Euro Downside in Focus as OECD Pushes ECB to Prevent Deflation

Talking Points:

- OECD raises 2015 growth expectations for 3 of the 4 biggest economies

- OECD pushes ECB to take action to prevent deflation

- OECD encourages Fed to end easing

Want to trade with proprietary strategies developed by FXCM? Find out how here.

|

OECD May 2014 Economic Outlook |

2014 |

2015 |

2014 Forecast from 11/2013 |

2015 Forecast from 11/2013 |

|

World GDP |

3.4% |

3.9% |

3.6% |

3.9% |

|

US GDP |

2.6% |

3.5% |

2.9% |

3.4% |

|

US Inflation |

1.3% |

1.6% |

1.8% |

1.9% |

|

US Unemployment |

6.5% |

6.0% |

6.9% |

6.3% |

|

Japan GDP |

1.2% |

1.2% |

1.5% |

1.0% |

|

Japan Inflation |

2.6% |

2.0% |

2.3% |

1.8% |

|

Japan Unemployment |

3.8% |

3.7% |

3.9% |

3.8% |

|

Euro-zone GDP |

1.2% |

1.7% |

1.0% |

1.6% |

|

Euro-zone Inflation |

0.7% |

1.1% |

N/A |

N/A |

|

Euro-zone Unemployment |

11.7% |

11.4% |

12.1% |

11.8% |

|

China GDP |

7.4% |

7.3% |

8.2% |

7.5% |

|

China Inflation |

2.4% |

3.0% |

2.4% |

2.4% |

The Organisation for Economic Cooperation and Development raised its expectations for 2015 growth in three of the four of the world’s biggest economies in the May release of its Economic Outlook. Even though the OECD cut its world growth forecast for 2014 to 3.4% from 3.6%, the organization maintained a 3.9% world GDP projection for 2015.

Ahead of Thursday’s European Central Bank meeting, the OECD called on the ECB to take new policy actions to move inflation decisively towards its target and warned that inflation could turn into deflation. Although the OECD lowered its Chinese growth forecast for 2014 and 2015, it said that the new GDP rates are more economically sustainable.

The OECD encouraged the Fed to end quantitative easing by the end of 2014, as the OECD said that the US recovery should gain pace, lowering unemployment, reducing economic slack, and inflation rising close to target.

The OECD’s suggestion for the ECB to take new action could affect EUR/USD trading. If the ECB decides to adopt new monetary policy measures to prevent deflation, the Euro could decline in Forex markets.

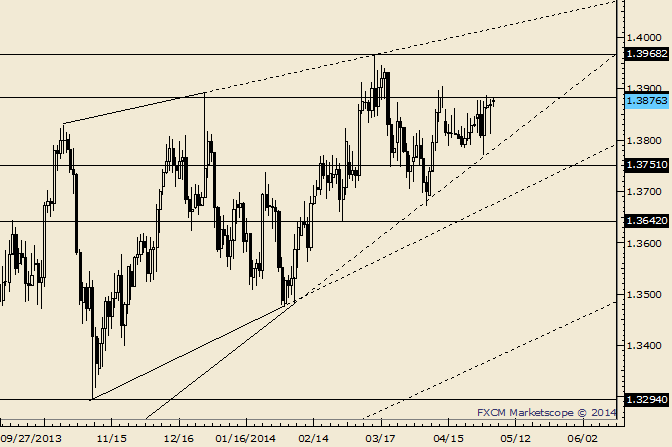

However, Senior Technical Strategist Jamie Saettele warns that an ending diagonal is underway in Euro trading against the US Dollar, in which case the EUR/USD would most likely trade above 1.4000 before topping out. See Jamie’s chart below:

EUR/USD Daily- May 6, 2014 by Jamie Saettele

Charts created Jamie Saettele using Marketscope 2.0. Add DailyFX Support/Resistance to your charts at FXCM Apps.

-- Written by Baruch Spier, DailyFX Research. Feedback can be sent to [email protected] .

original source

Indonesia

Indonesia