Euro Punished by ECB?s New Measures as QE Remains on Hold

Fundamental Forecast for Euro: Neutral

- The ECB came very close to enacting QE, but the controversial program remained on hold in spite of worsening conditions,

- The Euro’s ensuing plunge at the end of the week put on ice bulls hopes for a short covering rally.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

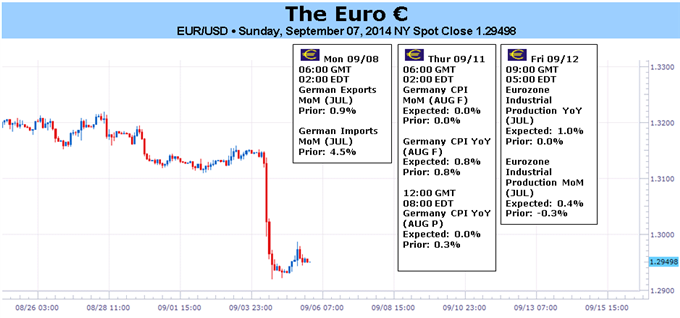

Weeks of speculation came to a head on Thursday when the European Central Bank surprised market participants by unveiling new easing measures, propelling the Euro to its lowest level against the US Dollar since July 10, 2013. EURUSD finished the week lower by -1.40%, trading at $1.2951 by Friday’s New York close.

Admittedly, the EURUSD’s fall has proceeded faster than anticipated, but a recent rise in volume and volatility support the breakout in price – and it’s now been eight consecutive weeks without a gain seen by the pair. EURUSD 1-month ATM implied volatility rose to 6.238% by the end of the week, a +51.5% gain from the lows seen in early July. Beyond this limited look back period, the spike in volatility is indeed only relative in nature: 1-month ATM implied volatility steadied between 6.000% and 7.000% from January through mid-April this year.

The recent bump in volatility may be here to stay for some time, or rather, the low volatility lull may be working its way off the very bottom. Geopolitical events in Eastern Europe and Iraq aren’t dissipating any time soon, especially as military presences increase, worrisome headlines may become more commonplace. Unlike previous swells of ‘uncertainty,’ the risks are more tangible and present a potentially more profound influence on sentiment.

The geopolitical events aren’t nearly the main show for the Euro-Zone, even though the Russian-Ukrainian crisis is having a veritable impact on business confidence and trade. The additional weight exogenous factors are placing on the Euro-Zone growth picture may have pushed the ECB to act earlier than it thought it otherwise would have on Thursday.

The scope of the measures are impressive but fall short of the Fed-styled, sovereign QE. The stimulus pipeline is saturated, with TLTRO activity due to begin in two weeks and the ABS-program, expected at €500B, to start in mid-October. ECB President Mario Draghi himself acknowledged that these measures would amount to a significant expansion of the ECB’s balance sheet; no wonder the German representatives on the Governing Council voted against the easing measures.

For now, pressure on the Euro is to remain although bulls will cling to the hope of a short covering rally given the overextended nature of current futures positioning. Non-commercials/speculators currently hold 161.4K net-short contracts, the most since the week of July 17, 2012 (167.3K contracts). Considering how weak economic data has been recently – the Euro Citi Economic Surprise Index hit its yearly low of -53.8 on September 3 before closing the week at -42.5 – expectations for the Euro are dropping fast. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

original source

Indonesia

Indonesia