GBP Capped by Channel Resistance- CAD to Face Sticky CPI Inflation

Talking Points:

- GBP/USD to Break Out of Descending Channel on Scotland ‘No’ Vote

- USD/CAD Risks Larger decline on Sticky Canadian Consumer-Price Inflation

- USDOLLAR at Risk for More Meaningful Correction as RSI Threatens Bullish Momentum

For more updates, sign up for David's e-mail distribution list.

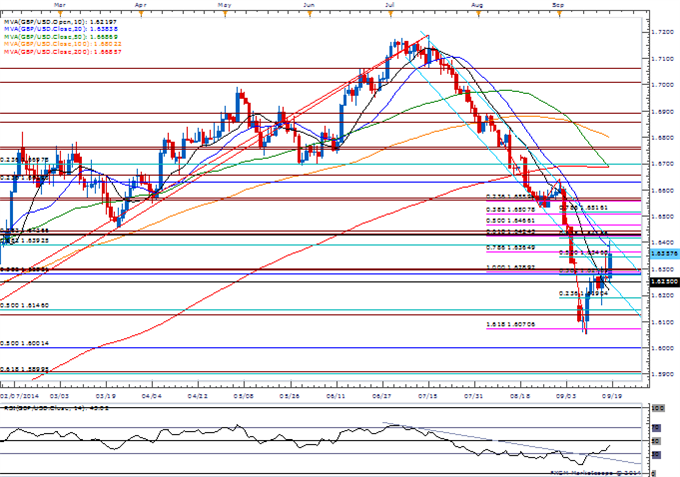

GBP/USD

- GBP/USD climbs to a fresh weekly high of 1.6408 ahead of the results to the Scotland Referendum, with the Relative Strength Index (RSI) continuing to come off of oversold territory; need to see a break & close above 1.6410 (61.8% retracement) to 1.6430 (50.0 expansion) to favor a bullish breakout.

- However, the GBP/USD may struggle to hold above 1.6000 (50.0% retracement) should Scotland vote to leave the U.K.

- DailyFX Speculative Sentiment Index (SSI) continues to show relative net-short U.S. dollar positioning, but the ratio for the GBP/USD continues to narrow as it stands at +1.09.

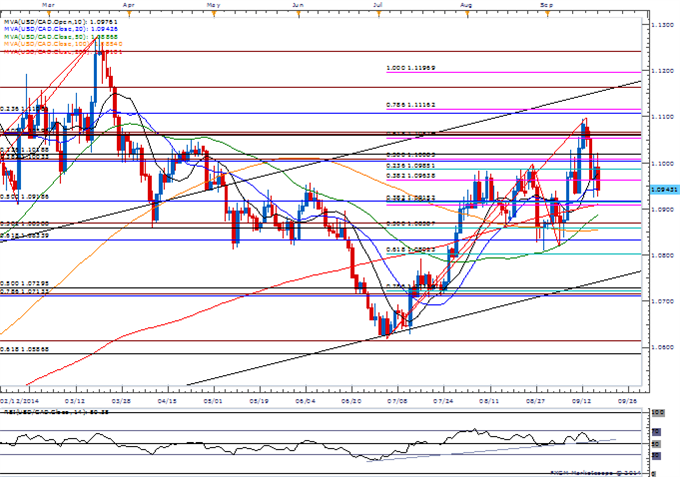

USD/CAD

- USD/CAD may face a larger decline over the next 24-hours of trade should Canada’s Consumer Price Index (CPI) boost interest rate expectations.

- Headline reading is expected to show sticky price growth, while the core rate of inflation is expected to increase an annualized 1.8% in August after expanding 1.7% the month prior.

- Strong Canada CPI print may undermine the bullish outlook for USD/CAD; break & close below the August low (1.0809) would invalidate the inverse head-and-shoulders formation.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Time To Be Cautious on AUD/USD?

Big Day for FX Markets - What We’re Watching

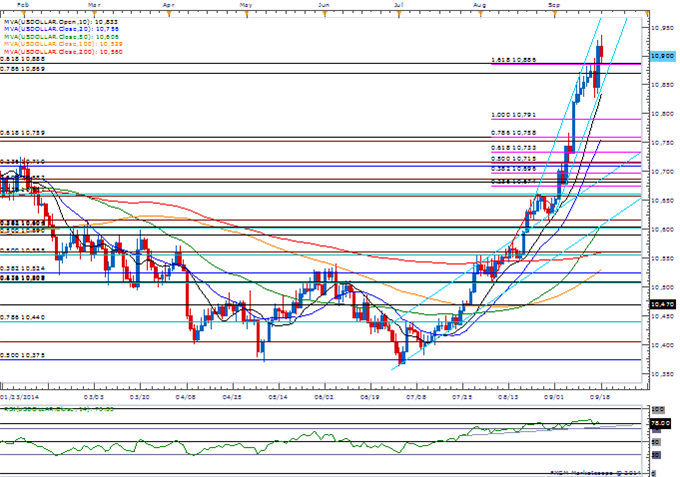

USDOLLAR(Ticker: USDollar):

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

10900.2 |

10938.37 |

10884.95 |

-0.18 |

117.31% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar Index falls back from a fresh yearly high of 10,884 amid the mixed batch of data; Dallas Fed President Richard Fisher, the new dissenter on the Federal Open Market Committee (FOMC) is scheduled to speak at 21:00 GMT.

- Despite the bullish reaction to the FOMC interest rate decision, the RSI highlights the risk for a larger correction should the oscillator fail to retain the bullish momentum.

- Break of channel support may bring up former resistance around 10,758 (23.6% expansion) to 10,759 (61.8% retracement).

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Initial Jobless Claims (SEP 13) |

12:30 |

305K |

280K |

|

Continuing Claims (SEP 6) |

12:30 |

2466K |

2429K |

|

Housing Starts (AUG) |

12:30 |

1037K |

956K |

|

Housing Starts (MoM) (AUG) |

12:30 |

-5.2% |

-14.4% |

|

Building Permits (AUG) |

12:30 |

1040K |

998K |

|

Building Permits (MoM) (AUG) |

12:30 |

-1.6% |

-5.6% |

|

Fed Chair Janet Yellen Speaks on U.S. Economy |

12:45 | ||

|

Philadelphia Fed. (SEP) |

14:00 |

23.0 |

22.5 |

|

Household Change in Net Worth (2Q) |

16:00 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia