GBP Range in Focus Ahead of BoE- AUD Vulnerable to Dovish RBA

Talking Points:

-GBP/USD Range in Focus Ahead of BoE Interest Rate Decision.

- AUD/USD Rebound Vulnerable to Dovish RBA Policy Statement.

- USDOLLAR Struggles as Personal Spending, ISM Manufacturing Disappoint.

For more updates, sign up for David's e-mail distribution list.

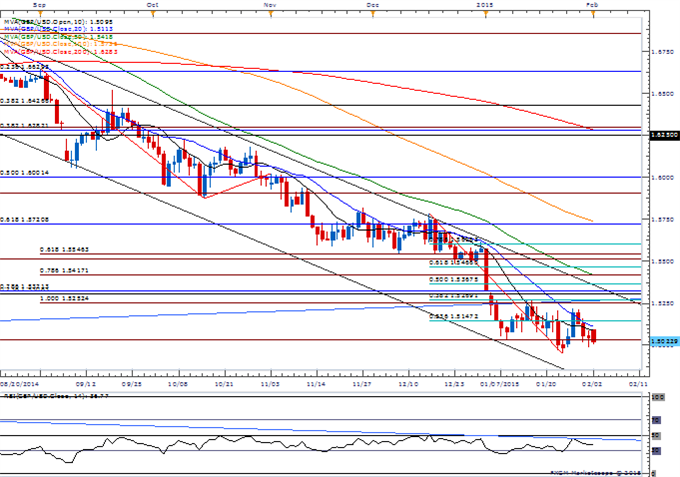

GBP/USD

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD may continue to face range-bound prices as the Bank of England (BoE) is widely expected to retain its current policy at the February 5 meeting; may see another unanimous vote.

- BoE Inflation report due out on February 12 may have a greater impact on the British Pound as the central bank updates its growth/inflation forecast; will Governor Mark Carney continue to warn of higher borrowing-costs?

- Even though retail crowd remains net-long GBP/USD, seeing a string of lower-highs in the DailyFX Speculative Sentiment Index (SSI) as the ratio currently stands at +1.79.

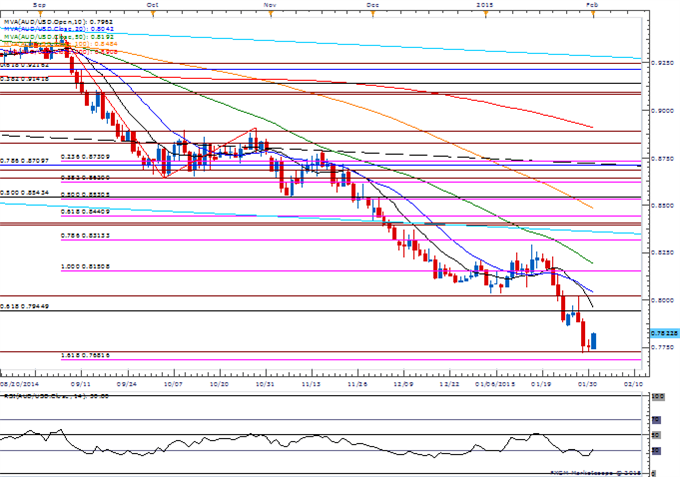

AUD/USD

- AUD/USD may face a larger rebound as it holds the December low (0.7718), while the Relative Strength Index (RSI) comes off of oversold territory.

- Even though the Reserve Bank of Australia (RBA) is expected to keep the benchmark interest rate on hold at the February 2 meeting, dovish rhetoric from Governor Glenn Stevens may prompt a further decline in AUD/USD as the central bank head prefers the exchange rate closer to 0.7500.

- Failure to hold above the December low should expose the next downside region of interest around 0.7680 (161.8% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: USD/JPY Continues to Tease

EURUSD - Looking For Pre-ECB Prices In Near-Term

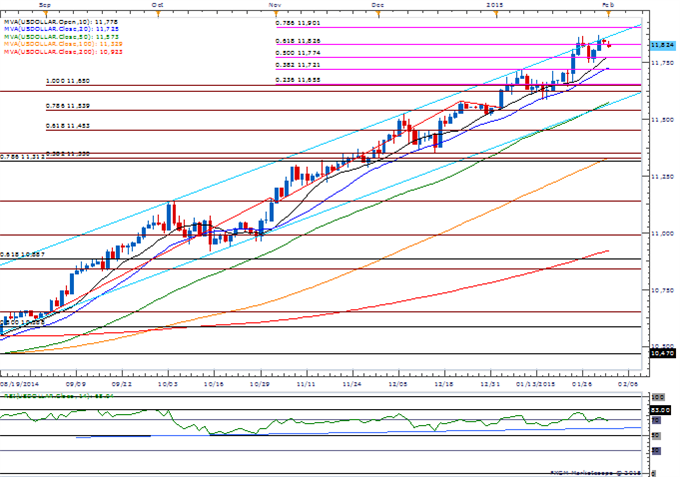

USDOLLAR(Ticker: USDollar):

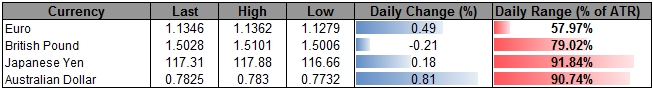

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

11824.34 |

11848.84 |

11812.65 |

-0.17 |

54.79% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar paring gains as Personal Spending & ISM Manufacturing fall short of market expectations; will keep a close eye on the RSI as it struggles to hold above 70.

- The highly anticipated Non-Farm Payrolls (NFP) report may continue to heighten the appeal of the greenback as the economy is expected to add another 232K jobs in January, while Average Hourly Earnings are projected to increase an annualized 1.9% following the 1.7% expansion in December.

- As the RSI struggles to hold in overbought territory, will watch former resistance zones for new support, with the first region of interest coming in around 11,721 (38.2% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Personal Income (DEC) |

13:30 |

0.2% |

0.3% |

|

Personal Spending (DEC) |

13:30 |

-0.2% |

-0.3% |

|

Personal Consumption Expenditure Deflator (MoM) (DEC) |

13:30 |

-0.3% |

-0.2% |

|

Personal Consumption Expenditure Deflator (YoY) (DEC) |

13:30 |

0.8% |

0.7% |

|

Personal Consumption Expenditure Core (MoM) (DEC) |

13:30 |

0.0% |

0.0% |

|

Personal Consumption Expenditure Core (YoY) (DEC) |

13:30 |

1.3% |

1.3% |

|

Markit Purchasing Manager Index Manufacturing (JAN F) |

14:45 |

53.7 |

53.9 |

|

ISM Manufacturing (JAN) |

15:00 |

54.5 |

53.5 |

|

ISM Prices Paid (JAN) |

15:00 |

39.5 |

35.0 |

|

Construction Spending (MoM) (DEC) |

15:00 |

0.7% |

0.4% |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia