Graphic Rewind: USD Bulls Lose Confidence Ahead of Friday NFP Release

Talking Points:

- Greenback index falls to a 9-day low after weak GDP release

- Euro takes gains against USD despite inflation miss

A look back at the past 24 hours of Forex trading using movements in the US Dollar Index:

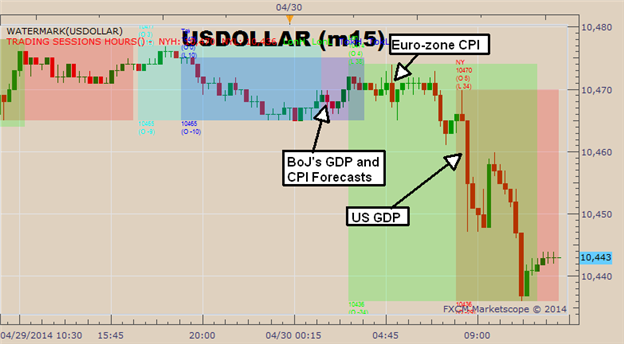

US Dollar 15-Minute 12:00 04/28 to 12:00 04/29 EST

Charts created by Baruch Spier using Marketscope 2.0. Add the Trading Session Hours Indicator to your own Forex charts atFXCM Apps.

The Dow Jones FXCM Dollar Index fell to a 9-day low in today’s trading, as disappointing US GDP data may be eroding greenback traders’ confidence ahead of the upcoming FOMC rate decision and the Non-Farm Payrolls releases.

Overnight trading between Tuesday and Wednesday, we heard that the Bank of Japan decided to keep its monetary asset purchases unchanged at an annual rate of 60-70 trillion Yen. There was no initial USD/JPY reaction to the decision, but the Yen took about ten pips of gains against the US Dollar on an announcement that the BoJ had lowered its GDP forecasts.

On the news that Euro-zone inflation slightly missed expectations for April, the Euro initially took a small dip to a 3-week low against the dollar before erasing all of those losses and eventually rising to a new daily high. The Euro gains may have been the result of the annual core inflation rate meeting expectations at 1.0%.

Finally, the US Dollar began its decline following the announcement that the US economy expanded by a mere 0.1% (annualized) in the first quarter, coming in severely lower than expectations for 1.2% GDP growth. USD/JPY dipped 30 pips on the release, and the dollar has continued to post losses in the Forex markets, as greenback traders may have lost some confidence in a strong April Non-Farm Payrolls number this Friday.

Want to trade with proprietary strategies developed by FXCM? Find out how here.

-- Written by Baruch Spier, DailyFX Research. Feedback can be sent to [email protected] .

original source

Indonesia

Indonesia