Exogenous Threat to Euro Exists as ECB Policy Diverges from BoE, Fed

Fundamental Forecast for Euro: Neutral

- The Euro and Swiss Franc were under more intense pressure versus the British Pound, hitting new yearly lows.

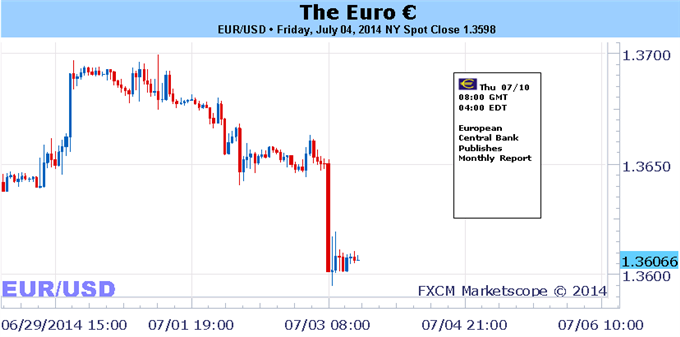

- EURUSD was vulnerable going into Thursday and a breakdown may have just started after the strong US NFPs.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

The Euro experienced a minor setback this week against most of its major counterparts, losing the most ground to the increasingly resilient and impressive British Pound. Even EURUSD had a late-week letdown on the back of the US labor market showing additional fortitude, as the US unemployment rate fell to a post-recession low of 6.1%, the lowest since September 2008. The recent barrage of important data on both sides of the pond suggests a widening differential in central bank policy, leaving the Euro at a disadvantage against the British Pound and the US Dollar going forward.

As traders were buying US Dollars on Thursday after the June US labor market showed the fifth consecutive month of jobs growth above +200K, European Central Bank President Mario Draghi was simultaneously holding court after the ECB policy meeting; the Governing Council’s latest actions did little to help support the Euro.

In absence of new policy action, ECB President Draghi’s greatest contribution on Thursday was to remind traders that not only would interest rates remain low for an extended period of time, but that the ECB was also intensifying prep work related to asset-backed securities (ABS) purchases.

The problem for the ECB with ABS purchases, which is why the market hasn’t taken the threat as a significant reason to drive Euro exchange rates lower, is that the ABS market in the Euro-Zone is not nearly as developed as it is in the United States; and therefore the amount of ABS purchases potentially necessary is difficult to quantify. The ECB, up until this point, was not (and still truly isn’t) necessarily aware of how big the ABS market was and how strong of a purchase program they would need to design.

While the threat of a major LSAP is certainly brewing, the clout behind the ECB’s potential €1 trillion TLTRO is rather weak, at least from the perspective that it could keep downside pressure on the EUR-crosses in a meaningful way. Simply put, these are not carte blanche liquidity injections; the rules published by the ECB on Thursday make well-clear their intention to improve liquidity channels and reduce credit fragmentation across the Euro-Zone.

If the TLTROs are effective, they end result will be capital used to boost organic growth opportunities rather than speculative reach for yield (in the US, the UK, and the Euro-Zone, open-ended QE is widely perceived as free money for financial institutions at the expense of taxpayers and savers, so the ECB is being careful to craft a program that won’t fan the speculative flames). Over time, the TLTROs could even prove to be broadly EUR-positive, but not for several months or years.

For now, the Euro is stuck with a central bank in holding position, preparing for its next move, as it waits and observes what its prior actions have resulted in. One thing is clear, however: the ECB is taking on a more dovish stance by expanding its non-standard policy easing toolbox, and has no intention of tightening policy within the next 12- to 18-months.

The ECB’s ‘lower for longer’ stance is prohibitive for the Euro because the British Pound and the US Dollar are being bombarded with strong economic data and rising sovereign yields as a result, as market participants start to price in interest rate hikes from the Bank of England and the Federal Reserve, respectively.

In this interim period of ECB inaction, we turn our attention outwardly to the BoE and the Fed as the more significant drivers of price action in EURGBP and EURUSD (and GBPCHF and USDCHF as well, given the highly significant, nearly perfect positive correlation between EUR and CHF since September 2011 when the SNB levied the Sf1.2000 floor in EURCHF). –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

original source

Indonesia

Indonesia