Euro Stagnation May Finally End if CPI Rebound Confirms Data Upswing

Fundamental Forecast for Euro: Neutral

- Stronger than expected Euro-Zone PMI figures see the region’s data slump reversing, as seen through EURAUD and EURUSD..

- The European currencies may be ready to rally versus the US Dollar en masse.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

Forex traders should rejoice at the prospect of April ending, as it has been a month to forget:10-day EURUSD average trading range (ATR) is at its lowest level since mid-2007, a testament to the low volatility and quite frankly boring trading environment. Fortunately, with a number of key event risks on the economic calendar, the time for the Euro’s slumber to end may finally be arriving.

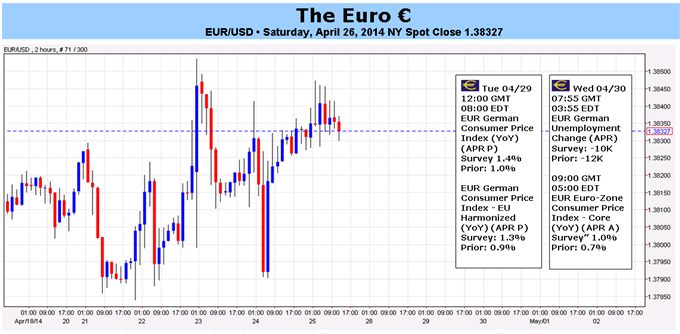

The EURUSD in particular could be more volatile than recent times with the bevy of US economic data due as well, including the ever-market moving FOMC rate decision on Wednesday and the Nonfarm Payrolls report on Friday. But the Euro’s own economic calendar is impressive enough this week (after this past week’s thin docket) to stir greater movement across the Euro complex.

The fundamental backdrop for Euro-Zone economic data is improving, and that yields potential for a breakout by the Euro if the incoming inflation data confirms the broader upswing. For starters, the Euro-Zone Citi Economic Surprise Index, which measures the actual outcome of data releases relative to their expectations, has rebounded back to -1.9 by April 25 from a yearly low of -20.1 on April 22 – in no small part due to the surprising elevation in the aggregate Euro-Zone PMI surveys.

Over the forthcoming days, the German and Euro-Zone Consumer Price Index releases represent the most formidable opportunities and threats to the Euro. Both the regional reading and that of her largest economy, Germany, are expected to show improvement on an annualized basis. German EU Harmonized CPI is due at +1.3% y/y from +0.9% y/y, while Euro-Zone Core CPI is due at +1.0% y/y from +0.7% y/y.

In context of the broader upswing in data, these higher inflation readings could be enough to keep any substantive, non-standard policy measures off the table at the European Central Bank’s next policy meeting on May 8.

All is not well in Euroland, however. Interbank lending pressures are creeping up, and now the overnight lending rate (EONIA) is above that of the ECB’s main reference rate: 0.294% (EONIA) versus 0.25% (ECB main refinancing rate). There could be several causes for this, the primary of which being the ECB’s balance sheet and excess liquidity in the region. Both have dropped to levels before the ECB’s LTRO operations began in late-2011. The balance sheet sits at €2.17 trillion as excess liquidity in the region has fallen to €95 billion.

Simply put, as banks continue to deleverage for the AQR (stress tests) due in November, credit creation and lending activity have fallen by the wayside, holding back potential economic growth. If interbank lending rates continue to be pressured higher, the ECB might be forced to act via lowering the main interest rate by a smaller 0.15-bps cut. In April, the EONIA rate has averaged 0.224%; in March, it was 0.192% (excluding the March 31 spike to 0.688%, the March average would have otherwise been even lower at 0.167%).

Economic data may no longer be the primary concern for the ECB if the incoming inflation data from Germany and the Euro-Zone show improvement as expected. But in light of the tightening lending environment in Europe, and the small detail that monthly German inflation figures are expected to show deflation at -0.1%, the ECB might consider a smaller rate cut going forward on the basis of enhancing the inflation upswing as well as preventing any further financial tensions from the Russian-Ukraine conflict spilling over into the region’s financial markets. But the ECB has been rarely successful in using verbal rhetoric to weaken the Euro, and that power may be eroded even further if data over the coming days shows the improvement that is currently forecast. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

original source

Indonesia

Indonesia