Gold Regains Footing Before US Data, Yet Is There Room For A Recovery?

Talking Points

- Gold and Silver Find Bids On Safe-Haven Buying As Geopolitical Tensions Flare

- Crude Oil Supply Glut May Overshadow Russian Production Disruption Fears

- WTI At A Critical Juncture As Prices Compress Between Key Technical Levels

Gold and silver are edging cautiously higher during the Asian session. This may reflect some repositioning from traders following a period of steep declines for the precious metals over recent weeks. Newswires have also cited that flare-ups in geopolitical tensions may have sparked some safe-haven buying. Such fear-driven flows may hold the potential to yield a corrective bounce. However, as proven in the past they seldom deliver a sustained recovery for the alternative assets.

Over the session ahead the metals may also take some guidance from their pricing currency, the US Dollar. Revised US second quarter GDP data and consumer sentiment figures are set to cross the wires. Amid firming Fed bets it would likely take a material deterioration in the data to dent the USD. Yet at the same time further gains for the greenback are questionable. The reserve currency’s ascent over the past few months may prompt some profit-taking, which in turn could afford the precious metals a consolidation.

Turning to the energy space; concerns over Russian supply disruptions appear to have resurfaced. This follows reports that a bill is in the works to allow the seizure of foreign-owned assets by Moscow. This likely helped natural gas climb by more than 1 percent on Thursday. The energy exporter accounts for roughly one third of Western Europe’s gas imports.

At this stage the potential for severe crimps to Russian crude oil and gas production are likely a longer term consideration. These may be overshadowed in the near-term by lingering concerns over a global supply glut for crude. In turn this could leave the Brent and WTI benchmarks lacking the fuel needed to generate a more meaningful rebound.

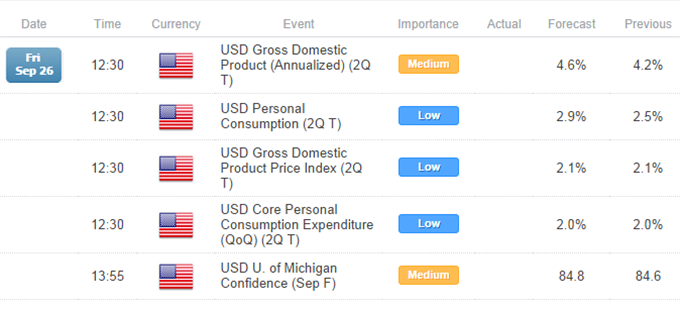

UPCOMING ECONOMIC EVENTS

Source:DailyFX Economic Calendar, Times In GMT

MARKET MOVEMENTS (THURSDAY 25, CLOSE: 5PM EDT)

|

Energy |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

US Oil |

92.86 |

93.51 |

92.04 |

92.44 |

(0.42) |

-0.45% |

|

UK Oil |

97.05 |

97.53 |

96.21 |

97.01 |

(0.04) |

-0.04% |

|

Natural Gas |

3.897 |

3.969 |

3.816 |

3.96 |

0.06 |

1.49% |

|

Metals |

Open |

High |

Low |

Close |

$ Chg. |

% Chg |

|

Gold |

1,216.76 |

1,224.61 |

1,206.49 |

1,221.28 |

4.52 |

0.37% |

|

Silver |

17.67 |

17.69 |

17.32 |

17.51 |

(0.16) |

-0.93% |

|

Palladium |

814.7 |

814.9 |

793.6 |

799.8 |

(14.90) |

-1.83% |

|

Platinum |

1,315.90 |

1,317.00 |

1,297.90 |

1,311.70 |

(4.20) |

-0.32% |

|

Copper |

3.052 |

3.062 |

3.019 |

3.034 |

(0.02) |

-0.59% |

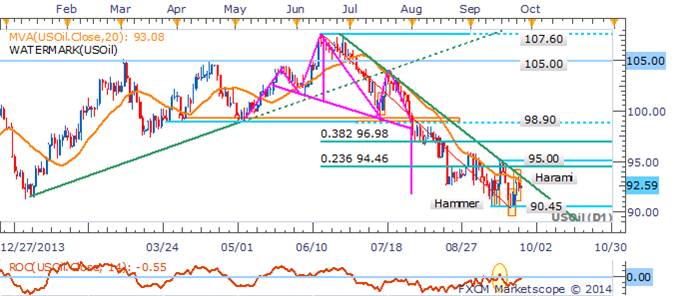

CRUDE OIL TECHNICAL ANALYSIS

Crude oil is having another case of déjà vu as it revisits its descending trendline on the daily. The emergence of another Harami formation suggests the bears may be looking to firm their grip on prices. Alongside a core downtrend on the daily this casts the spotlight back towards the recent lows near 90.45. A daily close above the overhanging trendline resistance would be required to warn of a small base.

Crude Oil: Price Compression Continues As Gaze Returns To Recent Lows

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD TECHNICAL ANALYSIS

Gold is teasing at a break beyond the 1,222 ceiling that has kept the precious metal capped over recent weeks. A daily close above the barrier coupled with the Hammer formation that has emerged, would suggest the potential for a recovery. Yet a strong rebound may be limited given the backdrop of a sustained downtrend and nearby trendline resistance looming overhead. In the alternative scenario, a daily close below the 1,208 floor would open the next leg lower to the 2013 lows near 1,180.

The DailyFX SpeculativeSentimentIndex suggests a mixed bias for gold based on trader positioning.

Gold: Awaiting Clearance From Congestion Zone Between 1,208 and 1,222

Daily Chart - Created Using FXCM Marketscope 2.0

SILVER TECHNICAL ANALYSIS

Silver’s slide under the 17.75 barrier alongside the continued presence of a downtrend (signaled by the 20 SMA and ROC) leaves the immediate risks lower. A daily close below the 17.30 mark would shift the spotlight to the low seen in late March ’10 near 16.50. A climb over trendline resistance and the 18.19 mark would be required to warn of a base and a sustained recovery for the precious metal.

Silver: Continues Descent Against Broad Bearish Backdrop

Daily Chart - Created Using FXCM Marketscope 2.0

COPPER TECHNICAL ANALYSIS

Copper continues to trade heavily as signs of a short-term downtrend remain intact. A daily close below the 3.01 floor would be seen as a fresh selling opportunity and open a knock on the 2.96 mark.

Copper: Awaiting Close Below Nearby Barrier To Open Next Leg Lower

Daily Chart - Created Using FXCM Marketscope 2.0

PALLADIUM TECHNICAL ANALYSIS

The sustained presence of a downtrend for Palladium warns of further weakness for the precious metal. Further, a failure to close above the 820 ceiling alongside a Doji formation indicates hesitation from the bulls to return to the commodity. This leaves it awaiting a daily close below buying interest at 792 to generate a push towards the April lows at 765.

Palladium: Sustained Downtrend Warns Of Further Weakness

Daily Chart - Created Using FXCM Marketscope 2.0

PLATINUM TECHNICAL ANALYSIS

Platinum has achieved the 1,314 target offered in recent reports. This may see the precious metal succumb to some profit-taking and a period of short-term consolidation. A Hammer candlestick offers further evidence that the bears may be losing their grip on the commodity. Yet against a broader bearish backdrop a convincing close below the 1,314 barrier would be seen as a fresh opportunity for short positions. The next downside targets are offered by the July and June 2013 lows at 1,308 and 1,285 respectively.

Platinum: Signs Of Exhaustion Emerge Near 1,314

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source

Indonesia

Indonesia