Euro Exposed to Fresh Lows as Draghi Invites New QE Speculation

Fundamental Forecast for Euro: Neutral

- The early week EURUSD consolidation gave way to a breakdown in the triangle by Wednesday.

- The Jackson Hole Economic Policy Symposium produced speeches from Yellen and Draghi that dropped EURUSD.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

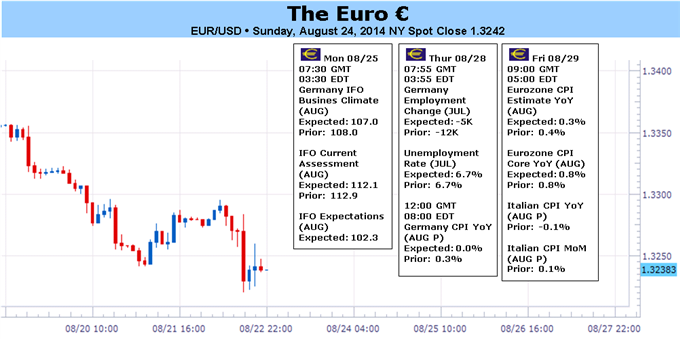

The Euro’s performance was tilted more negative last week, outperforming only two currencies (EURJPY +0.35% to ¥137.64), while EURUSD was the worst performer and closed down -1.20% at $1.3242. Euro-Zone economic data remained on the downswing, with the Citi Economic Surprise Index closing at -36.2, just above the yearly low set on July 21 at -43.3. It’s becoming a more difficult trading environment for the Euro, however.

Per the CFTC’s COT report, non-commercials/speculators increased their pressure on the 18-member currency, increasing net-short positions 138.8K contracts. This is the most extreme short positioning seen in the corresponding futures market since the week ended July 31, 2012 (139.0K). While these shorts represent tinder to fuel a sharp short covering rally by the Euro, a catalyst is needed that has yet to be uncovered.

Traders may have good reason to be increasing pressure on the Euro. In light of the region’s weak growth, inflation, and employment readings of late, European Central Bank President Mario Draghi said that the central bank may be ready to do more on the easing front. Speaking at the Jackson Hole Economic Policy Symposium, ECB President Draghi said that investor speculations on Euro-Zone inflation “exhibited significant declines at all horizons” in August.

ECB President Draghi pointed to one gauge in particular that exhibited the decline of inflation expectations in the Euro-Zone – which might be enough to push the ECB towards a more aggressive non-standard easing program such as QE. The 5-year, 5-year inflation swap rate fell below +2.00% this month for the first time since October 2011, when the Euro-Zone was in the midst of the sovereign debt crisis.

Inflation data due out this coming week isn’t expected to shift the trend in disappointing data for the ECB. On Friday, both German and broader Euro-Zone CPI readings for August will be released. The Euro-Zone CPI Estimate is expected at +0.3% from +0.4% (y/y), the weakest inflation reading since October 2009. Out of Germany, the monthly CPI gauge is expected flat from +0.3%, and the yearly reading due at +0.8% unchanged; these are not evidence of economic growth proliferating. See the DailyFX Euro Economic Calendar for the week of August 24 to 29, 2014.

The time may be approaching for the ECB to act, even though the preferred timeframe to implement new measures is after October, when the ECB finishes collecting and analyzing banks’ balance sheets for the stress tests (AQR). Now that business confidence has started to ebb on the Russian-Ukrainian crisis, weak growth in the region may be dragged lower. Whereas the sovereign debt aspect of the Euro-Zone crisis is currently dead, the economic and political issues are very much alive, keeping the Euro in traders’ crosshairs for at least in the short-term. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

original source

Indonesia

Indonesia