GBP/USD Faces Growing Risk for Bullish Breakout as DailyFX SSI Flips

Talking Points:

- GBP/USD Remains Capped by 1.6410-40 Ahead of BoE Carney’s Speech; SSI Flips to Negative.

- USD/CAD Continues to Carve Higher-Lows as Canada Retail Sales Disappoints.

- USDOLLAR Preserves Bullish Setup Ahead of U.S. Durable Goods, Final 2Q GDP Report

For more updates, sign up for David's e-mail distribution list.

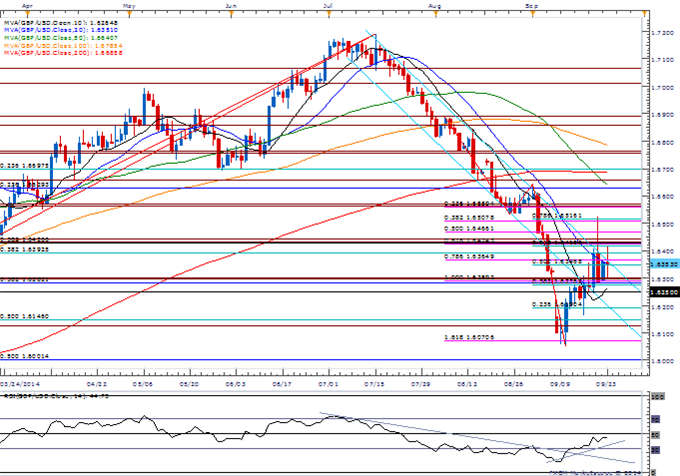

GBP/USD

- GBP/USD remains capped around 1.6410 (61.8% retracement) to 1.6440 (23.6% expansion) along with channel resistance; need a break & close above this region to favor bullish outlook.

- Bank of England (BoE) Governor Mark Carney to speak on September 25 at 12:40 GMT; will the central bank head highlight a growing dissent within the committee?

- DailyFX Speculative Sentiment Index (SSI) highlights a material shift in retail position and has flipped for the first time since August, with the ratio current standing at -1.04.

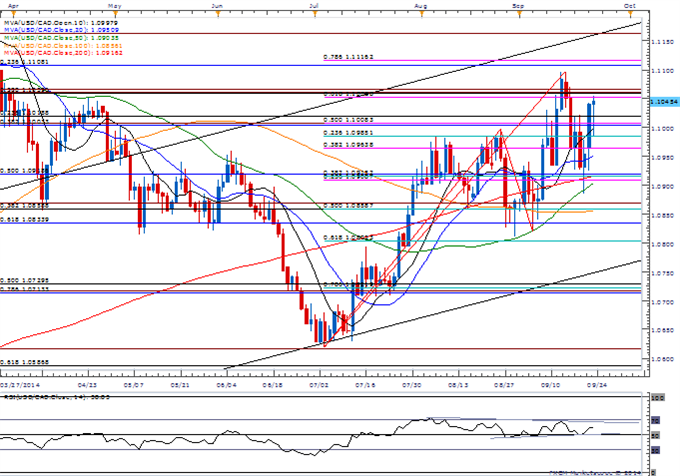

USD/CAD

- USD/CAD trims decline to 1.0985 as Canada Retail Sales unexpectedly contracts 0.1% in July, marking the first decline in 2014.

- Inverse head-and-shoulders formation remains favored as long as USD/CAD holds above the August low (1.0809); string of higher-lows raises the risk for a higher-high.

- Would like to see a topside break in the Relative Strength Index (RSI) to see a resumption of the bullish momentum as the oscillator remains stuck in a wedge/triangle formation.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Minor USD Reprieve Or Something More?

EUR/USD Overlooks PMI Results Despite Manufacturing At 13-Months Low

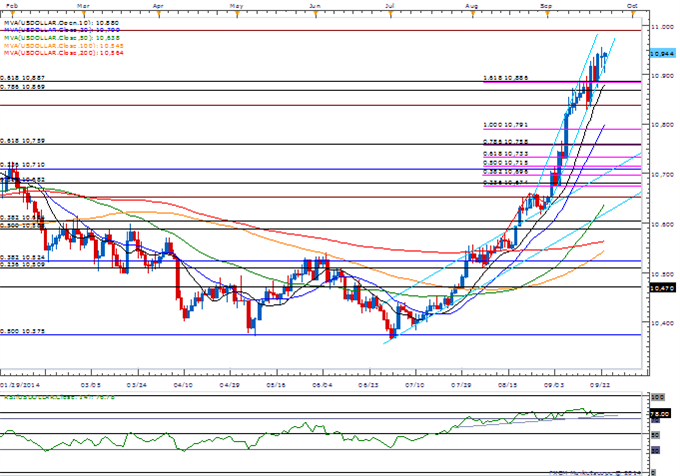

USDOLLAR(Ticker: USDollar):

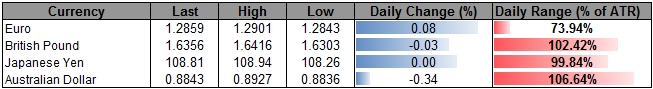

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

10944.89 |

10947.5 |

10903.66 |

0.06 |

88.27% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar Index retains ascending channel, bullish RSI after paring the decline to 10,903; will stay supportive as long as the current structures remain in play.

- Even though U.S. Durable Goods Orders are expected to contract 18.0% in August, a marked upward revision in the final 2Q Gross Domestic Product (GDP) report may heighten the bullish sentiment surrounding the dollar as it boosts interest rate expectations..

- Will continue to watch 10,989 (50.0% expansion) to 11,009 (July 2013 high), but fresh comments from Fed dove Charles Evans may drag on the dollar as the Chicago Fed President is a voting-member on the FOMC this year.

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Fed's James Bullard Speaks on U.S. Economy |

13:00 | ||

|

House Price Index (MoM) (JUL) |

13:00 |

0.5% |

0.1% |

|

Fed's Jerome Powell Speaks on U.S. Economy |

13:20 | ||

|

Fed's Esther George Speaks on U.S. Economy |

13:30 | ||

|

Markit Purchasing Manager Index Manufacturing (SEP P) |

13:45 |

58.0 |

57.9 |

|

Richmond Fed Manufacturing Index (SEP) |

14:00 |

10 |

14 |

|

Fed's Narayan Kocherlakota Speaks on U.S. Economy |

18:00 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia