EUR/USD, USD/CHF Flag Before Next Move – GBP/CAD Up Next

Talking Points:

- EURUSD, USDCHF in ST flags, ready for next moves in trend.

- GBPCAD, USDCAD near key resistance levels pre-breakouts.

- August forex seasonality in QE era supports a stronger US Dollar.

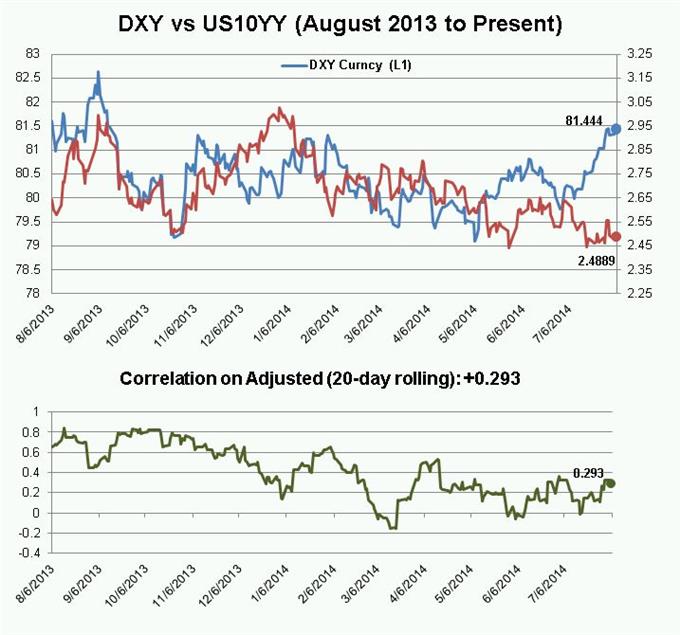

The US Dollar continues to strengthen independent of US yields. The greenback's recent pivot higher has been largely absent of help from its underlying yield complex, and a generally flatter yield curve over the last several months has weighed on the US Dollar as growth expectations floundered.

The chart below highlights this weak, positive correlation:

Perhaps the disconnect is due to the flares of geopolitical risk across the globe. On one hand, stronger US labor market data and a Fed rate hike likely in July 2015 should be supporting a stronger US Dollar (check). On the other hand, geopolitical risk and mixed US inflation data should be supporting stronger US Treasuries (lower yields; check). There's a little something for everyone (that or I have no good explanation otherwise).

In line with the resiliency of the US Dollar (and her tracking index, the USDOLLAR Index), there are several non-indexed pairs that should be on the radar, primarily USDCAD and USDCHF. USDCAD's climb higher towards C$1.0955 also draws our attention to GBPCAD, which was nearing a critical breakout level near C$1.8475.

As pointed out in the video above, EURUSD and USDCHF seem to be flagging in tandem; I'll be watching both for confirmation (a notable divergence was in early-May, when EURUSD set new yearly highs but USDCHF did not set new yearly lows; a break in one flag should go with a break in the other).

Read more: USDOLLAR Breakout Valid Above 10495; AUD/USD Weak Under 0.9310

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail [email protected]

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

original source

Indonesia

Indonesia