GBP/USD Threatens Range, Retains Bullish Momentum Despite Soft UK CPI

Talking Points:

- GBP/USD Threatens Range Despite Soft U.K. CPI- BoE Minutes in Focus.

- NZD/USD Continues to Carve Lower-Highs Ahead of Widening Current Account Deficit.

- USDOLLAR Fails to Retain Bullish RSI Momentum Ahead of FOMC Meeting, Yellen Press Conference.

For more updates, sign up for David's e-mail distribution list.

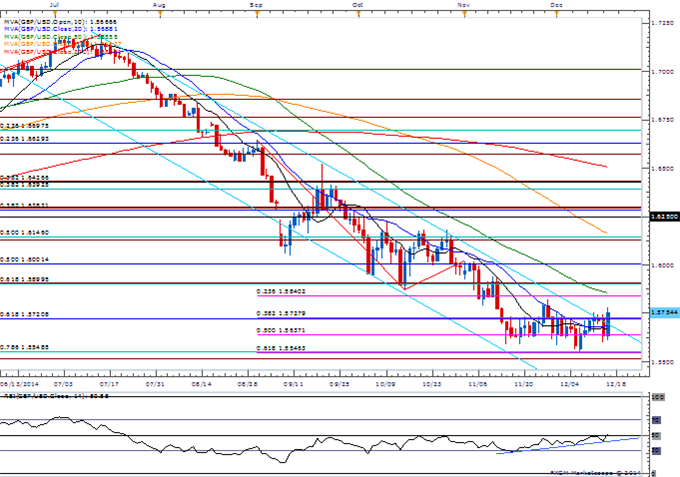

GBP/USD

Chart - Created Using FXCM Marketscope 2.0

- Despite the marked slowdown in the U.K.’s Consumer Price Index (CPI), GBP/USD appears to be breaking out of the range-bound price action as the bullish momentum in the Relative Strength Index (RSI) gathers pace; waiting for a close above 1.5720-30 for conviction/confirmation.

- Bank of England (BoE) sees lower energy prices boosting economic activity, but the meeting minutes may continue to reveal a 7-2 split as the majority remains in no rush to normalize monetary policy.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long GBP/USD since October 28, with the ratio currently holding at +1.32.

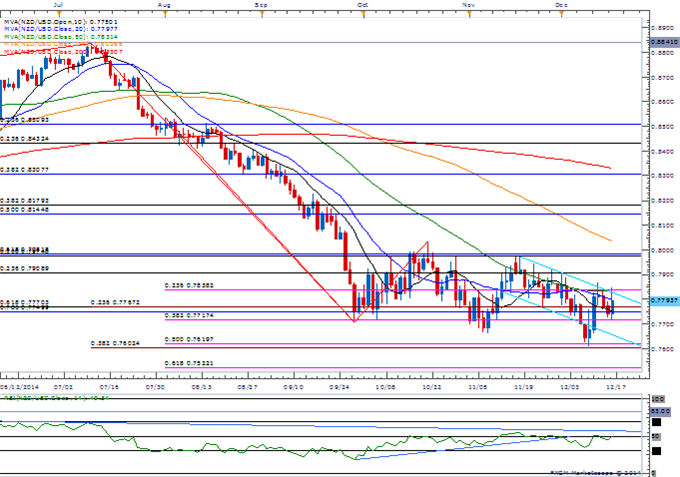

NZD/USD

- NZD/USD may continue to operate within the downward trending channel amid the ongoing series of lower-highs; will continue to favor downside targets with the bearish RSI momentum in play.

- New Zealand’s 3Q Current Account Balance may dampen the appeal of kiwi as report is expected to show the largest deficit since 2008.

- Will keep a close eye on the monthly as it lines up with the Fibonacci overlap around 0.7600-20, with the next downside region of interest coming in at 0.7520 (61.8% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Key Levels to Watch Ahead of the FOMC

Crude Oil, RUB Meltdown Continue - Not Impacting USD Profit Taking

USDOLLAR(Ticker: USDollar):

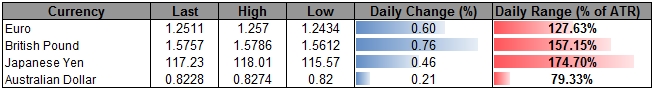

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

11389.24 |

11441.25 |

11347.55 |

-0.40 |

150.85% |

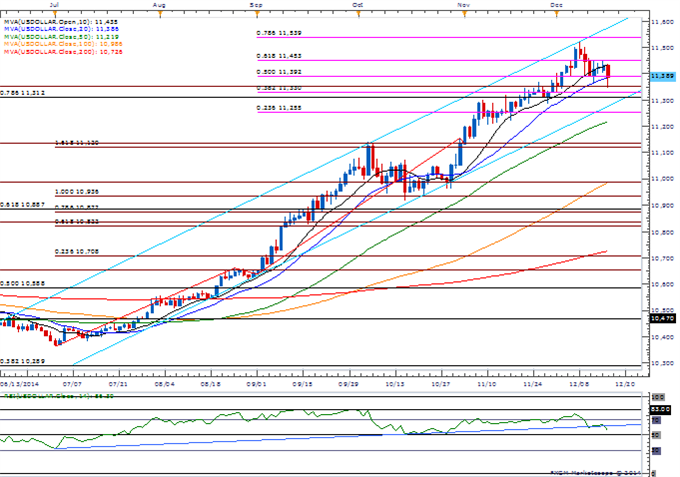

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar faces a risk for a larger correction as it fails to retain the bullish RSI momentum carried over from July; will look for a close below 11,392 for favor a further decline.

- Even though the Federal Open Market Committee (FOMC) is expected to implement a more hawkish twist to the forward-guidance for monetary policy, may see Chair Janet Yellen strike a relatively balanced tone at the press conference following the interest rate decision.

- String of lower highs & lows may foster a larger pullback, with former resistance zones around 11,312 (78.6% retracement) to 11,351 (78.6% expansion) in focus.

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Housing Starts (NOV) |

13:30 |

1040K |

1028K |

|

Housing Starts (MoM) (NOV) |

13:30 |

3.1% |

-1.6% |

|

Building Permits (NOV) |

13:30 |

1065K |

1035K |

|

Building Permits (MoM) (NOV) |

13:30 |

-2.5% |

-5.2% |

|

Markit Purchasing Manger Index Manufacturing (DEC P) |

14:45 |

55.2 |

53.7 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia