GBP/USD Threatens Bearish Channel Ahead of BoE Inflation Report

Talking Points:

- GBP/USD Comes Up Against Channel Resistance Ahead of BoE Quarterly Inflation Report.

- USD/CAD Fails to Preserve Bullish RSI Momentum Going Into Canada Employment.

- USDOLLAR Fails to Benefit From Upbeat ISM Non-Manufacturing as Employment Component Slows.

For more updates, sign up for David's e-mail distribution list.

GBP/USD

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD clears near-term range & climbs to a fresh weekly high of 1.5313 as Bank of England (BoE) preserves its current policy ahead of the Inflation Report due out on February 12.

- Failure to maintain the bearish momentum in the Relative Strength Index (RSI) highlights the risk for a larger rebound in GBP/USD; waiting for a break & close above channel resistance for conviction/confirmation.

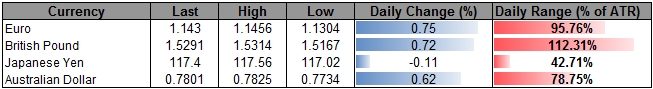

- Seeing increased volatility in the DailyFX Speculative Sentiment Index (SSI) as retail-crowd turns net-short GBP/USD earlier this morning, with the ratio currently standing at -1.20.

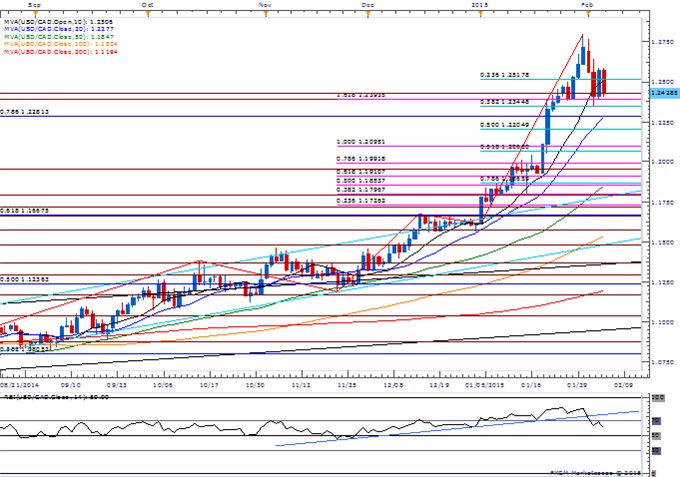

USD/CAD

- USD/CAD vulnerable to a larger pullback as the RSI fails to retain the bullish momentum and comes off of overbought territory; market participants looking for a minor rebound of 5.0K in Canada employment following the unexpected 4.3K contraction in December.

- May see USD/CAD continue to hold above 1.2340-50 (38.2% retracement) amid the string of closes above 1.2390-1.2400 (161.8% expansion).

- As the RSI comes off of oversold territory, NZD/USD looks poised for a larger correction, with the key focus standing at the former support zone around 0.7600 (38.2% expansion) to 0.7620 (61.8% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

USOil - Price Action Suggest It Could Catch Fire

Price & Time: Waiting On A Catalyst To Break Away From Recent Ranges

USDOLLAR(Ticker: USDollar):

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

11773.96 |

11827.06 |

11761.96 |

-0.37 |

93.04% |

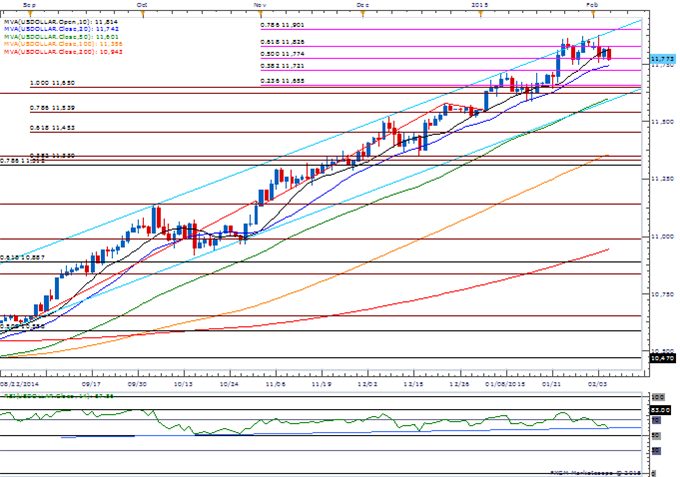

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar may continue to face choppy price action ahead of the highly anticipated Non-Farm Payrolls (NFP) report as it retains the weekly range; market expectations are for another 230K expansion while the jobless rate is projected to hold steady at an annualized 5.6%.

- Despite expectations for a Fed rate hike for mid-2015, will keep a close eye on the Average Hourly Earnings figure as the central bank struggles to achieve its 2% target for inflation.

- Will watch former resistance around 11,721 (38.2% expansion) from here especially as the RSI threatens the bullish momentum carried over from the previous year.

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Challenger Job Cuts (YoY) (JAN) |

12:30 |

-- |

17.6% |

|

Non-Farm Productivity (4Q P) |

13:30 |

0.1% |

-1.8% |

|

Unit Labor Costs (4Q P) |

13:30 |

1.2% |

2.7% |

|

Initial Jobless Claims (JAN 31) |

13:30 |

290K |

278K |

|

Continuing Claims (JAN 24) |

13:30 |

2400K |

2400K |

|

Trade Balance (DEC) |

13:30 |

-$38.0B |

-$46.6B |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia