Gold Braces For Another Dose of Yellen, Crude Looks To Inventories

Talking Points

- Gold selling pressure eases ahead of Yellen’s second round of testimony

- Crude oil rebounds as traders look to upcoming US inventories data

- Selling into rallies preferred based on WTI and gold technicals

Gold and silver have managed to claw back some ground in Asian trading ahead of round two of testimony from Fed Chair Janet Yellen during the US session. Similarly, crude oil continues its recovery with the commodity likely to take some guidance from upcoming US inventories data.

Pressure On The Precious Metals Eases

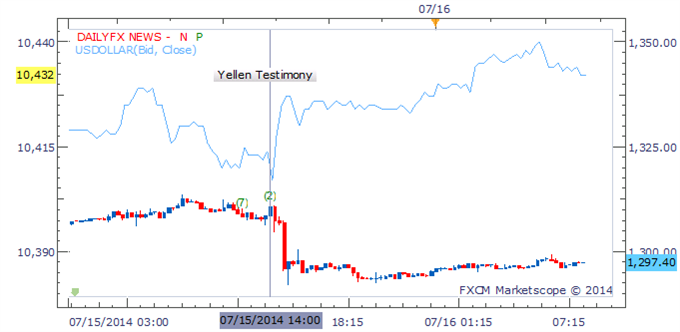

Gold is managing a small recovery (+0.28 percent) during the Asian session as traders return to the yellow metal following steep declines witnessed on the back of testimony from Fed Chair Janet Yellen on Tuesday. The response from the precious metals to the central banker’s address was somewhat surprising, given her comments fell on the more dovish end of the rhetoric spectrum. This suggests traders may have simply been waiting for the event risk to pass before looking to resume their selling of the alternative assets.

Gold, US Dollar Index Daily Chart - Created Using FXCM Marketscope 2.0, DailyFX News Indicator Available Here

The Chairwoman is set to deliver another speech in the session ahead, this time to the House Committee. However, the second chapter is likely to read in a similar fashion to the first. If no fresh insights into the potential path of monetary policy are revealed the reaction from the commodities space may be more muted. Additionally, a relatively light US economic docket for the session ahead may leave the US Dollar lacking fuel to sustain its recovery, which in turn could ease the pressure on gold and silver.

Crude Rebounds As Traders Turn Gaze Back To US

WTI traders will be turning to upcoming US inventories data for guidance as the commodity edges cautiously higher in late Asian trading. The Department of Energy’s Weekly Petroleum Status Report is tipped to reveal the third consecutive drawdown in total crude stockpiles with a median forecast from economists for 2,370K barrel decline. Full details and times on the economic calendar here.

The latest Report from the DOE revealed crude production in the US hit its highest rate in close to three decades. Additionally, despite recent declines total supplies are close to their record highs seen earlier in the year. This puts crude at critical juncture with a recovery for WTI hinging on speculation of a strong US economic recovery and greater demand for the commodity from its largest consumer.

Also in the energy’s space natural gas has faced renewed selling pressure with the commodity hitting its lowest level since January in recent trading. Newswires have cited expectations for milder weather conditions (reducing demand for natural gas) amongst possible reasons behind its sustained weakness. However, with total storage levels still well below seasonal averages, there may be some room for a recovery if the supply shortfall is sustained.

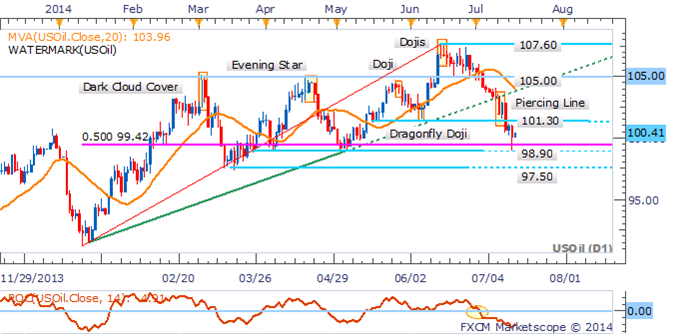

CRUDE OIL TECHNICAL ANALYSIS

The downside remains preferred for crude oil following the break below 101.30 coupled with a short-term downtrend on the daily. The next definitive support rests at 98.90, however expect some buyers to slow the descent at the psychologically-significant 100.00 handle.

Crude Oil: Downside Remains Preferred, Sellers Targeting 98.90

Daily Chart - Created Using FXCM Marketscope 2.0

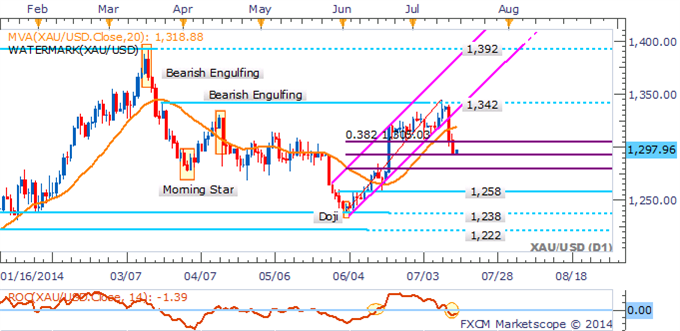

GOLD TECHNICAL ANALYSIS

The gold bears have taken a breather following a test of the 50% Fib Retracement level at 1,292. However, with evidence of a downtrend in play, a bounce would be seen as an opportunity to look at new short positions.

The DailyFX SpeculativeSentimentIndex suggests a mixed bias for gold based on trader positioning.

Gold: Selling Into Bounces Preferred

Daily Chart - Created Using FXCM Marketscope 2.0

SILVER TECHNICAL ANALYSIS

In a similar fashion to its bigger brother gold, silver’s collapse warns of further weakness to come. The break below the 23.6% Fib Retracement Level at 20.83 has confirmed the Evening Star candlestick formation and opens a push to support at 20.40.

Silver: Facing Further Weakness On Break of Key Support

Daily Chart - Created Using FXCM Marketscope 2.0

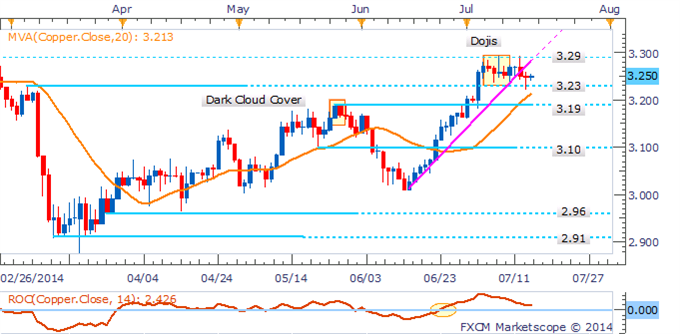

COPPER TECHNICAL ANALYSIS

Copper has breached its ascending trendline on the daily leaving the bulls hopes to hang on respect of support at 3.23. While a cluster of Dojis highlights hesitation from traders, there remains an absence of key reversal patterns to warn of weakness ahead.

Copper: Bulls Hang Hopes On Respect Of 3.23

Daily Chart - Created Using FXCM Marketscope 2.0

PALLADIUM TECHNICAL ANALYSIS

Palladium’s pullback to support at 861 is seen as a buying opportunity, given the uptrend for the precious metal persists. A break lower would shift the immediate risk to the downside.

Palladium: Pullback Offers New Entry Opportunities

Daily Chart - Created Using FXCM Marketscope 2.0

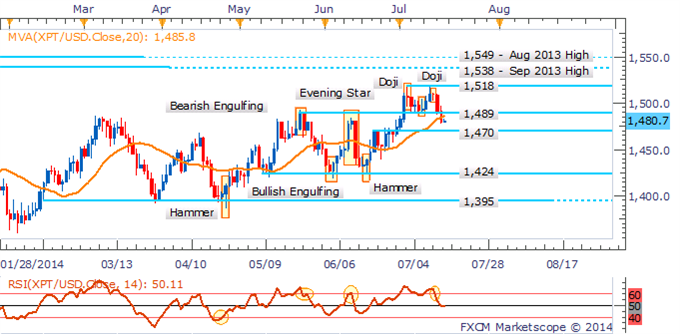

PLATINUM TECHNICAL ANALYSIS

A shift in the short-term trend appears to be underway for platinum following a push below key support (now resistance) at 1,489. Buyers are likely to emerge at the 1,470 mark which suggests new shorts may be better served on a retracement back to 1,489.

Platinum: Trend Shift Underway

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia