EUR/USD Waits for ECB, Fed Catalyst- GBP Threatens Bearish Momentum

Talking Points:

- EUR/USD Holds Tight Range Ahead of ECB’s Targeted LTRO Program

- GBP/USD Risks Further Decline on Dovish BoE Minutes, Scotland Independence

- USDOLLAR Extends Advance Ahead of FOMC Meeting; Forward-Guidance in Focus

For more updates, sign up for David's e-mail distribution list.

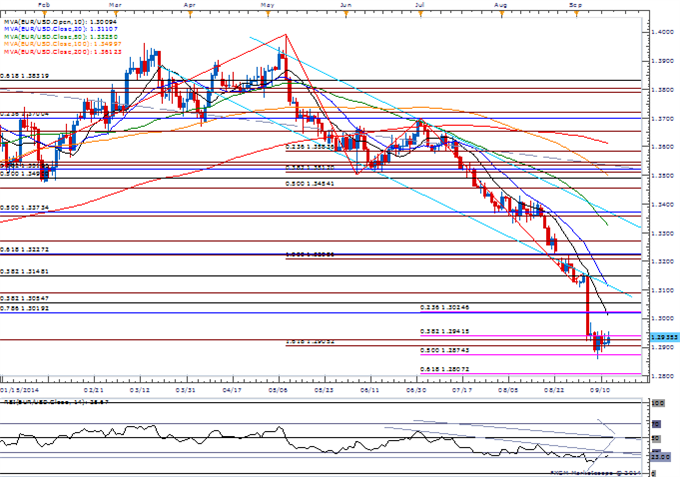

EUR/USD

- Looks as though the EUR/USD will face a narrowing range as European Central Bank (ECB) looks to offer the targeted Long-Term Refinance Operation (LTRO) on September 18.

- Depending on the outcome, ECB’s ‘turbocharged quantitative easing (QE)’ program may come under question on whether the non-standard measure will have the intended impact; may raise bets for more easing.

- The DailyFX Speculative Sentiment Index (SSI) continues to narrow, but shows retail-crowd remains net-long on EUR/USD as ratio currently stands at +1.24.

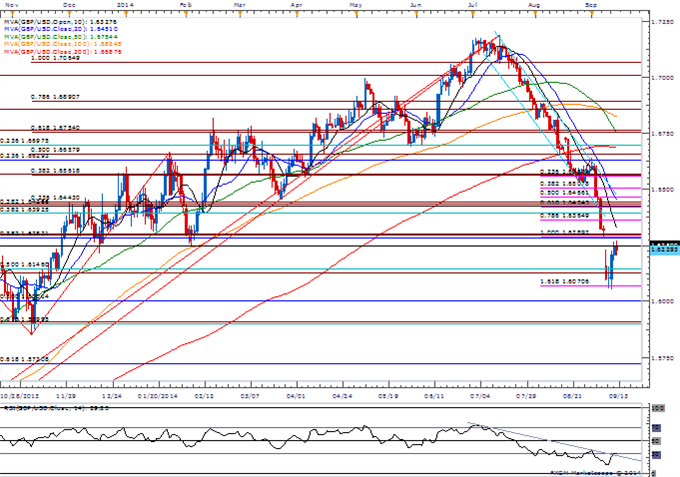

GBP/USD

- GBP/USD looks poised for a larger rebound as the Relative Strength Index (RSI) comes off of oversold territory; need break of bearish momentum to favor topside targets.

- Seems like Bank of England (BoE) Minutes will continue to show 7-2 split; biggest risk for surprise surrounds the Scotland Referendum, with the vote taking place on September 18.

- Next key downside region to watch is the 1.6000 handle (50.0% retracement), but need to see a break and closing price above the 1.6280-1.6300 region (former support) to favor a larger rebound.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

AUDCHF Monthly Opening Range Setup- Scalps Target Key Support

Dollar Looks to Fed to Secure Strongest Run in Half a Century

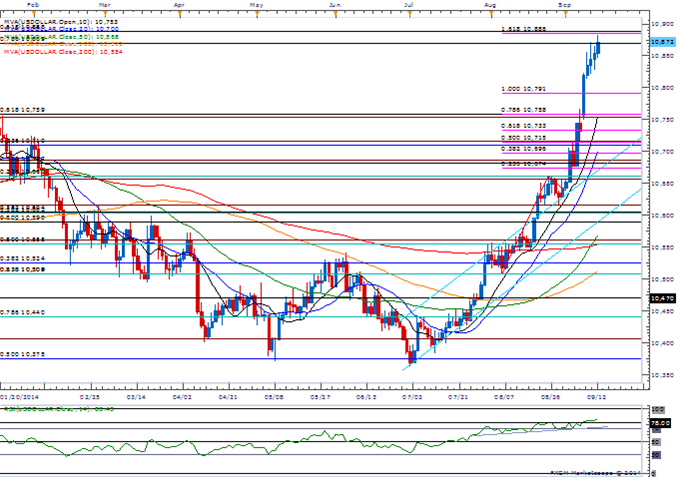

USDOLLAR(Ticker: USDollar):

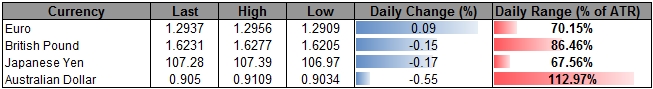

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

10872.82 |

10883.13 |

10853.66 |

0.15 |

74.70% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar Index climbs.

- A close above 10869 (78.6% retracement) raises the risk of seeing a full retracement of the decline from July 2013 high (11,009) especially as the RSI continues to push deeper into overbought territory.

- The DailyFX SSI continues to show the retail-crowd remains net-short USD ahead of the Federal Open Market Committee (FOMC) interest rate decision; will look for a more detailed forward-guidance for monetary policy as the central bank looks to halt its asset-purchase program in October.

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Advance Retail Sales (AUG) |

12:30 |

0.6% |

0.6% |

|

Advance Retail Sales ex Autos (AUG) |

12:30 |

0.3% |

0.3% |

|

Advance Retail Sales ex Auto and Gas |

12:30 |

0.5% |

0.5% |

|

Advance Retail Sales Control Group (AUG) |

12:30 |

0.5% |

0.4% |

|

Import Price Index (MoM) (AUG) |

12:30 |

-1.0% |

-0.9% |

|

Import Price Index (YoY) (AUG) |

12:30 |

-0.6% |

-0.4% |

|

U. of Michigan Confidence (SEP P) |

13:55 |

83.3 |

84.6 |

|

Business Inventories (JUL) |

14:00 |

0.4% |

0.4% |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia