations. Any move under 50 could add to USDCNH strength as the pair continues to make fresh intraday highs during Asian and US sessions, even when price action is relatively muted across other pairs.

Friday Event Risk: AUD New Home Sales, NFP

To end the week, we will get US Non-Farm Payrolls and unemployment data for the month of April. We have recovered since December’s disappointing sub 100K print and last month achieved a 192K print. With such a heavy degree of event risk preceding this release, it is difficult to gauge how markets will take the print whether it is better or worse.

Weekend Event Risk: CNH Non-Manufacturing PMI (APR)

Gregory Marks, DailyFX Research Team, FXCM

Keep up to date on event risk with the DailyFX Calendar.

How does a Currency War affect your FX trading?

original source

Indonesia

Indonesia