EUR/USD Threatens 1.20- Downside Targets in Focus on Dovish ECB

Talking Points:

- EUR/USD Fails to Break 1.20 Even as ECB’s Draghi Talks Up Quantitative Easing (QE).

- USD/CAD Breaks Out of Range; RSI Coming Up Against Overbought Territory.

- USDOLLAR Advance Capped by Weaker-than-Expected ISM Manufacturing.

For more updates, sign up for David's e-mail distribution list.

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

- May only be a matter of time before EUR/USD breaks 1.20 as European Central Bank (ECB) President Mario Draghi sees a risk for deflation; fueling bets for quantitative easing at the January 22 meeting.

- Downside break in Relative Strength Index (RSI) to favor a further decline in EUR/USD, with the next target coming in around 1.1960-70 (78.6% expansion).

- May see stops get triggered on a move below 1.20 as the DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long EUR/USD since December 16, with the ratio currently standing at +1.63.

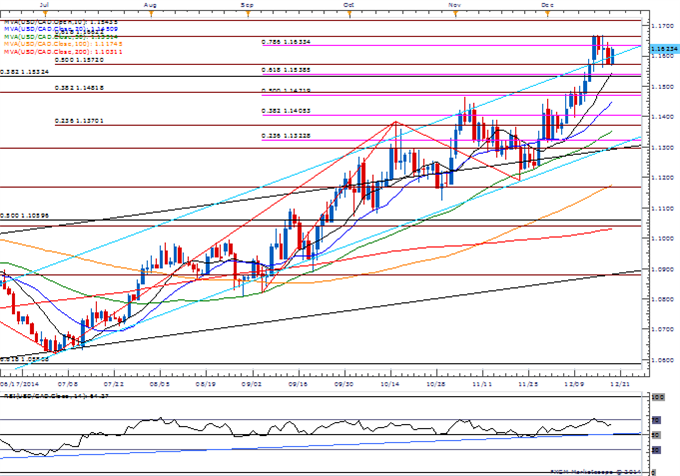

USD/CAD

- Weak crude oil prices may continue to drive USD/CAD higher as Bank of Canada (BoC) Governor Stephen Poloz remains in no rush to further monetary policy.

- As RSI comes up against overbought territory, a topside push should provide conviction/confirmation for a further advance in dollar-loonie.

- Next topside objective for USD/CAD comes in around 1.1750-60 (100% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

"Everybody" Hates The Euro Again

Top Trading Opportunities of 2015

USDOLLAR(Ticker: USDollar):

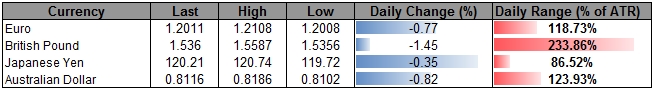

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

11617.20 |

11622.67 |

11545.66 |

0.60 |

149.55% |

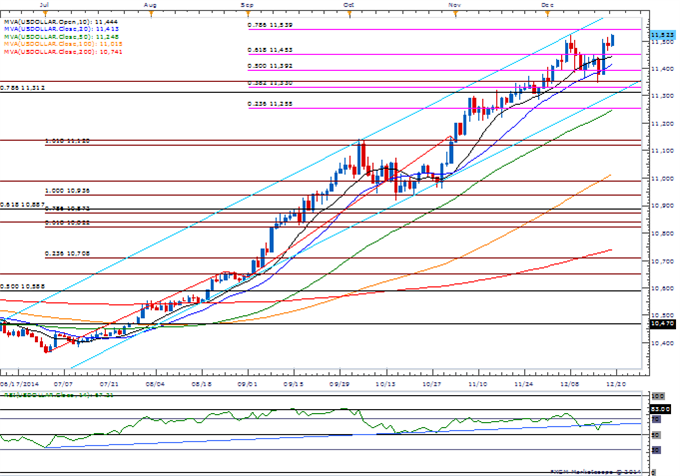

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar struggling to hold its ground following the batch of dismal data prints; employment component of ISM Manufacturing may help to boost Non-Farm Payrolls (NFP) forecast as the index advanced to 56.8 from 54.9 in November.

- Nevertheless, long-term outlook for USDOLLAR remains bullish as growing number of Fed officials show a greater willingness to normalize monetary; will have to see how the 2015 rotation will impact interest rate expectations.

- Despite the lack of momentum to clear 11,623 (100% expansion), the RSI may highlight another topside move in USDOLLAR as the oscillator threatens the bearish momentum & looks to push back into overbought territory.

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Markit Purchasing Manager Index- Manufacturing (DEC F) |

14:45 |

54.0 |

53.9 |

|

ISM Manufacturing (DEC) |

15:00 |

57.5 |

55.5 |

|

ISM Prices Paid (DEC) |

15:00 |

44.0 |

38.5 |

|

Construction Spending (MoM) (NOV) |

15:00 |

0.4% |

-0.3% |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia